Gold Breaks the LBMA

Gold is soaring to new all-time highs as new stresses appear in the paper markets in London and New York. Is the day of reckoning approaching for the highly levered LBMA?

Gold has been on an absolute tear to start 2025. After languishing in the $2600-$2700 range after reaching a new all time high in late October 2024, it has begun a steady and relentless climb in price for the entire month of January and is still going strong as we enter February.

Now, the rising gold price, the rush for physical bullion by the banks, and the falling value of paper gold certificates issued by the Bank of England are signaling that severe stresses have begun to afflict the vaunted London Bullion Market Association (LBMA).

In this report, I will dive into why gold is centralized, how the LBMA functions, and what signals are flashing code red, indicating that something is breaking the Bank of England and the LBMA’s ability to supply physical gold to the market.

The game is afoot. Let’s get started.

Gold is a unique commodity in many senses- first, it occupies a unique role as a “commodity money”, that is a good/raw material that has been used in its physical form as money for thousands of years. However, in our modernized and financialized market economy, gold has had the role of true monetary medium stripped away from it. Instead, it acts more as a store of wealth or a debasement hedge than actual money. This is largely due to the microtransaction problem in monetary economics: the size of transaction and amount scales down exponentially as you move to larger transactions. So, there will be 20x more $100 txs in a closed loop economic system than $1,000 transactions, and onward and onward. Small transactions rule the day, and gold is horrible for small transactions.

This is why gold was typically stored centrally in a bank vault, and promises (in the form of bank notes) circulated to facilitate microtransactions and increase convenience for economic actors.

However, even though gold is largely demonetized, it still trades as a debasement hedge. I’ve covered this extensively in Printer is Coming, where I tracked the price action of gold against the global net liquidity indicator we’ve created in TradingView. The result was that gold has always front-run waves of QE by around 12-18 months, depending on the cycle:

“Look at the price action comparison between gold and Fed Net Liquidity (calculation for this provided in a prior substack). Gold here begins its rally in December 2018, as the Fed is in the midst of a tightening cycle and markets are falling off a cliff. On Christmas Eve, 2018, the Dow Jones Industrial Average had its worst day since the Great Depression, and both the NASDAQ and SPY entered bear market territory, down 20%. All that month, however, gold continues to rally.

Powell pauses the taper as the warning signal from equity markets finally hits home. He does not, however, decide to reverse course and increase the Fed’s balance sheet- that doesn’t come until later in 2019, after the Repo crisis.

All through the spring of 2019, gold continues to steadily climb upwards. Again, no major financial crisis, no new QE program, no insanely fiscally profligate government (at least not more than usual) that would cause this- just a rising price.

A year or so later, COVID-19 hits and the market goes haywire. Powell and others attempt to ignore the issue and shoulder on, but the equity market begins to collapse. By mid-march, liquidity is drying up in the Treasury market, as repo participants begin to pull back from lending or borrowing. This is crucial since repo is essentially the oil that greases the national banking machine, and a breakdown in repo markets is a precursor to a more generalized financial crisis.

The Fed responds appropriately, and engages in a rescue program much larger than it ever has before. A tidal wave of QE hits markets, along with huge amounts given to a laundry list of programs: central bank liquidity swaps, Repo facilities, Foreign Reverse Repo, et cetera.

[...]

For the next few months, gold continued to rally until it hit an all-time-high at $2,070 an ounce. Goldbugs across the world rejoiced, and Peter Schiff paraded around CNBC claiming that the gold price was set to go vertical from here. The Boomers holding Newmont or Barrick could rejoice.”

The analysis continues, and I go through several more examples of gold frontrunning a global liquidity wave (led by the Federal Reserve) by around 12-18 months. December 2018 to March 2020 is only 15 months, which is on par with our timeframe.

I attribute the current rise to large market participants forecasting another wave of QE- especially from China, who appears to be battling a deflationary bomb that has been set off in their real estate and financial sectors. This strong bull market, which has driven gold higher and higher this year, has started to apply pressure to the western markets as we will discuss shortly.

One of the big factors pulling western markets upwards is the arbitrage happening in China is the fact that the Shanghai International Gold Exchange (SGEI) is a physically settled market, much different from the cash settled western markets. This is something I covered at length in my prior substack piece Gold Endgame Begins.

