Bitcoin Submerged

Something is fundamentally wrong with the world’s hardest money.

Gold is ripping. Up over sixty percent last year, with over forty five all time highs. The yellow metal has done what decades of goldbugs predicted it would: it has finally broken free from the shackles of paper market suppression and forced the world to acknowledge what central banks have known all along.

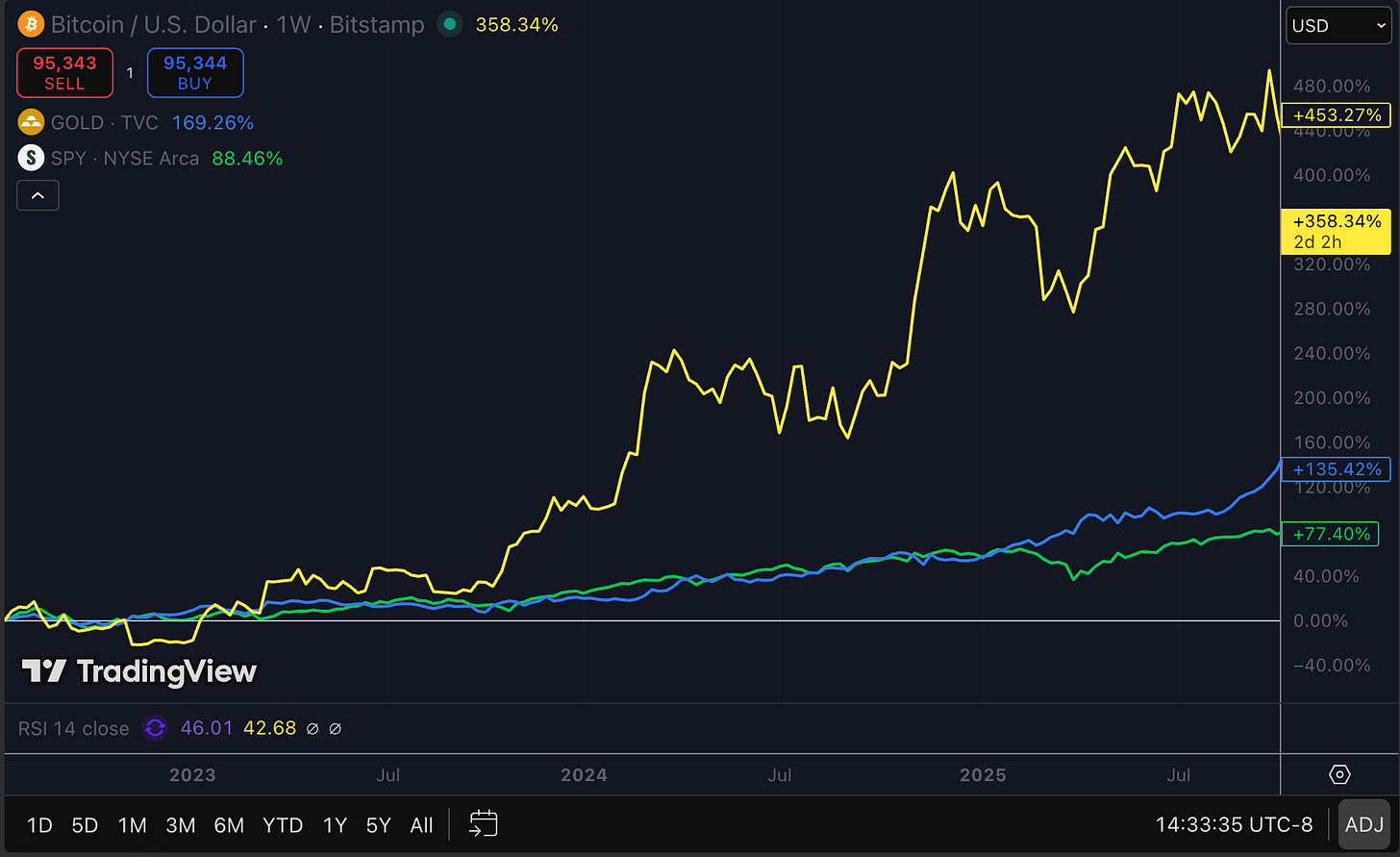

The S&P keeps grinding higher. It’s up 15% in 2025, driven by earnings growth that has finally somewhat justified the nosebleed valuations.

And Bitcoin? On December 15th it went below eighty five thousand. Then it ended 2025 lower than where it traded the year before.

The asset that was supposed to be digital gold, the hedge against everything, the twenty one million coin solution to infinite money printing: it has decoupled from the very thesis that was supposed to drive it higher.

(Bitcoin in orange, Gold in Yellow, SPY in Green- 3 month chart)

Even now, it’s struggling to retake $100K, a level that it took out with confidence over 13 months ago.

The Bitcoin to gold ratio, the measure of how many ounces of gold it takes to buy one Bitcoin, fell from forty to just twenty in under a year. A fifty percent decline in relative value against the very asset Bitcoin was supposed to outperform.

But I don’t believe this is a story about Bitcoin failing. This is a story about what happens when Wall Street arrives. And Wall Street plays by different rules.

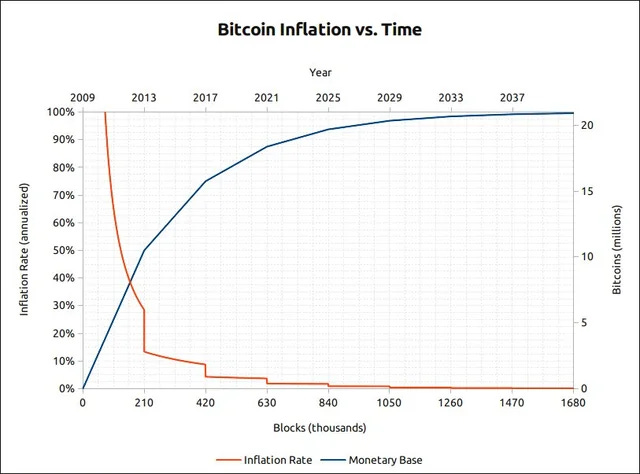

For years, crypto investors operated with a simple mental model. Gold rises when people fear currency debasement. Stocks rise when liquidity flows and growth accelerates. And Bitcoin? Bitcoin was supposed to capture both: a leveraged bet on monetary chaos with the upside volatility of a tech stock.

The thesis was elegant in its simplicity: a hard cap of twenty one million coins meaning no central bank can print more. Digital scarcity in an age of infinite money printing. When the Fed expands its balance sheet by trillions, Bitcoin should benefit.

