ANOTHER: The Inside Gold-For-Oil Deal That Could Rock The World's Financial Centers

A controversial anon blogger in 1997 revealed an astounding deal hidden in the markets that shaped geopolitics for the last few decades.

ANOTHER began writing in 1997 about the true nature of the global monetary system, and why the gold price had been suppressed. His ideas were revolutionary, and contradicted the typical simplistic gold-bug viewpoints on economics and geopolitics.

Goldbugs have for decades claimed that gold prices have been suppressed as part of a central bank war against Libertarians and Keynesians.

An ideological suppression of true money, gold.

ANOTHER offers a different view:

What if the powers that be have done so to stop the meltdown of the international monetary system?

The Saudis (and other oil states) were acquiring gold at spot, spiking prices in the mid-1970s, and then were made a deal by a small amount of elites to hide gold in oil mkts?

ANOTHER's first post seems linked to the LBMA publicly disclosing its clearing volume in January 1997.

The LBMA was just a decade old at that time- Its formation was a response to the collapse of a London bullion bank in 1987, which occurred due to over-leveraging in an attempt to offset the decrease in gold trading during the early 1980s.

Following that, gold had declined from 1987 to 1997, dropping from $500 per ounce to $350 per ounce.

Despite this, the LBMA was consistently clearing thirteen hundred tonnes of gold daily during that period. This development was significant and perplexing for the closely-knit community of international gold traders and analysts in 1997.

And then, ANOTHER entered the scene.

ANOTHER 1997- “It was once said that ‘gold and oil can never flow in the same direction’. If the current price of oil doesn't change soon we will no doubt run out of gold.”

He went on to explain what is called “the gold for oil deal”.

He wasn't referring to the move of oil prices in USD; rather, he was discussing oil priced in gold.

This wasn't based on the known market price of gold, which was USD 332 per ounce at the time, but rather on the undisclosed "gold for oil deal" price.

It was actually a clever way of saying “if the price of gold doesn't change soon, we will run out of gold.”

Imagine you are an oil-rich nation like Saudi Arabia, possessing vast but limited oil reserves beneath your land. This oil holds immense global value, prompting you to extract it and sell it to Western countries.

Once sold, the oil is burned and forever gone!

This immense wealth makes you incredibly rich, but you also want to secure a lasting asset for future generations to replace the finite oil reserves.

That asset, in this case, is gold.

The problem is if you attempt to purchase real physical gold with your surplus US dollars at the prevailing market price of gold, it would break the market.

This lesson was learned in the 1970s.

Attempting to buy real gold with surplus US dollars at the spot gold/oil ratio would just be counterproductive.

You can buy the same weight in gold by spending just a fraction of your surplus, leaving room for "practical investments" like massive malls in the desert.

The BIS also feared that such a move could undermine the international monetary and financial system based on the US dollar ($IMFS).

For 70 years, from 1946 after WWII to 2016, the gold/oil ratio remained relatively constant. It fluctuated between approximately 9 and 29, with an average of around 15.

But that's not an equilibrium price. It's the $IMFS price.

In 1978 and 1979, as the international monetary and financial system based on the US dollar ($IMFS) was on the verge of collapse, European central bankers were in panic.

Fearing the consequences of losing a crucial global benchmark currency system, they intensified their efforts to establish an alternative of comparable magnitude—the euro.

But it all might be in vain if the $IMFS collapsed before the launch of the euro.

To address this, they convened in Belgrade in October 1979 and made a pact to uphold the struggling US dollar system until the euro could be introduced.

To sustain the US dollar system, they provided support by purchasing US dollars and selling gold whenever the system faced threats.

In the mid-1980s, they introduced a novel paper gold market centered on Barrick, the gold mining company, and the newly established bullion banks associated with the LBMA.

Instead of directly selling gold in the market, central banks permitted bullion banks to sell "ownership invoices" or certificates of ownership representing central bank gold.

However, the physical gold remained stored in the central bank vaults.

At the same time, Barrick secured the central bank gold certificates with forward contracts on its gold reserves still in the ground.

The purchasers paid for gold that had yet to be extracted, and these contracts were backed by central bank gold held in vaults. The cash received was deposited in an account, accruing interest.

Before long, the bullion banks began lending more gold than they had initially guaranteed from the central banks, basically fractional reserve banking.

Thus the paper gold market was born.

The mines were being used to expand the gold trading arena, which was driving down the price by adding phantom supply faster than demand, and they were none the wiser!

