As we begin a new year, let me roll out a list of predictions I have for the next 12 months… and we will watch for which come true.

The Fed will start cutting rates by Q2 or Q3, and QE will eventually follow.

The last FOMC meeting held on December 12th was far more dovish than most market observers had expected. As widely expected, the Federal Reserve's policymaking panel chose not to increase the federal funds rate, their benchmark interest rate. However, somewhat unexpectedly, they have indicated the likelihood of implementing several interest rate cuts in 2024. This can be seen most strikingly in their Dot Plot estimations for the next few years.

(The Federal Reserve's dot plot is a regularly updated chart that documents the individual projections of each Fed official regarding the fed funds rate. The dots on the plot represent the anticipated midpoint of the fed funds rate at the end of each period, as envisioned by each U.S. central banker.

In this most recent projection from the Fed, only two officials anticipate that borrowing costs will remain the same next year. The majority of officials foresee rate reductions, with one official projecting a single 25bps cut in 2023, five officials anticipating two cuts, six officials expecting three cuts, four officials envisioning four cuts, and one official foreseeing six reductions.

Whatever the eventual case may be, it appears that the Fed is set to pull back on their “higher for longer” policy, declaring that their goals have been largely reached. To their credit, inflation has slowed substantially. The latest data from the Labor Department revealed that the Consumer Price Index (CPI) increased by 3.1% year-over-year in November, lower than the 3.2% gain in October and a substantial decline from the 40-year high of 9.1% recorded in June 2022.

Additionally, in late November, the Commerce Department reported that the Core Personal Consumption Expenditures (PCE) Price Index showed a 3.5% year-over-year increase in October, down from the 3.7% gain reported in September. (This is their favorite gauge, and it excludes the “volatile and unpredictable” food and energy factors from the calculation.)