When fiscal deficits balloon past six percent of GDP and the national debt crosses thirty eight trillion, Bitcoin should moon.

And from late 2022 through 2024, the thesis held. Gold gained sixty seven percent. Bitcoin surged nearly four hundred percent. The correlation was tight enough that analysts started treating them as complementary hedges: gold for the boomers, Bitcoin for the zoomers, both profiting from the same macro forces.

Source: TradingView

Then late 2025 arrived and the correlation went straight out the window.

Look at what should have happened this year. Sticky inflation persisted through the first half. Fiscal deficits ballooned. Trade wars reignited with sweeping tariff announcements. These were precisely the conditions that should have launched Bitcoin into price discovery. Every macro variable pointed up.

SPONSOR:

Taking self-custody of your Bitcoin has never been more critical, and that’s exactly why the team at Blockstream has created the perfect solution: the Jade Plus hardware wallet.

Use Code PB10 for 10% off your JadePlus Wallet! Click the Link here.

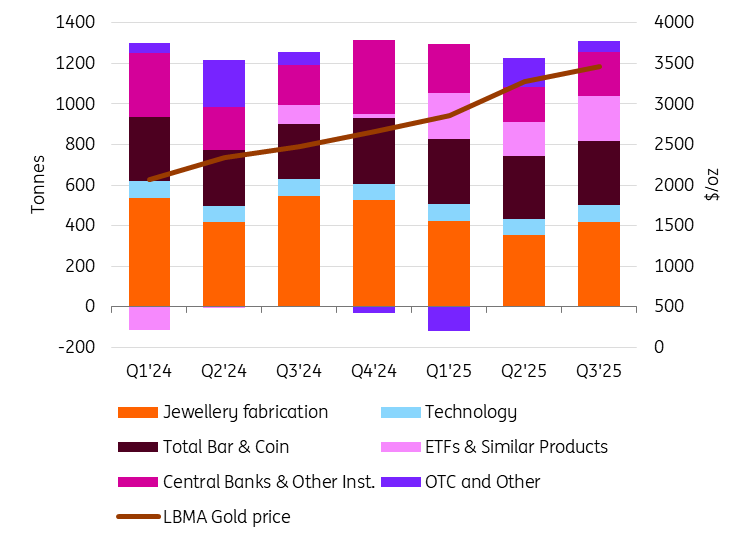

Gold got the memo. It smashed through four thousand dollars per ounce for the first time in history, eventually reaching over forty five hundred. Central banks bought over six hundred thirty four tonnes through Q3 alone: the continuation of a three year buying spree that shows no signs of slowing. The World Gold Council reported that institutional demand remained robust throughout the year.

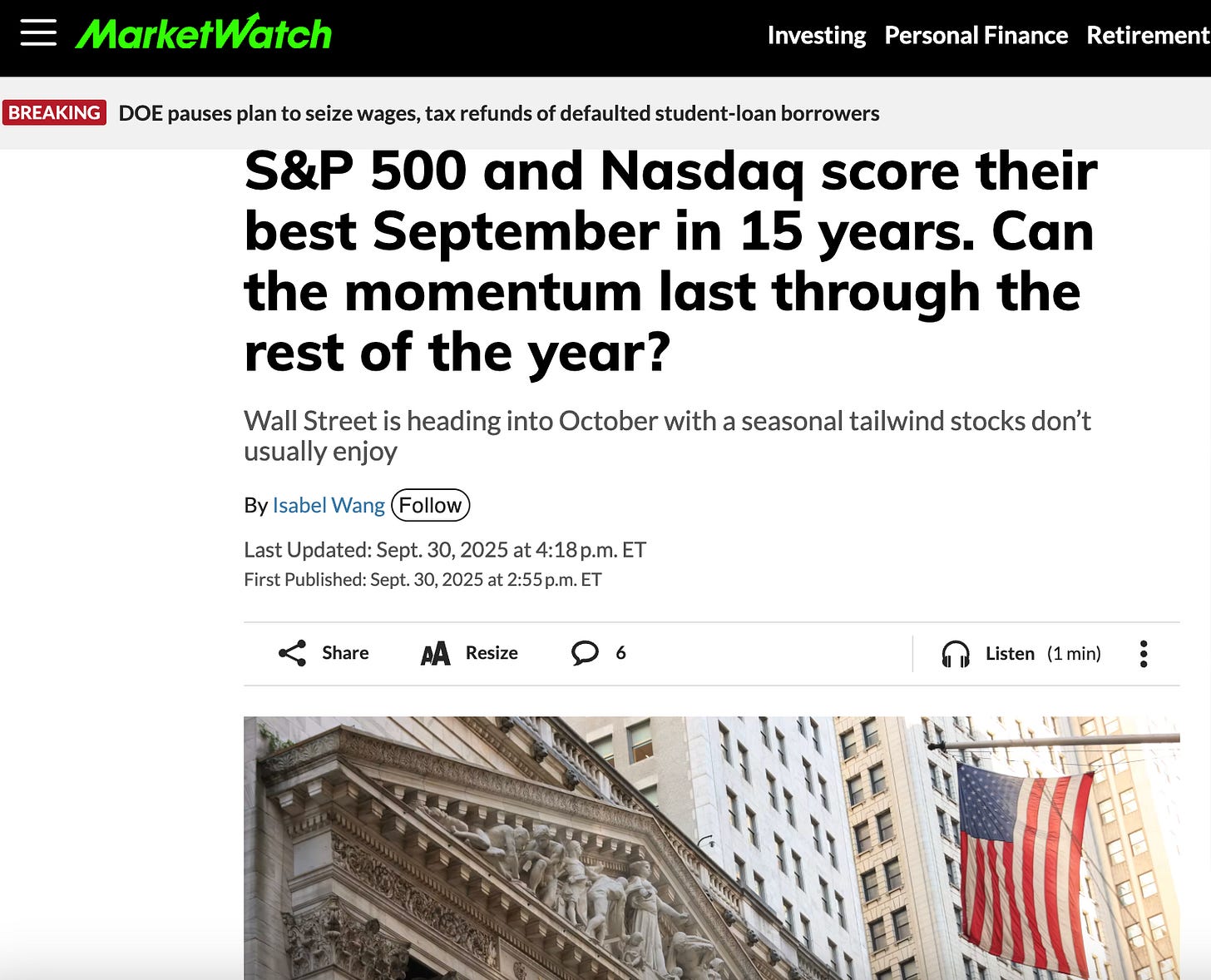

Stocks held up. The S&P 500 notched its strongest September performance in years, driven by the Magnificent 7 and hopes of an AI boom.