In any regard, the long and short of it is with a physically settled market on the scene, and with that market trading at significant premium above the west, traders were able to buy up COMEX or LBMA futures and demand delivery, and then sell the physical in Shanghai. This meant that the COMEX at the time was being drained of millions of ounces of gold, which was naturally sending prices skyrocketing higher at a time when the Fed was not cutting nor any other major players of the global central banking apparatus.

Just a few days ago, on February 5, 2025, gold reached an all-time high, with spot prices climbing to $2,858.12 per ounce. This surge was blamed on the escalating trade tensions between the United States and China, leading investors to seek safe-haven assets- however, as they often are, this MSM story was not fully truthful.

SPONSOR: I’ve talked a lot about the value of Bitcoin and its use case as fiat currencies inflate away. As such, I'm proud to have Onramp as a sponsor supporting this newsletter, a firm at the forefront of pioneering a trust-minimized form of Bitcoin custody.

With Onramp Multi-Institution Custody, assets live in a segregated, cold-storage, multi-sig vault controlled by three distinct entities, none of which have unilateral control.

To learn more about Onramp's custody solutions, and financial services like inheritance planning, connect with their team or schedule a consultation. You can use this link to get a discount on their services.

Now let’s get back to it!

For decades, we’ve seen the price manipulated through the bullion banks, who are structurally short due to their gold inflows that they have to hedge, and central banks, who have done programs like gold leasing or unallocated gold certificates that they have used to dilute the amount of paper gold in the market, driving down price. We also have the issue of the market substructure- the vast majority in the west trades through either the LBMA in the UK or the COMEX in the US. Both these exchanges are cash-settled, which means the vast majority of participants only take cash delivery and roll the contracts forward when trading profitably. This means that a small amount of physical, say 30,000 ounces, can support 1 million ounces of paper gold trading in the futures market. One research paper estimated that only 3% of contracts are settled physically.

This is due to some of the measures that COMEX takes to make it more difficult to settle in physical gold- we don’t need a conspiracy to explain this one, settling in physical gold is costly both in terms of manpower and money required to secure the gold appropriately.

To take physical delivery, a trader must:

Hold a long position in a futures contract through its expiration.

Issue a delivery notice to COMEX.

Receive a warehouse receipt, which represents ownership of gold in an approved depository.

Arrange for physical withdrawal if desired (which involves additional fees and logistics).

Gold is delivered in 100 troy ounce bars, meaning an investor must purchase contracts in multiples of 100 ounces to take delivery.

This can be a significant capital commitment, as a single contract represents around $200,000+ at current gold prices.

COMEX only allows delivery from a few approved depositories, such as Brink’s, JPMorgan, and Malca-Amit. Moving the gold out of these vaults requires additional approvals, transport logistics, and fees.

Taking physical delivery is expensive, including storage fees, insurance, and transportation costs.

If the gold is withdrawn for personal storage, it may lose its COMEX "good delivery" status, making it harder to resell at market prices.

Overall, as you can see none of these factors make it easy to accept physical delivery, and this has the indirect effect of allowing the market to trade far below where the actual intrinsic value of the metal is, since all this excess purchasing power gets redirected to paper markets instead of the bullion.

But, in the past few days, the meltdown at the LBMA, one of the large paper markets in the West, has begun. To fully understand what’s going on, we have to go back to 2020, when the gold markets were first at risk of breaking.

Dave Kranzler has given the best explanation I’ve seen so far:

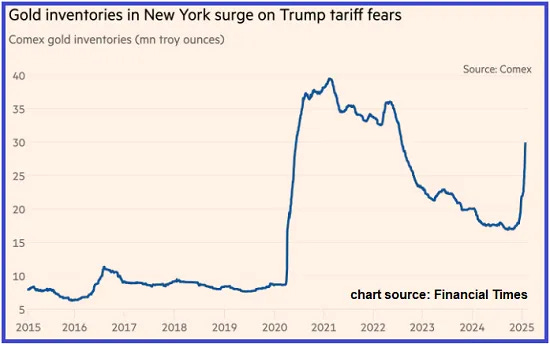

Note in the chart above that the amount of gold reported by the Comex banks to be in the Comex vault system has spiked higher, similar to the spring of 2020. Back in 2020 the amount of gold available to deliver to contract longs standing for delivery had become too low to withstand the possibility that a meaningful percentage of entities taking delivery might actually move the delivered bars being held custody at the Comex to alternative non-Comex vaults (which I would recommend). Thus a shortage of good-to-deliver gold bars had developed. The cover story for this was that the covid situation had created logistical problems for gold refiners which curtailed the amount of gold that could be refined and distributed to their end destination. But if that's the case, why did the Comex all of a sudden come into possession of so much gold in a very short period of time?