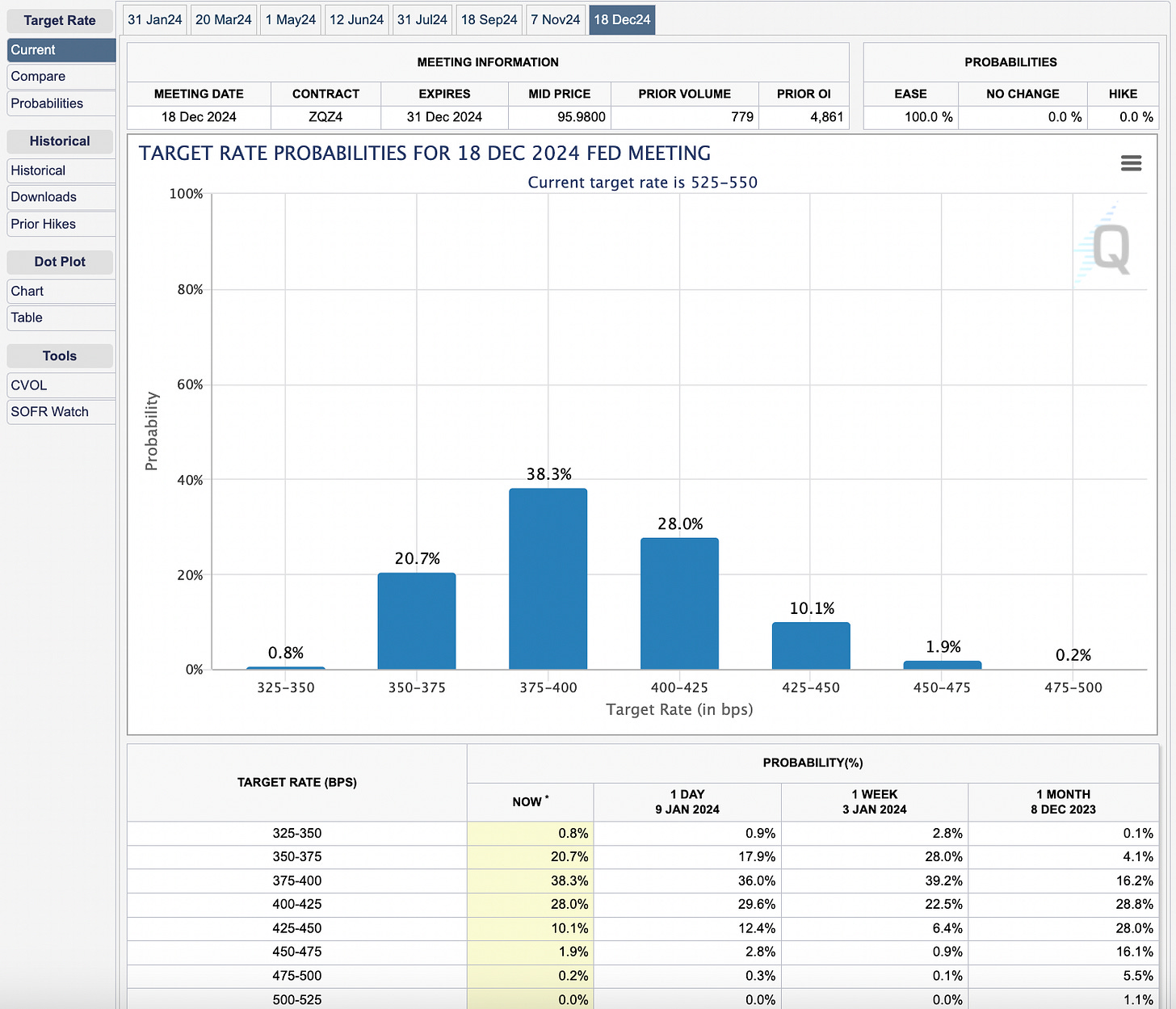

CME Group has a FedWatch tool, which predicts likelihood of particular Fed Funds terminal rates by deciphering the implied rate from the Fed Funds futures market. I’ll include a few screenshots for reference, but it appears that market participants don’t expect cuts to begin until Q2 and then for them to accelerate in Q4.

The market is pricing in an end of year rate of 375-400 basis points (3.75-4%) for 2024, which would be a 1.5% drop in rates within a year- quite a fast cutting cycle. However, this doesn’t make sense at all in my view.

To begin with, the Fed has never done a slow and steady cutting cycle. If you look at a historical chart of the Fed Funds rate, they have always hiked slowly until they reach a crisis, breaking something major in the financial system. So essentially the inverse is true.

The ONLY slow cutting cycle was 2 years in the mid- 1980s, when the repercussions of the Volcker Shock were being unwound, debt to GDP was 35%, globalization was in full swing and Japan was fully online buying hundreds of billions of Treasuries. So, with that exception, every time they have signaled a slow cutting cycle, but ended up panicking and frantically slashing rates as fast as they could- of course never predicting the crisis that would cause this reaction.

What would the crisis be that forces the Fed to cut? Unfortunately I do not know. And perhaps, just like 2018, it won’t be a true crisis but rather a thousand tiny cuts from a bleeding market (bond market this time) to force the brilliant central planners to concede that 5% rates are not sustainable.

We did hit $1T in interest expense this year, after all.

QE will restart

And to explain the second point, ever since the “invention” of QE by central bankers in the 2000s, it has been used in.. well literally every policy response. Therefore, is it too much of a stretch to assume that it will be used again?

Despite this, Powell remains adamant that the balance sheet runoff will continue, and that the only potential caveat to this is that the Taper will be tapered- i.e., he will still continue balance sheet reductions but just at a slower pace. This is despite the fact that these policies are counterproductive- tightening with one hand by reducing the balance sheet and loosening on the other hand by dropping rates.

That is one hell of a trapeze act.

However, his hand will eventually be forced. The Fed has awakened the monster that is the Monetary Black Holetm and a tsunami of Treasury debt is coming. Recall the maturity profile of government debt- it is massively front-loaded to the next few years.

Furthermore, all this new debt (and the old debt that gets rolled over) is financed at high rates. If the Fed isn’t even going to start cutting until May, that’s almost half of the year’s bond issuance getting a 5% or higher rate. This will only serve to push us further and further into the debt black hole, accelerating the trend that has been taking place for decades.