But Bitcoin has been stuck at the starting line. The old mental models stopped working. Not because Bitcoin failed, but because Bitcoin has changed.

Wall Street is here.

Before 2024, Bitcoin was primarily held by three groups: early adopters sitting on massive gains, retail speculators trading the volatility, and a handful of crypto native funds. The market moved on narratives, tweets, and momentum. When Elon Musk posted a meme, the price boomed. When China banned mining, prices collapsed. It was chaotic, volatile, and reflexive.

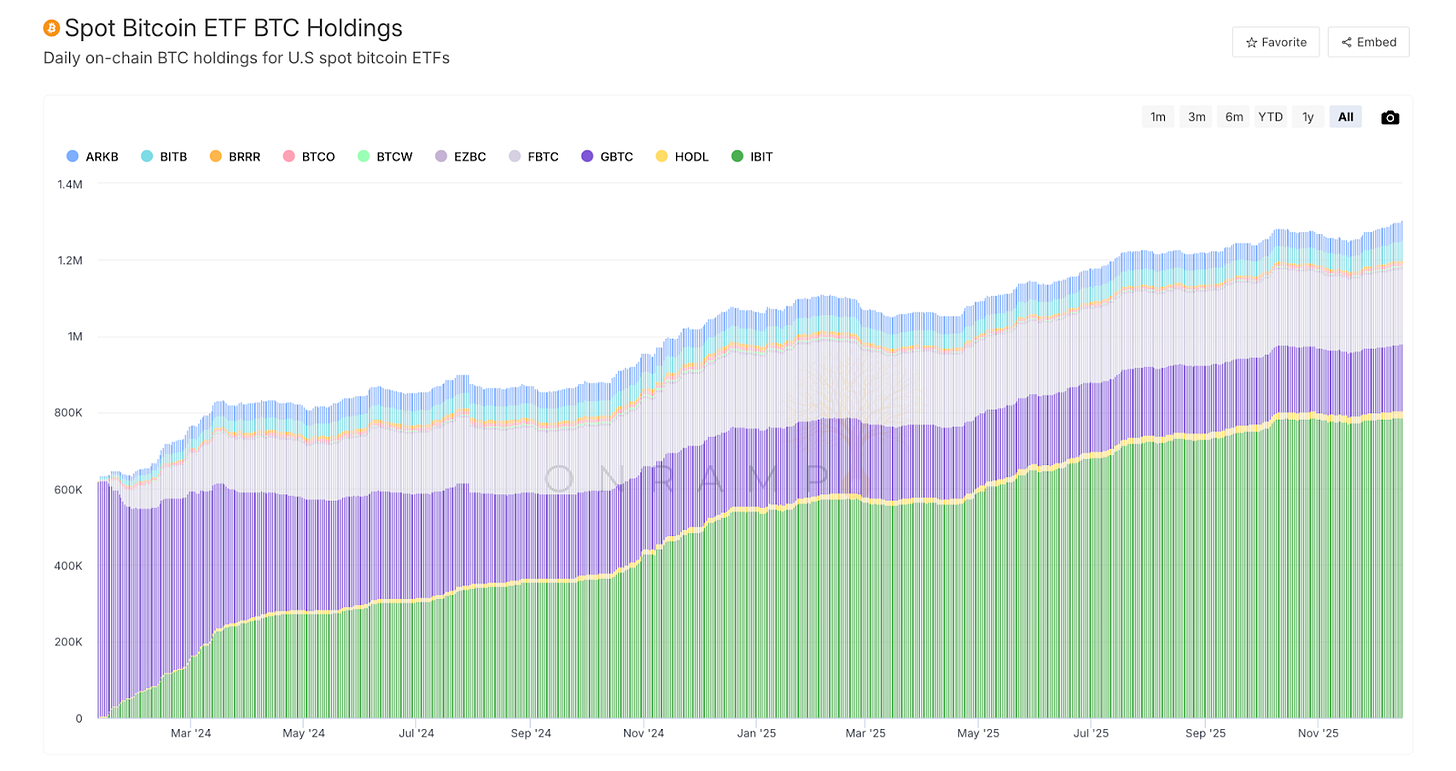

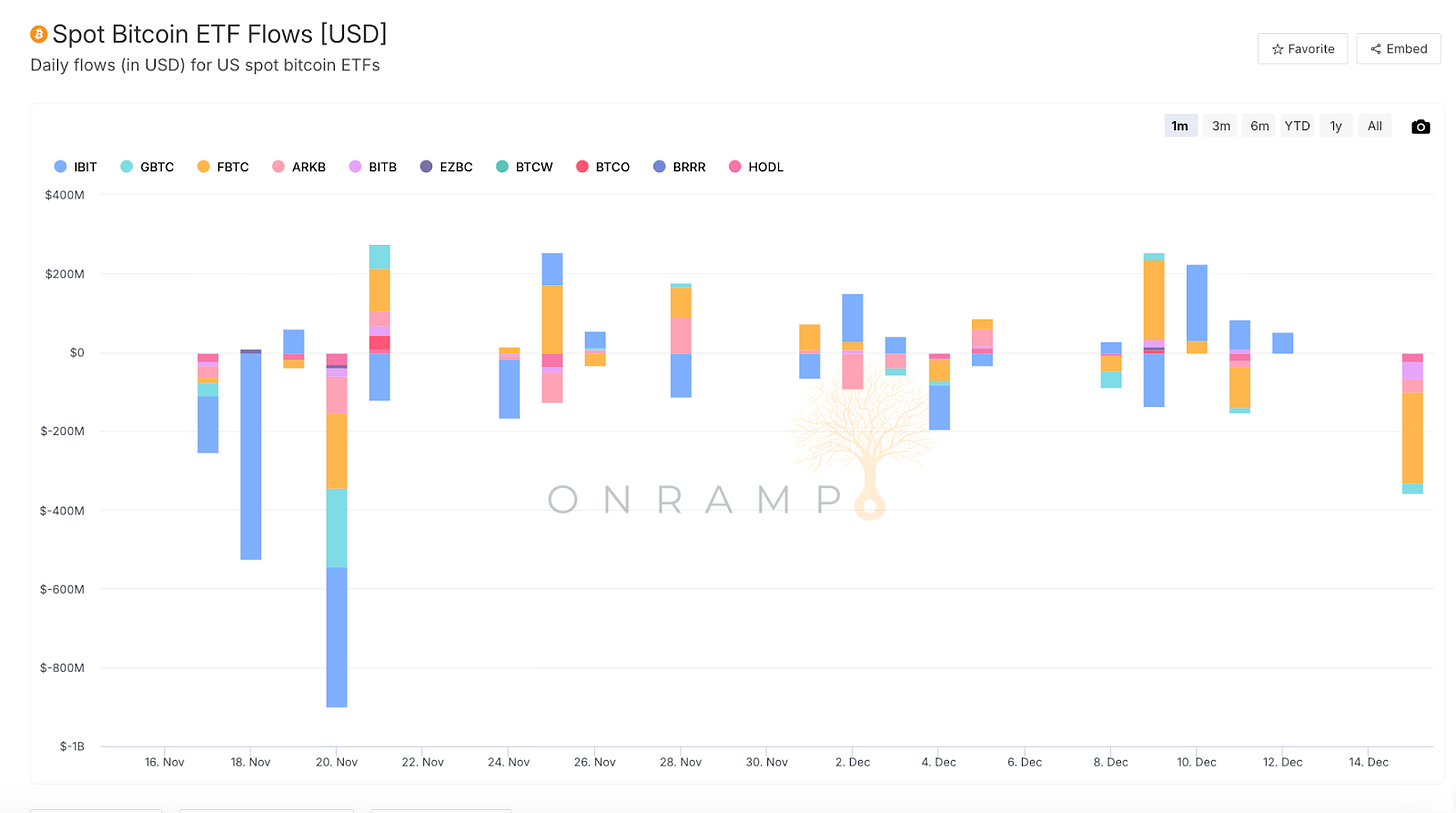

Then came January 2024. The SEC approved the spot Bitcoin ETFs. BlackRock, Fidelity, and a dozen other asset managers suddenly had products to sell. And within months, these ETFs accumulated hundreds of thousands of Bitcoin. By mid 2025, total ETF assets under management peaked at around one hundred fifty two billion dollars, and total coins held crossed 1.3 million.

Source: OnRamp Bitcoin

This was new money entering the market. Institutional money. And this money comes with compliance departments, risk committees, and quarterly reporting requirements.

