Brave New World

The modern economy is rapidly splitting into two realities. What happens when Sovereign Individuals face off against Nation States?

Authored by Alex Petrou

"We are going to keep the U.S. the dominant reserve currency in the world, and we will use stablecoins to do that."

— Scott Bessent, 79th United States Secretary of the Treasury

The White House’s Inaugural Digital Asset Summit

March 7, 2025

Scott Bessent’s statement might have seemed like science fiction just 30 years ago. The notion that the U.S. could maintain its global dominance through magic internet currency would have been regarded as absurd, a far cry from what the world understood about money and power at the time. Yet, a couple of authors in the late '90s did envision a future where digital currencies would rewrite the rules of global economics…

Nearly three decades ago, a book was published by Lord William Rees Mogg and James Dale Davidson that would prove remarkably ahead of its time. Within the Bitcoin community, The Sovereign Individual has gained an almost mythical status for its strikingly accurate predictions about the rise of cyberspace and, more notably, the emergence of what the authors described as "cybercash".

The culture surrounding the book has taken on a vibe not unlike the Grays Sports Almanac from Back to the Future Part II, where Marty McFly gains access to a book filled with future sports results — a cheat code for what’s to come.

“As cybercommerce begins, it will lead inevitably to cybermoney.

This new form of money will reset the odds, reducing the capacity of the world's nationstates to determine who becomes a Sovereign Individual…

…Tens of billions, then ultimately hundreds of billions of dollars will be controlled by hundreds of thousands, then millions of Sovereign Individuals.”

As remarkable as The Sovereign Individual may seem today, its initial reception was far more mixed. When it was first published, the book didn't command the same level of reverence it enjoys now. A review posted online on May 19, 2010, not long after the release of the Bitcoin whitepaper, captured this divide perfectly.

"In this combination of sweeping metahistory and myopic self-interest, some statements are penetrating, others appalling, and all are astonishing."

However, for all their foresight, the authors failed to predict one crucial twist: the co-opting of this digital revolution by the very forces they expected to be undermined. While Rees-Mogg and Davidson imagined a world where individuals would seize control of their financial futures, today we find the U.S. government leaning into digital currency in a way they may not have anticipated. The very digital transformation they foresaw as an engine for decentralisation is now being harnessed to preserve, not dismantle, traditional power structures.

Does this deviation from their original vision invalidate their entire thesis? Can the authors’ broader predictions about the future of money and governance still stand, or do these missteps render their conclusions irrelevant?

The question isn’t whether they saw the future, which they certainly did, but rather whether they fully understood the form it would take. While the book may seem less far-fetched today than it likely did at the time of its publication, the story is definitely far from over. Unlike James Dale Davidson and Lord William Rees-Mogg, we have the advantage of nearly three decades of hindsight to guide our exploration and critique. The real question now is whether its core thesis will ultimately stand the test of time. Let’s dive in.

SPONSOR: I’ve talked a lot about the value of Bitcoin and its use case as fiat currencies inflate away. As such, I'm proud to have Onramp as a sponsor supporting this newsletter, a firm at the forefront of pioneering a trust-minimized form of Bitcoin custody.

With Onramp Multi-Institution Custody, assets live in a segregated, cold-storage, multi-sig vault controlled by three distinct entities, none of which have unilateral control.

When the authors wrote The Sovereign Individual, some of their predictions seemed absurd. But many of those ‘unrealistic’ predictions have proven remarkably accurate. Take, for instance, their assertion that:

“For the first time, those who can educate and motivate themselves will be almost entirely free to invent their own work and realize the full benefits of their productivity.”

If you look around today, it’s not uncommon to see individuals building businesses, amassing fortunes, and cultivating global audiences from the comfort of their own homes. The barriers to entry are lower than ever: all you need is internet access, a bit of self-discipline, and a sprinkle of ingenuity. With fewer gatekeepers standing between creators and the world, the entrepreneurial spirit has exploded in ways that were once unimaginable.

Just look at the vast ecosystem of content creators, freelance workers, and online entrepreneurs who, with nothing more than a laptop and an internet connection, are pulling in six-figure salaries or more.

