China Teeters

Warning signals are flashing red in the world’s largest real estate market. Is China on the brink of another 2008?

Two years ago, news first broke of major issues arising at a large real estate developer headquartered in Shenzhen, Guangdong Province, China. Evergrande, one of the largest asset managers and property developers, was having issues meeting basic payroll and began defaulting on vendor obligations, such as payments to contractors.

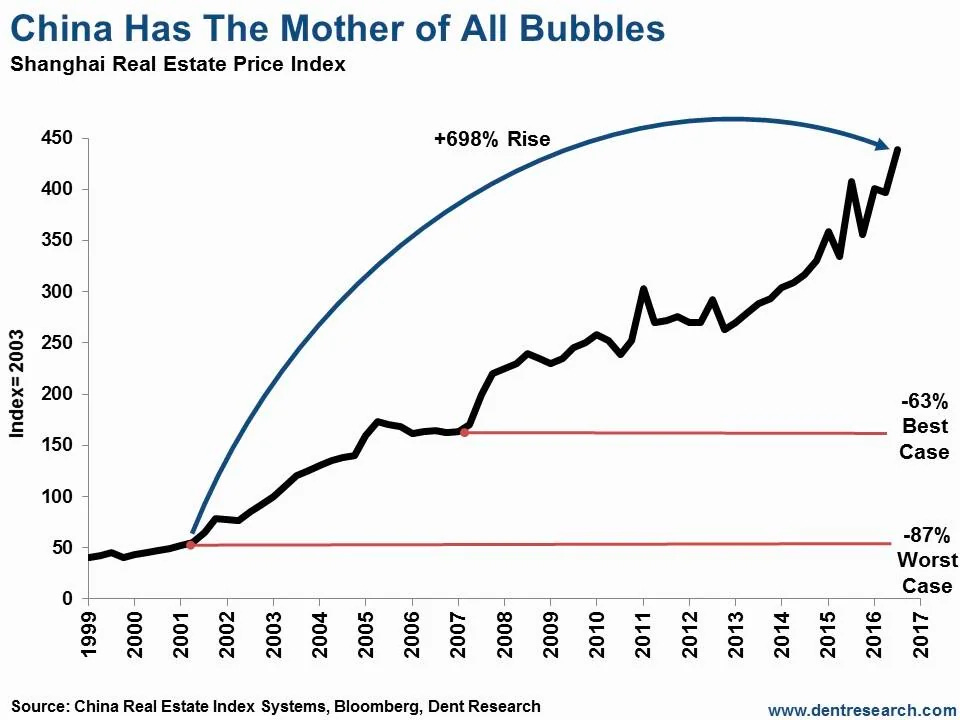

The Chinese real estate market has been on a tear for the last few decades, being valued at some measures up to $52 Trillion. Lenders, deeply intertwined with the CCP, have blown past lending standards and started authorizing bad loans for builders, even for projects completely underwater, creating a housing bubble that supersedes even the 2008 financial crisis.

Developers took on massive amounts of debt to build “ghost cities”- entire metropolises that remain uninhabited. The Chinese government, desperate to continue the massive industrial growth the country has experienced over the last 30 years, pushed the developers to undertake these projects. Now, these projects stand to make near zero revenue, and the firms that funded them look to the developers to repay their debts.

Keep reading with a 7-day free trial

Subscribe to The Dollar Endgame to keep reading this post and get 7 days of free access to the full post archives.