FOFOA explains:

"There were basically three things locked together that could jeopardize the $IMFS, the US dollar exchange rate, the gold market and oil. To understand this complex dynamic, we again go back to the Bretton Woods period where the gold/oil ratio began."

Saudi Arabia exercised control over the oil price via OPEC, while London influenced the gold price through the LBMA.

Previously, this influence was exerted through the bullion banks that later formed the LBMA, and even earlier through the London Gold Pool in the 1960s.

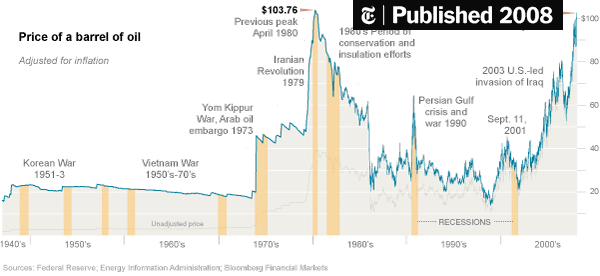

During periods of war, the oil price tended to spike. In the early 1970s, Saudi Arabia increased it from $3 to $15 per barrel. Subsequently, during the Iraq-Iran conflict, the price skyrocketed even further to $40 per barrel.

In the mid-1980s, they managed to reduce it back to $15 per barrel, coinciding with the formation of the LBMA. However, in 1990, when Iraq invaded Kuwait, the oil price surged once more, running above $30 per barrel.

The Gulf War in 1990-1991 marked a shift in the oil-for-gold deal. ANOTHER referred to the gold/oil ratio as the "old agreement," stating that it was discarded after the Gulf War.

The new agreement took place over-the-counter (OTC) via the LBMA, not on an exchange.

As we covered, it was trading gold reserves for oil reserves on paper, with central banks providing guarantees backed by their physical gold held in London at the Bank of England. ANOTHER said the Saudis initiated an annual purchase of 20 million ounces, equivalent to 622 tonnes per year (guaranteed by central bank paper), starting in 1991.

Additionally, they had the option to obtain a small amount of physical each year. This was advantageous for the Saudis, enabling them to acquire a larger amount of gold at market prices than they could have otherwise. Once more, the drive behind this move was to sustain the $IMFS until the launch of the euro, which was still a few years away. However, in 1996, a large player in Asia discovered the deal!

In any case, it was the Asians—possibly a renowned trader from Hong Kong or another Chinese group, as per FOA—that significantly boosted LBMA volume in late 1996 and '97.

FOA suggests that a substantial portion of this surge was linked to the transfer of Hong Kong from the UK to China.

(FOA stands for Friend of Another, an associate of the original blogger)

As per FOA, the massive drain of gold at that time "posed a threat to disrupt the delicate balance" of the $IMFS.

ANOTHER claimed that ~ 14,000 tonnes of unbacked paper gold needed to be covered, with European central banks being responsible for guaranteeing this paper!

ANOTHER in November 1997:

This set the stage for the Washington Agreement on Gold (WGA), also referred to as the Central Bank Gold Agreement (CBGA). Signed two years later in 1999, it remains in effect to this day.

Something happened. Asia, which had previously been draining the UK's gold reserves, suddenly stopped.

China itself joined the WTO in 11 December 2001, and began buying dollars and Treasuries en masse. When questioned on when the breakdown would occur, FOA would write:

“There is no trading an economic system whose currency is ending its timeline.”

Although the LBMA did not collapse, and the paper gold market did not freeze, as was predicted by ANOTHER and FOA, the series of events demonstrated clearly the fragility of the system, and the incessant papering over of the cracks.

Physical gold, they said, was KING. FOA would go on to write extensively in 2000, discussing why the system was flawed and what could be done about it. I highly recommend you check out these writings saved in the Internet Archive.

web.archive.org/web/2017090303…

You can find the original writings of ANOTHER here:

The nature of the beast remains today- 97% of futures contracts settled for physical instead of cash. Rehypothecation is rampant.

If this system unwinds the price of gold could skyrocket to $55,000 per troy ounce.

Changing the monetary system FOREVER.

Much of this data is from summary texts made by FOFOA, his writing can be found here:

If you want to see other interviews with FOFOA, you can see interviews with him here:

(https://ingoldwetrust.report/wp-content/uploads/2019/05/IGWT_2019_SPECIAL_Freegold_EN.pdf and https://ingoldwetrust.report/in-gold-we-trust-report/exclusive-interview-on-nixon-shock-with-fofoa/)

Internet archive links aren't working me. Anyone else ?

Great post! To learn, do you have any recommended books to start learning about the oil and gold market?