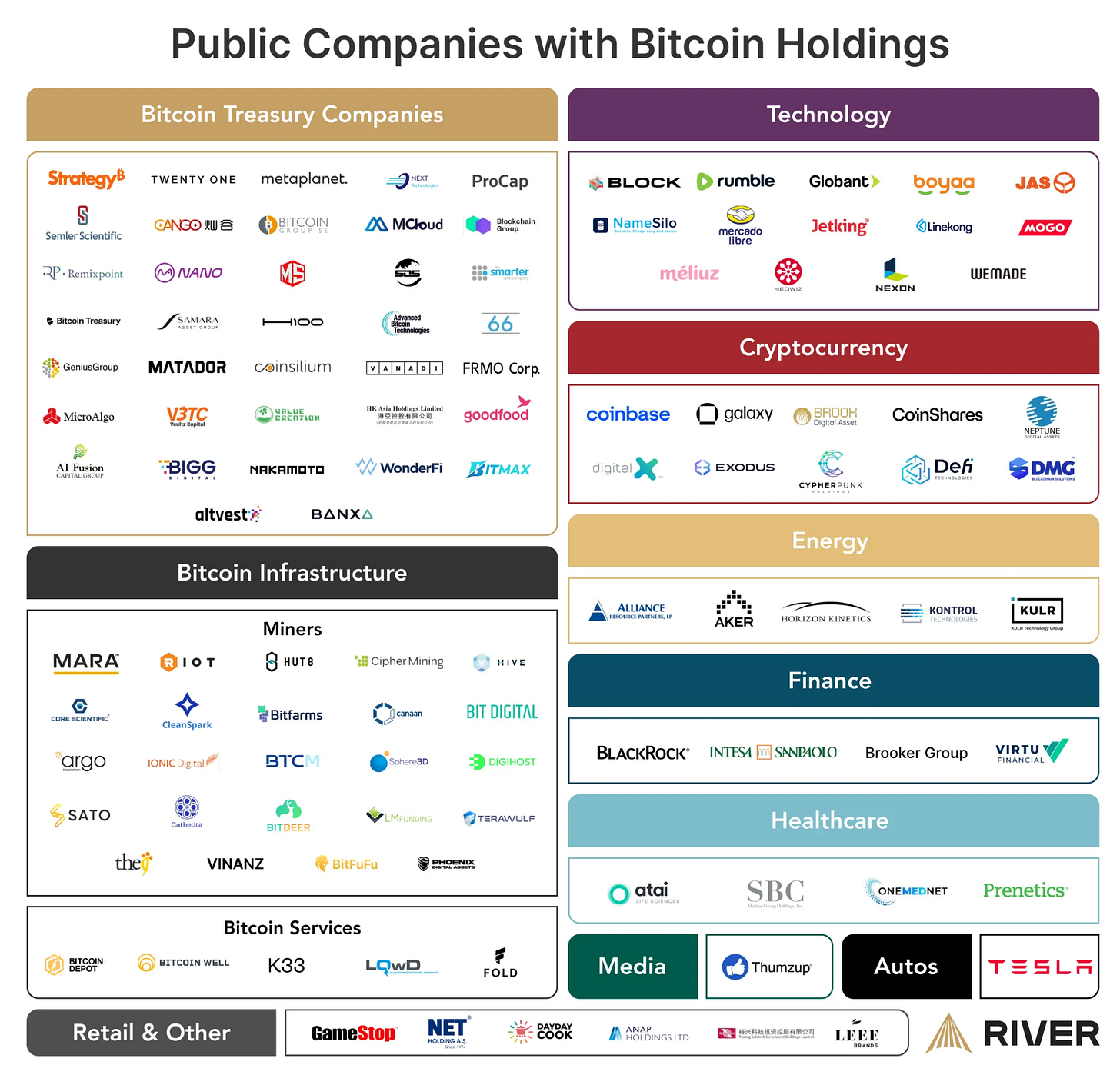

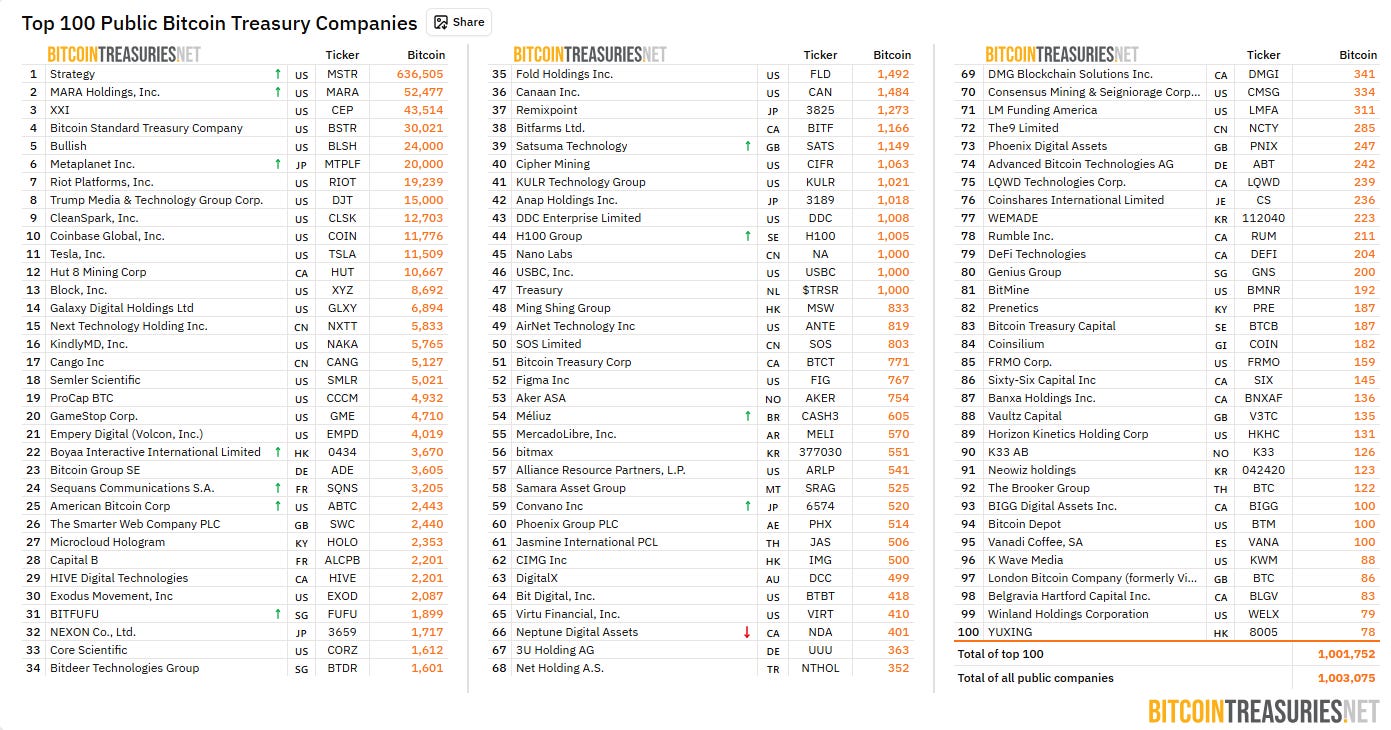

Corporate treasuries followed. Strategy, formerly MicroStrategy, had pioneered the model years earlier, but now dozens of companies announced their own Bitcoin treasury strategies. Some were legitimate businesses diversifying reserves. Many were shells hoping to replicate Strategy’s stock price magic. By some counts, over 172 publicly traded companies now hold Bitcoin on their balance sheets.