The long end of the curve cannot take this beating. Last year, the yield curve was deeply inverted, which is typically a signal of recession and a general marker of a dysfunctional bond market- longer dated bonds should have higher yields, according to economic theory. To alleviate the pressure, the Treasury adjusted their issuance schedule so that fewer long dated bonds would be issued and more bills would be sold, making the average maturity of Treasury debt shorter. In fact, a record 72% of government financing will be done through T-bills (less than 1 year maturity) in Q1 of 2024!

Net Liquidity growing will be massively bullish for risk assets

I’ve gotten excoriated for saying this, and I think the public just generally misunderstands my comments. If the Fed truly tapers (i.e. net liquidity decreases substantially), there will be massive corrections in equity and bond markets as funds are eliminated from the financial system, so less cash chases the same assets. This did not happen in 2023- largely because net liquidity INCREASED, not decreased. I made a post about this in late 2023, explaining it in more detail, but suffice it to say, the modern financial system is more complex than it was in 2008 and there are more sources of liquidity than just the Fed’s balance sheet.

However, as I pointed out in the Dollar Endgame Book, the correlation between central bank liquidity and stock markets is nearly 1. This means that wherever the Fed goes, equities will follow- and so a year of rate cuts and QE means that equities are going to soar again. Bonds will catch a bid as well, but not to the extent of stocks, and will likely reverse this trend once inflation comes back.

I will cover this again in a later post, but with the RRP draining, and the BTFP coming up on expiration, and the TGA refilling, reserves are being sucked out of the financial system and Powell’s vaunted Taper will begin running into problems. To counteract these deflationary forces, Powell will have to restart balance sheet growth again sometime in the near future. This will also be massively bullish for crypto and gold as real yields fall again and the liquidity tsunami re-enters the financial system. To answer my fourth prediction, this means that likely gold/BTC will soar to new all time highs sometime this year, likely in Q3 or Q4.

The Bitcoin ETF approvals on Thursday means billions of institutional dollars are now flowing into the orange coin, and this is bullish for all holders, even those who own alt-coins, as historically money flowing into BTC pours over into the adjacent crypto tokens as well. (This is not investment advice). That being said, it is still my position that Bitcoin is the superior crypto and should remain a substantial part of any inflation-hedged portfolio.

Inflation will return

In December, inflation increased from 3.1% to 3.4%, indicating that the Federal Reserve has not fully succeeded in its mission to bring down rapidly spiking prices in the wake of massive fiscal stimulus in 2021. Initial forecasts had anticipated a reading of 3.2%.

The primary drivers behind the rise in price growth in December were housing and shelter costs, contributing more than half to the overall increase, according to the Bureau of Labor Statistics. On a year-over-year basis, total shelter costs saw a 6.2% increase, while rents specifically rose by 6.5%.

Inflation will still likely ease in the first half of 2024, but as the Fed’s liquidity programs come online in the second half, and as fiscal deficits continue to grow, inflation will return. This means that new liquidity added to the banking system will have a major outlet in the form of government spending, increasing M2 and bringing prices back up. There is no year in the next 12 where deficits are projected to be less than $1T, and 2024 is going to see this fiscal crisis get worse. In just the month of December, the deficit soared to $129B, or up 52%!

High deficits mean more Treasury bond issuance, which will be financed by either the banks (net neutral to systemic liquidity) or the Fed (net additive). Since the Fed is signaling easing, that means more reserves added to the system, and thus M2 money supply increases.

A further data point to support this contrarian assertion (since most of Fintwit and Wall St. are claiming Inflation is Canceled and the Fed won the war) is the cyclicality of inflationary cycles. For example, back in the 1970s a major inflationary push was underway, with gas prices spiking and wage pressures shooting CPI up for most of the decade. However, what most do not know is that the inflation came in waves- with each growing larger than the previous one until the largest wave in the late 1970s.