In March 2025, a post went viral on Twitter/X that perfectly captured what these authors foresaw. @levelsio shared how he had created a game using only AI in just 17 days, a project that had already generated $87,000 in revenue and was on track for $1 million in annual recurring revenue (ARR).

This isn’t an isolated case. With rapid advancements in AI, stories like this are becoming increasingly common, and there’s little reason to believe the trend will slow down. As technology continues to lower the barriers to entry, the world Davidson and Rees-Mogg envisioned where motivated individuals can thrive independently seems closer than ever.

But for all the prescient insights, not every prediction from the book has panned out.

“At the highest plateau of productivity, these Sovereign Individuals will compete and interact on terms that echo the relations among the gods in Greek myth. The elusive Mount Olympus of the next millennium will be in cyberspace – a realm without physical existence that will nonetheless develop what promises to be the world’s largest economy by the second decade of the new millennium. By 2025, the cybereconomy will have many millions of participants. Some of them will be as rich as Bill Gates, worth tens of billions of dollars each. The cyberpoor may be those with an income of less than $200,000 a year. There will be no cyberwelfare. No cybertaxes and no cybergovernment.”

Now, it’s safe to say that in 2025, the world’s richest are not holed up in cyberspace, nor are we living in an economy where the digital realm is the primary source of wealth. While The Sovereign Individual foresaw a world where cyberspace could be the backbone of global commerce, it also predicted that the wealth gap between the cyber-rich and cyberpoor would be more extreme in the year 2025.

For context, Bill Gates’ net worth in 1997 was roughly $36.4 billion, approximately $70 billion in today’s terms. By comparison, Strategy (MSTR), the largest corporate holder of Bitcoin, is barely worth that much. Despite the digital asset boom, not only are there far fewer ultra-wealthy “cyber elites” than the authors imagined, but even the biggest corporate Bitcoin player has just about matched Gates' inflation-adjusted fortune.

However, while their timeline may have been off, the broader trend they predicted still holds weight. The rise of digital wealth is undeniable, and while we haven’t seen countless “cyber elites” emerge by 2025, the potential remains. After all, at around $330,000 per Bitcoin, Satoshi Nakamoto would become the richest person in the world.

Some of the book's more speculative predictions are still very much up for debate. The idea of “cyberdoctors,” “cyberlawyers,” and “cybersurgery” is still a tantalising possibility. Sure, telemedicine and digital legal services have made strides, but we’re not yet living in a world where a diagnosis or a surgery can be performed remotely with the precision of a seasoned professional through a screen. That being said, the technological landscape is constantly evolving, and the idea of a fully digitalised, borderless healthcare system could still materialise. It just might take a little longer than Rees-Mogg and Davidson expected.

Then there’s the authors' view on digital money and its role in defeating inflation and breaking the grip of government-issued currencies.

“Governments facing serious competition to their currency monopolies will probably seek to underprice the for-fee cyber currencies by tightening credit and offering savers higher real yields on cash balances in national currencies. Some governments may even seek to remonetize gold as another expedient from private currencies. They may well reason that they could gain higher seigniorage profits from a loosely controlled nineteenth-century gold standard than would be the case if they allowed their national currency to be displaced entirely by commercial cybermoney. But not all governments will respond the same way. Those in regions where computer usage and Net participation are low may opt for old-fashioned hyperinflation in the early stages of the cybereconomy.”

While the book predicted governments would respond aggressively to competition from digital currencies, we haven’t yet seen significant hostility toward Bitcoin or broader crypto from most major governments. And as for monetising gold in response to crypto, much of the recent debate about repegging currencies to gold appears to be driven more by concerns over inflation worries and insolvent debt rather than fear of cyber currencies themselves.

Rather than attempting to crush Bitcoin, policymakers seem more preoccupied with stabilising their own monetary systems. CBDCs, for example, appear to be less about countering crypto and more about giving governments greater control over domestic financial flows.