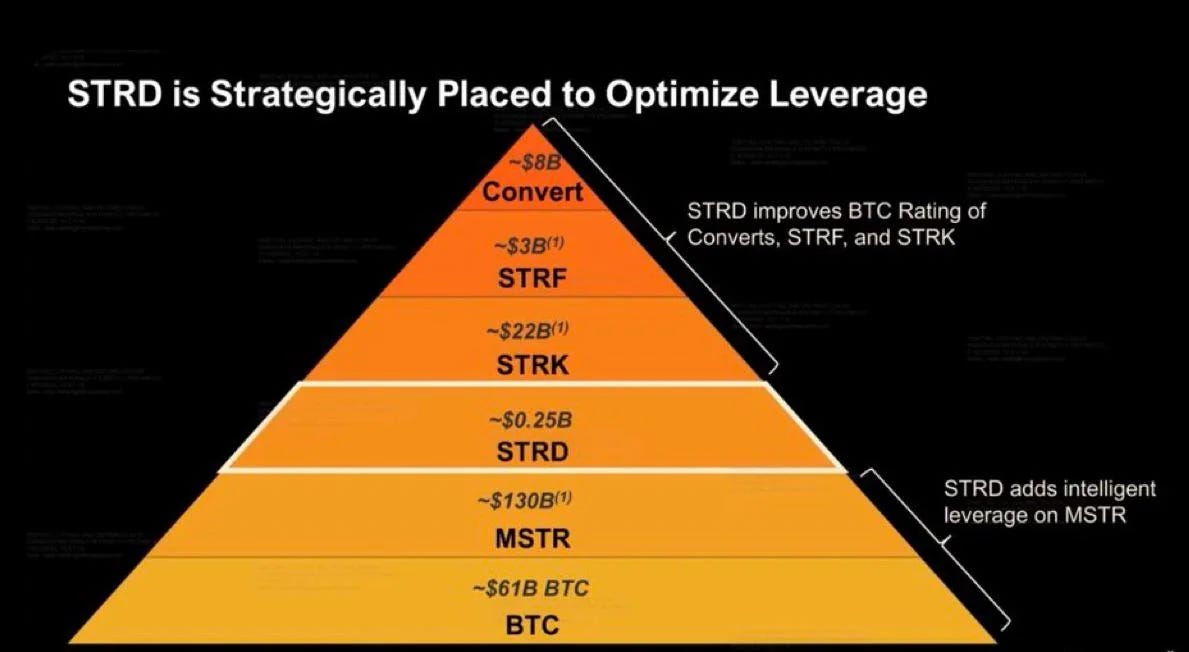

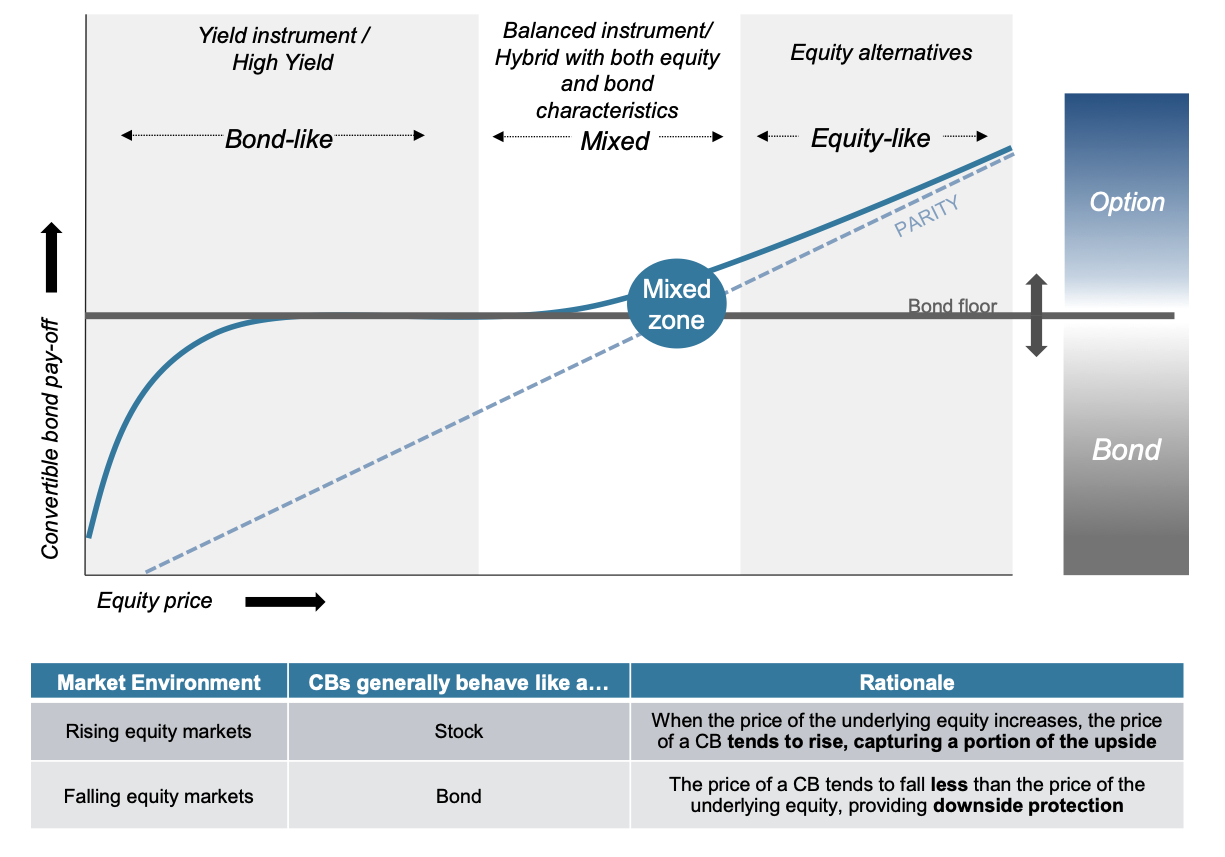

Structured products proliferated. Convertible bonds backed by Bitcoin holdings. Preferred shares promising eight, ten, even twelve percent dividends funded by Bitcoin related activities. An entire ecosystem of financial instruments emerged that use Bitcoin not as a speculative bet, but as collateral backing fixed obligations.

(By the way, does this image remind you of anything? Maybe something to do with Pyramids, Schemes, or a certain Italian Fraudster?)

And this is the crucial distinction that explains everything about 2025.

Gold is owned outright. When central banks accumulate gold reserves, and they have been buying at record pace, they do not pledge it against convertible bonds. There are no preferred dividends backed by gold holdings. No corporate treasuries that might be forced to liquidate if stock prices drop below certain thresholds. They simply hold it as a reserve asset, unencumbered.

But now, Bitcoin is increasingly encumbered. It sits on corporate balance sheets that owe money to bondholders. It backs preferred shares with mandatory dividend payments. It serves as collateral in structured products with fixed obligations regardless of price movements.