The reason for the cyclicality is multi-fold; Fed tightening cycles, re-adjustment of supply chains and labor markets, commodity channels updating and other factors will allow the economy to adjust to increases in broad money supply. Furthermore, debasement does not typically occur in a straight line but rather in spurts and stops, as crises like wars and pandemics give massive leeway for government money printing and then the aftermath causing a reduction in spending. Whatever the case may be, the pattern is a sine-wave formation during inflationary periods, with typical extreme monetary policy measures being taken to stop it from building momentum. In this period, it took Fed Chairman Volcker raising rates to 18%+ and keeping them there for years to break the back of inflation. This meant a massive correction in homes, a savings and loan crisis, and overall chaos in the forex market as DXY was whipsawed upwards for years when the dollar strengthened due to these high rates.

As the de-globalization trend continues, the debt spiral grows, and global instability increases, it is hard to see that this is a world in which inflation is NOT secular and is temporary; the math does not compute. In order to settle the debt and fund the deficits, money supply growth is a necessity.

Recession will appear

Now this one is more difficult to predict than the others because of the problems with the data reporting from the government that have recently arisen. You can see the data start to diverge with the employment numbers from Household vs Establishment surveys. These two indicators used to be extremely closely correlated- but this began breaking in 2022.

The jobs numbers were manipulated as far back as early 2008, but this has accelerated in recent years as the BLS has made a number of hedonic adjustments to make the figures appear better than they should. For example, workers who have not had a job in the last 12 months and who are no longer looking for work are excluded from the calculation- meaning that although they are unemployed they are not counted as such.

To fully explore the reason and mechanism for this manipulation would take too much time here, but I recommend you read this article written by Daniel Amerman, a CFA, dissecting exactly how the government does this: http://danielamerman.com/va/Work.html

The growth in payroll numbers has also been misleading. Despite strong figures every month, if you ask the median worker it is not easy to find new roles and wage growth continues to lag behind inflation- something you should not expect if you had a strong job market. The truth is, after digging underneath the hood, some startling stats come up- like the fact that government, public education, healthcare, and travel are essentially the only industries adding jobs.

In fact, the September payroll report would be 70% lower if not for a large increase in government jobs! Here’s some more stats from Axios:

Monetary policy effects typically lag by at least 18-24 months, and so we haven’t seen the full effects of Powell’s hiking cycle yet. The one thing that may buoy us above a technical recession is the massive fiscal deficits. Recall the equation for GDP includes government spending, so if the Treasury spends more, all things being equal, GDP will grow. Thus the illusion can appear that the economy is growing when the only real thing happening is the federal government getting further and further into debt. This does create some growth in the short term, but in the long term… well I don’t need to tell you what happens there!

Economic situation will worsen in China and Japan

Over the last couple of years, defaults on trust investment products, particularly those associated with real estate, have risen. Chinese data provider Use Trust reported that in 2022, defaults on real estate-related trust products amounted to 93 billion yuan ($13.1 billion), higher than the 91.7 billion yuan ($12.9 billion) recorded the year before.

This all began in 2021 when Chinese authorities began to clamp down on the rampant speculation and lack of regulation in the property industry. Practices such as subprime loans, poorly underwritten bonds, and pre-selling properties were commonplace. Again, this sector is a behemoth- Country Garden, the largest developer, only has about 5% of all unfinished properties in China.

There are 20 million units of unfinished housing in China that have already been sold, and with property developers depending on the sale of new units to settle debts, massive solvency issues have been raised in the sectors. Shadow banks, which financed this activity, are also now on the chopping block as these developers fail to pay loans and their equity values begin to plummet.

The Chinese central bank, the PBOC, has stepped up liquidity injections among a burgeoning slow-moving real estate crisis. In December, they made their largest monthly increase of 800B Yuan ($130B USD) of their Medium Term Policy Loans (MLF). Analysts say that it is likely that they will continue to step this up as their economy battles strong deflationary forces. The CPI crossed into the negative territory for the first time since COVID in July of this year, and this has only worsened in recent months. Their manufacturing index has also fallen into recession territory, and new land sales have slowed by over 75%.

I will have a piece coming on Japan soon as well as another piece on oil markets- so I will leave my comments on these topics for later. Before the oil piece however, I will likely do a post on Gamestop and the DRS movement to combat naked shorts- I am aiming to release this on January 28, the three year anniversary of the sneeze.

That will do it for now! Let’s see which of these predictions come true…

Hey PB, would love to see you do a post about what predictions were correct or close, and why.