In early March, Christine Lagarde, President of the ECB, revealed plans to launch the digital euro by October 2025, emphasising that "If we are not involved in experimenting and innovating in terms of digital central bank money, we risk losing the role of anchor that we have played for many many decades.”

https://cbdctracker.hrf.org/home

The irony is that governments does not even have to implement CBDCs in order to gain new levels of control over their domestic financial system. A new technology, meant to democratize finance and improve user onramping into the crypto ecosystem.

Stablecoins, such as Tether (USDT), have emerged as a combination of two powerful ideas: the unrelenting global demand for dollars described by the Dollar Milkshake Theory (We have discussed in detail in previous pieces such as The Milkshake Returns) and the cyber-financial revolution predicted in The Sovereign Individual. These digital assets were envisioned as tools of financial autonomy, yet their rapid growth has instead reinforced the dollar’s dominance in surprising ways.

Stables provide individuals with a means to transact outside traditional banking systems, making them especially popular in regions facing capital controls, inflation, or weak financial infrastructure. In this sense, they appear to fulfill the vision of The Sovereign Individual, empowering people to store and move wealth in a system beyond state control. Yet at the same time, stablecoins remain tethered (quite literally) to the dollar- instead of weakening the dollar’s grip, they have strengthened it.

In 2024, Tether reported a staggering $13 billion in net profit with a workforce of just 50 employees, an astonishing $260 million per employee. This level of efficiency places Tether among the most profitable companies in the world on a per-employee basis. Even more revealing is Tether’s position as one of the top 10 holders of U.S. Treasuries.

While Rees-Mogg and Davidson foresaw individuals using digital tools to opt out of centralised control, stablecoins are proving to be a double-edged sword. They provide an escape route for individuals in distressed economies, yet in doing so they fuel the dollar’s continued dominance.

This dynamic ties into the network effect concept, often linked to Metcalfe’s Law, which suggests that a network’s value grows exponentially with each new participant.

“As a good rule of thumb, proprietary technology must be at least 10 times better than its closest substitute in some important dimension to lead to a real monopolistic advantage.” - Peter Thiel

In the case of monetary systems, this means any currency seeking to displace the dollar must be not just marginally better, but vastly superior.

Not only that, but stables open up the door to much more insidious control over our financial system than ever before.

Most of the biggest stablecoins, like USDC and USDT, are backed by real-world assets like U.S. dollars held in bank accounts. These stablecoins are issued by centralized companies, which means they operate under the rules of the traditional financial system. That comes with oversight, regulations, and compliance. This gives the issuers the power to freeze, block, or even blacklist wallets holding their stablecoins. If a government or regulator asks them to cut someone off, they can do it with the push of a button.

We’ve already seen this happen. In 2022, after the U.S. Treasury sanctioned Tornado Cash (a privacy-focused Ethereum mixer), USDC issuer Circle immediately froze over hundreds of thousands of dollars worth of stablecoins linked to sanctioned wallets. It was a chilling reminder that stablecoins, despite living on blockchains, are only as censorship-resistant as the companies behind them allow.

Similarly, during the Canadian trucker protests in early 2022, some financial service providers froze bank accounts and wallets of individuals supporting the protests. If stablecoins were a more dominant form of currency at that time, they could have been subjected to similar restrictions, with issuers cutting off access to funds based on political pressure or social controversy.

Stablecoins also carry the potential to evolve into programmable money. Programmable money can be coded with specific conditions dictating how, when, and where it can be spent. For example, stablecoins could be programmed to block purchases of alcohol, fuel, or products deemed non-essential. Additionally, expiration dates could be embedded into stablecoins to prevent hoarding and force people to spend within a certain timeframe, ostensibly to stimulate economic activity. Governments could also implement behavior-based incentives, rewarding compliant citizens with tax rebates or discounts while restricting access for those who do not align with preferred guidelines.

A stablecoin social credit score.

These capabilities are not theoretical. China’s central bank digital currency (CBDC), the digital yuan, already features elements of programmability, enabling the government to monitor, restrict, and control financial behavior on a massive scale.

A central theme of the book is the ‘inevitable’ collapse of the nation-state under the crushing weight of government debt. While this assertion seems undeniably plausible, there’s a powerful counterpoint to consider, the Dollar Milkshake Theory.