Why does this matter for price dynamics?

Because collateral does not chase upside. Collateral is held to service liabilities. When your Bitcoin is backing hundreds of millions of dollars per year in dividend and interest payments, your behavior changes completely. You are not watching charts looking for the next breakout. You are watching your cash runway and calculating whether you can meet next quarter’s obligations.

This is a fundamental regime change. Bitcoin went from an asset that moved on narratives to an asset that moves on balance sheet math. The HODLers who used to set the marginal price are now competing with CFOs who have fiduciary duties and debt covenants.

Bitcoin did not get weaker. It got institutionalized. And institutions play a different game.

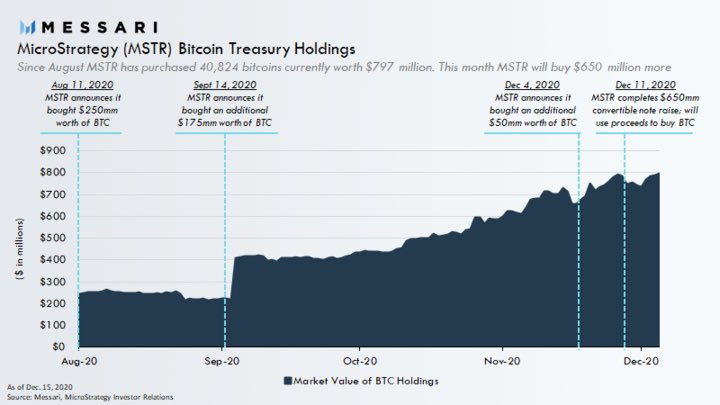

This all started five years ago.

In August 2020, CEO Michael Saylor announced that MicroStrategy would convert its treasury reserves into Bitcoin: not as a small hedge, but as the primary business strategy. The software business that had defined the company for decades became an afterthought. Bitcoin was now the product.