To briefly revisit the theory, Brent Johnson argues that, although the U.S. (like many other nation-states) is burdened by its immense debt ($36 trillion at the time of writing), there is a significant catch. The rest of the world collectively holds about $400 trillion in dollar-denominated liabilities. This debt, however, cannot simply be inflated away. This creates a scenario where the U.S. dollar has an overwhelming global demand. In essence, when there’s more demand for a currency than there is supply, a hyperinflationary collapse becomes a highly unlikely event. This is why the U.S. is uniquely positioned with what’s been termed "exorbitant privilege." This means that even as the nation-state faces crippling debt, the U.S. dollar remains relatively stable and less susceptible to collapse.

The theory provides a framework for understanding how the global sovereign debt bubble will unravel. The dollar heads to all-time highs against all other fiat currencies, bonds go sour, gold rises, and US stocks dominate as capital runs into dollar denominated assets.

This unique position the dollar has also makes it extremely difficult and highly unlikely for any other currency, whether fiat or cryptocurrency, to overthrow it. The entrenched demand for dollars, driven by global debt obligations and trade dominance, creates a powerful moat that alternative currencies have yet to breach.

So, does the DMT completely negate The Sovereign Individual's thesis of the nation-state’s impending demise and the bitcoin standard future? In part, yes, but it doesn’t entirely invalidate the argument.

A crucial piece of the puzzle that isn’t fully accounted for is the corporate burden. While Johnson emphasises the global demand for dollars, it's important to note that most dollar-denominated debt doesn’t sit with individuals but with corporations, particularly those outside the United States. As the eurodollar market expanded globally, it’s undeniable that the dollar system became increasingly difficult to untangle. Crucially, however, the burden of this dollar-denominated debt does not fall on most individuals worldwide. Instead, it is the sovereign entities, banks, governments, and corporations that are handcuffed by this debt, while individuals remain largely unencumbered by the dollar's constraints.

The reliance on large firms to sustain the Industrial Age economy was essential. As The Sovereign Individual argues, the dominance of corporate bureaucracy was, for a time, a necessary feature of industrial-scale production. Firms provided structure, coordination, and accounting controls that were essential for managing complex supply chains and vast labor forces. Yet these same bureaucracies are now proving to be liabilities in the emerging digital age.

The fixed costs of maintaining administrative teams and layers of middle management are increasingly burdensome in a world where nimble individuals can operate just as effectively with minimal overhead. As technology progresses, many of the economies of scale that once justified large firms are disappearing. Digital tools, automation, and remote collaboration have dramatically reduced the need for sprawling corporate hierarchies.

The way we see it, this convergence of these forces is key: the Milkshake is how the old world ends, and The Sovereign Individual is how the new one begins. As the traditional corporate giants falter under the weight of debt and inefficiency, individuals empowered by digital tools and decentralised financial systems are increasingly poised to thrive. The collapse of legacy institutions doesn’t mark the end of economic progress; it signals a profound shift in power from centralised hierarchies to self-reliant individuals.

Recently, a debate between Gary Stephenson, former trader and author of The Trading Game, and Daniel Priestly, entrepreneur and business strategist, went viral after airing on The Diary of a CEO podcast. Hosted by Steven Bartlett, the conversation quickly escalated, capturing the growing sense of unease about the state of the economy.

Both Gary and Daniel agreed that the UK, and much of the developed world, is in trouble. But their perspectives on why, and more importantly, how to fix it were miles apart. Gary pushed hard for higher taxes on assets and the ultra-wealthy, warning that wealth inequality is spiraling out of control. Daniel retourted by outlining the impracticalities of such policies and instead advocating for entrepreneurship and low taxation. Their disagreement was more than just a policy debate. It was a perfect encapsulation of the deep economic divide that has left so many people frustrated, angry, and increasingly disillusioned.