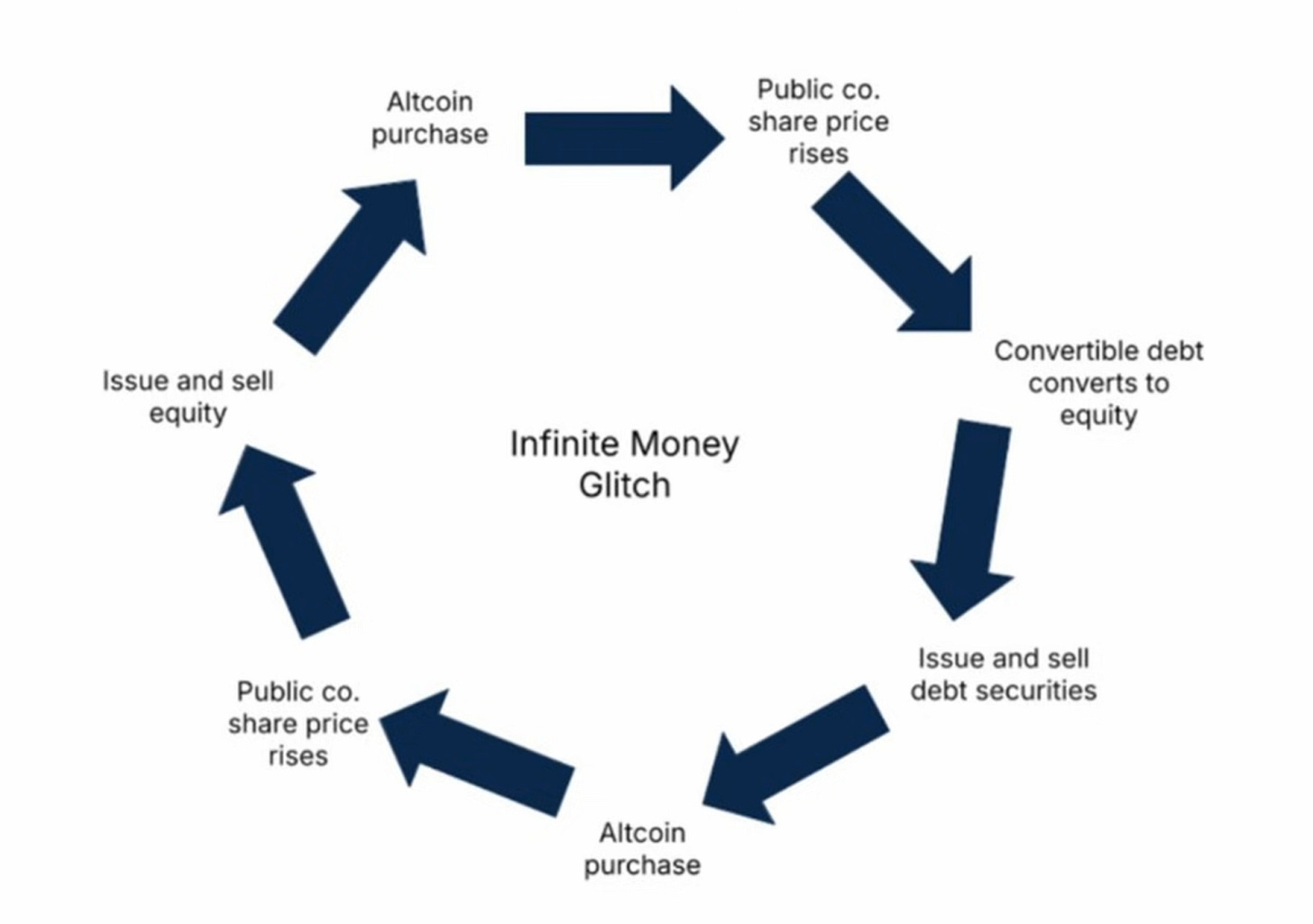

Here is how the flywheel worked in the glory days.

Bitcoin rises. Because Strategy holds so much Bitcoin with leverage from debt, its stock rises even faster, trading at a premium to net asset value. At the peak in late 2024, investors paid $3.40 for every dollar of Bitcoin on the books.

Source: StrategyTracker.com

That premium created magic. Issue new shares at the premium price. Use those dollars to buy more Bitcoin. This adds market demand, pushing Bitcoin higher. Stock rises further. Premium expands. Repeat.

The convertible bonds added another dimension. A convertible bond gives holders the right to convert debt into equity at a set price. The conversion option’s value depends heavily on volatility: the more the stock bounces around, the more valuable the option.

Strategy’s volatility was so extreme that hedge funds would buy convertibles and short the stock against them in gamma trading strategies. This allowed Strategy to issue billions in debt at zero percent interest. The option value alone compensated bondholders. Free money to buy Bitcoin.

By late 2025, Strategy held over 671,000 Bitcoin: roughly three percent of total supply, with market value around fifty seven billion and paper gains exceeding ten billion dollars.

Source: StrategyTracker.net

But the flywheel broke.

November 2024 marked the peak, when mNAV hit 3.4x. One year later, it collapsed below 1.0. For the first time since 2022, Strategy’s market cap fell below its Bitcoin holdings.

The gamma traders who provided cheap capital ended up killing it. When you buy a convertible and short stock against it, you are mechanically buying dips and selling rallies. Enough players doing this smooths out price action. Lower volatility meant future convertibles would be far less attractive: the option value that enabled zero coupon debt was shrinking.

Meanwhile, copycat treasury companies flooded the market. Why pay a premium for Strategy when dozens of competitors offered Bitcoin exposure cheaper?

Metaplanet, Japan’s largest corporate Bitcoin holder, collapsed eighty percent and took out a $130 million loan against its holdings to survive. Smarter Web Company in the UK traded at a discount to its crypto. The premium that seemed like Strategy’s birthright turned out to be a temporary inefficiency that competitors arbitraged away.

Today Strategy owes approximately $680 million per year in fixed obligations: interest on $8 billion in convertibles plus dividends on five classes of preferred stock. The deprioritized software business generates roughly $475 million in annual revenue while losing $62 million in cash flow. Without equity issuance or Bitcoin appreciation, the firm cannot cover obligations.

So the company built a cash reserve to bridge the gap: approximately $1.4 billion as of latest filings. At current burn rate, that is about twenty one months of runway without touching Bitcoin.

If Bitcoin rallies and the NAV premium returns above 1.0, Strategy issues shares at favorable terms and refills the war chest.

If Bitcoin stagnates and the premium stays compressed, the company faces a dilemma: dilute shareholders by selling stock below NAV, or liquidate Bitcoin to fund obligations.

This is not quite a death spiral. Debt maturities are staggered to 2032, and bondholders cannot force liquidation: they can only convert at strike prices well above current levels. But these market dynamics can definitely force the stock lower.

And here is the key difference - nobody is running the same strategy with precious metals.

When central banks accumulate gold, and they have purchased over one thousand tons each year since 2022, they are not pledging it against convertible bonds. There are no preferred dividends backed by gold holdings. No corporate treasuries that might be forced to liquidate if stock prices drop below certain thresholds.