What made the debate particularly intriguing to us was a comment from Daniel that summarised our views nicely:

“I think there is two economies going on at the moment, there is a dying economy, which is the Industrial Revolution economy, that is all the office jobs, factory jobs, that is very much being automated away and moved globally. And at the same time, there is this new bubbling up digital economy which I'd call the entrepreneur economy or the digital economy. Both of these economies are coexisting. One is going like that (points down) one is going like that (points up).”

This is not just a passing observation. It is the defining struggle of our time. The old world, the one built on industrial labor, steady wages, and predictable economic cycles, is collapsing under the weight of debt, stagnation, and political dysfunction. At the same time, a new world is emerging, one where the sovereignty of the individual in the digital economy is becoming more powerful than ever.

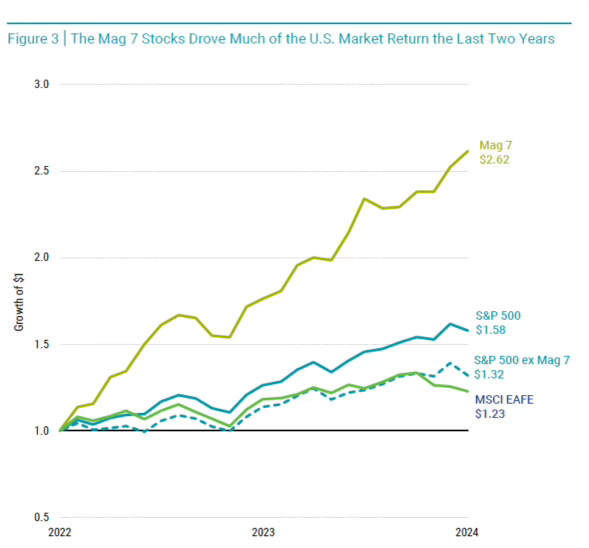

The debate also touched on the dominance of the Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) which are not just leading the U.S. stock market but are the U.S. stock market. Their outperformance is so extreme that it has sucked capital away from almost everything else. The 3 were puzzled at why with seemingly similar issues to the rest of the world, the US continues to dominate and why the UK, in particular, has failed to produce anything comparable. They could not see that this was a symptom of the underlying problem, the Dollar Milkshake in full force.

What this debate really exposed is that we are in the midst of a massive shift, one that most people can feel but cannot yet articulate. The old system built on debt, taxation, and traditional labor is breaking down into the USD. The new system driven by digital sovereignty and decentralised opportunity is rising. And for now, they coexist in an uneasy, chaotic balance.

Nevertheless, it's clear that the world is indeed bifurcating into two distinct economies: the crumbling edifice of the Industrial Revolution, and the ascendant digital economy. As this divergence continues, we contend that the dollar will continue to maintain its strength amid global crisis, and bitcoin will show resilience, as select groups of individuals will increasingly assert their sovereignty, unencumbered by the shackles of debt and fiat currency.

“The real issue is control. The internet is too widespread to be dominated by any single government. By creating a seamless global-economic zone, anti-sovereign and unregulable, the Internet calls into question the very idea of a nation-state”

- John Perry Barlow

We shouldn’t be cheering on stablecoins. Stablecoin companies will just become another privatized control mechanism - Facebook, Twitter, Palantir, NGOs, etc. They won’t start with the authoritarian mechanisms of CBDCs, but continued protection from the regulatory moat will incentivize compliance and controls. From an economic standpoint, adding to the Fed’s 14 magic money computers in the public sector cannot end well. Attempting to create another buyer of treasuries with the power to create unlimited dollars is a recipe for hyperinflation. As a Bitcoiner, I’m here for that eventuality, but this accelerated demise of the dollar will not be the graceful transition to the Bitcoin standard that will keep society intact.

I'm not so sure it's the crumbling of the Industrial Revolution.

I think it's the crumbling of the 'fiat-industrial complex'.

IMO almost all of big industries are well beyond their optimal size per economy of scale. This has only been possible under the current system, critically easy money and regulatory capture.

Now that every major corporation is larded to the max with debt & middle managers, any contraction in that easy money means it's over. Assuming the Trump administration follows through on deregulation, we should see many more smaller companies rise up to meet the market's needs.

Everything should be much more efficient and everyone better paid as a result.

I could be wrong.