Source: World Gold Council Q3 2025 Demand Data

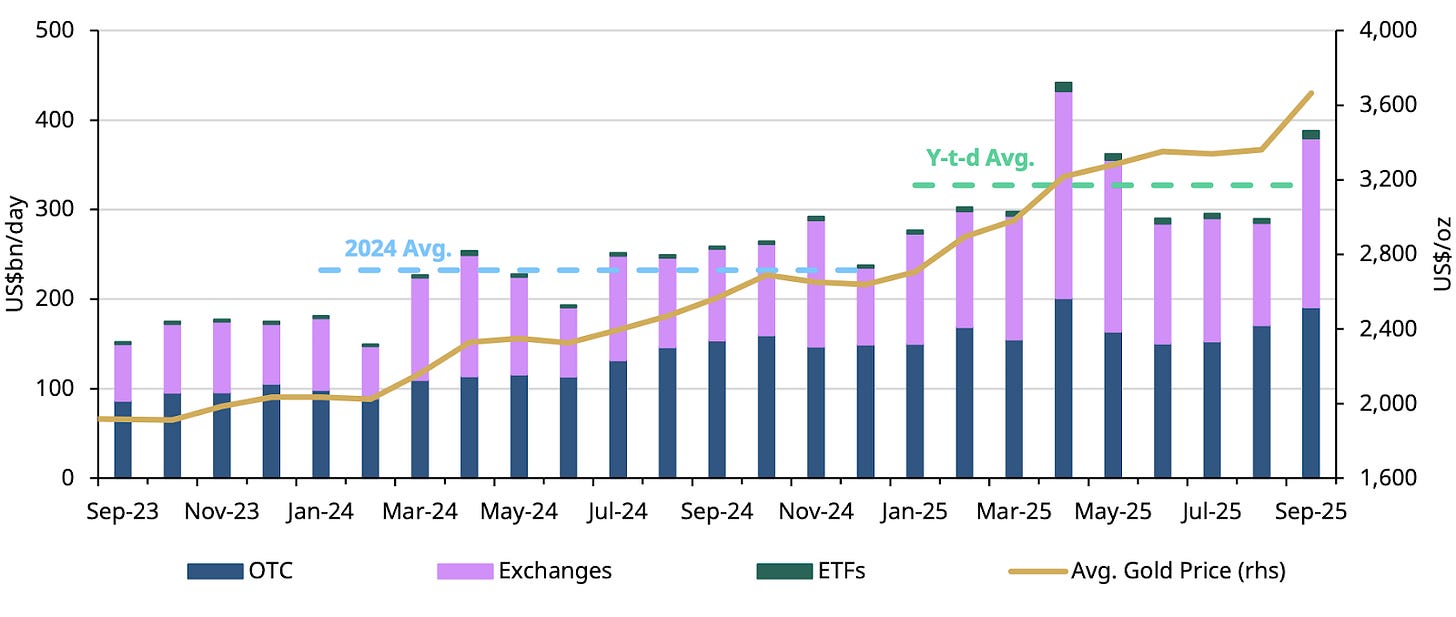

Gold ETFs have seen massive inflows in 2025 but Bitcoin ETFs have seen quite the opposite.

Spot Bitcoin ETFs experienced over three billion dollars in net outflows since October. BlackRock’s iShares Bitcoin Trust recording its longest withdrawal streak since launching.

Source: OnRamp Bitcoin

Analysts initially feared this represented institutional capitulation and that the big money was leaving. But deeper analysis revealed something more mechanical. Much of the outflow came from basis trade unwinds. These are arbitrage strategists closing positions as the futures premium compressed, not long term holders abandoning the asset.

In fact, according to on chain analyst Checkmatey, around 70% of Bitcoin wealth sits above $85K. This means the vast majority of new money is locked in at high prices. This money is barely breakeven right now and is unlikely to add more when the bull market has been this disappointing.

Bitcoin also does not behave like equities because it generates no cash flows.

When the S&P 500 rises eighteen percent, over half that return comes from actual earnings growth. Companies produce profits, pay dividends, buy back shares. There are genuine business activities that create a floor under stock prices.

As Bitcoin has no dividend, its value derives entirely from demand, scarcity, and narrative momentum. And by the way that is not a criticism: gold also produces nothing. But what gold does not have is the structural overhang of corporate treasuries with fixed obligations.

(Before the bitcoin bulls come for my head with pitchforks and torches, please know I am still long Bitcoin, I am just accepting the reality that the market dynamics have shifted considerably since 2020.)

When the biggest marginal buyer shifts from accumulation mode to survival mode, there is no earnings report to catch the falling knife. No dividend to provide a floor. Just supply and demand, with supply suddenly more motivated than demand.

The reflexive feedback loops have turned negative. Strategy underperforms, which hurts leveraged ETFs like MSTX and MSTU. Such products offer two times exposure to Strategy’s stock. Those ETFs are down approximately eighty five percent in the last 12 months, ranking among the ten worst performers out of forty seven hundred US ETF products.

Source: TradingView

Retail investors who bought these products have been destroyed. That destruction reduces trading volume and momentum, compressing the volatility of MSTR and ultimately making future convertible issuances more expensive. And this process naturally means there is less capital to buy Bitcoin with.

So where does this leave Bitcoin? And what does it mean for investors trying to navigate a market that no longer follows the old rules?

Let me be clear about what this story is and what it is not.

This is not a story about Bitcoin failing. Bitcoin achieved something remarkable in 2024 and 2025 when it became a legitimate institutional asset class. BlackRock, Fidelity, and the largest asset managers in the world now offer Bitcoin products. Public companies hold it on their balance sheets. It is discussed in earnings calls and SEC filings. That is by no means a failure.

Now a significant portion is owned by institutions with fixed obligations, ETFs subject to redemption pressures, and corporate treasuries navigating complex capital structures. These holders respond to different signals: credit spreads, volatility surfaces, and NAV premiums rather than Twitter sentiment and halving cycles.

What breaks the current stalemate? Two paths seem most likely.

The first is a renewed volatility regime. If Bitcoin breaks decisively higher, perhaps driven by a macro shock, a major sovereign adoption announcement, or simply renewed speculative enthusiasm, the NAV premium at Strategy and similar companies could return. Above 1.0x, the flywheel restarts. Share issuance becomes accretive again. Capital flows to Bitcoin purchases.

The second path is simply time. Strategy’s convertible bonds mature between 2027 and 2032. As those obligations roll off or convert to equity, the fixed payment burden shrinks. If the company can navigate the next two to three years without being forced into significant Bitcoin sales, the structural pressure eases naturally.

The long term holders have not disappeared. On chain data shows that roughly 61 percent of circulating Bitcoin supply is held by long term investors, defined as addresses that have not moved coins in over a year. That is a higher percentage than at previous cycle peaks. The diamond hands are still there - they are just no longer the only hands that matter.

For investors, the implication is straightforward: the old playbook needs updating. Bitcoin may still deliver tremendous returns over a full cycle.

But expecting it to track gold during fear spikes or front run equities during liquidity expansions, the patterns that worked for a decade, means expecting a market structure that no longer exists.

Bitcoin stopped being a pure narrative asset and started becoming financial infrastructure: balance sheet collateral, ETF wrapper, corporate treasury reserve.

Infrastructure can be boring. It sits there and does its job. It certainly does not generate memes or viral moments.

Until the moment everyone realizes they need it.

Excellent analysis. Really appreciate this

Never liked bitcoin and admit I lost out on tremendous gains even at the price bitcoin is trading at. My thought was why hold virtual gold when you can hold the real thing so I bought gold instead of bitcoin.