That gave birth to the Comex "enhanced 400 oz contract" (the Comex gold futures contract is based on 100 oz bars) which enabled the Comex and the LBMA to "co-mingle" their gold bars, making them available for delivery on the Comex. But that contract rarely, if ever, has traded and to my knowledge there has not been a delivery via this contract. However, as long as it enabled the Comex to show a much higher gold inventory, it pre-empted any potential run on Comex gold bars. I believe the bars accounted for under this contract are still sitting in London vaults not Comex vaults.

The real truth is that a shortage of deliverable bars had developed on the LBMA, where big buyers like China and India actually have the bars shipped to their respective countries because the buyers of gold in those countries want possession, whether it's the Central Banks, investors or jewelry buyers. The new co-mingled contract enabled the Comex and the LMBA cooperatively to kick the shortage can down the road.

Essentially, COMEX (the US-based commodities exchange responsible for the majority of gold trading in NA) has been front-running what they see as massive in specie (physical) gold demand by loading up their vaults with extra bullion in case of redemption. This only happens during periods of market stress, where large (we’re talking millions of ounces) of redemption requests are coming in each week.

Guess what? It’s happening again.

As SchiffGold lays out, January usually has relatively low demand, but this year has been an exception for the COMEX. As of Jan 28th 19,001 contracts have been delivered, but to put this into perspective, that volume, equivalent to approximately $5.2 billion, is typical only for a “major month”. In contrast, minor months generally see less than a quarter of the volume of major ones, and January is a minor month. Look at the chart below- this January blew previous Januaries out of the water.

What caused this surge in delivery volume? The primary driver was the influx of net new contracts throughout the month—contracts that were opened and settled immediately with delivery.

What’s even more unusual is the timing of these purchases. Typically, net new contracts are initiated early in the contract cycle and taper off as the next month's contracts approach. However, by the end of the month, new contracts were still being bought and delivered, making this month’s activity highly atypical.

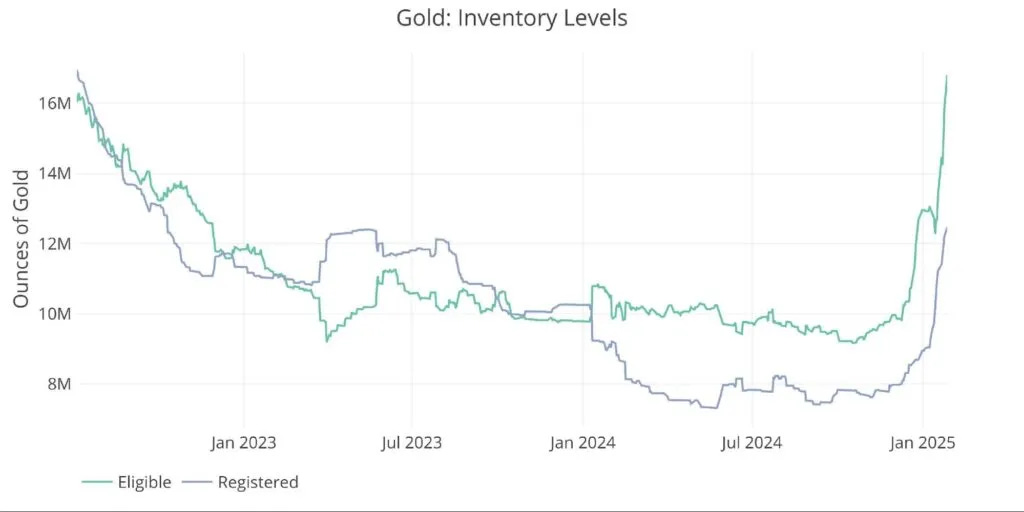

How did COMEX respond to a delivery request for 1.9 million ounces of gold? By massively restocking its inventory. Since December 1st, COMEX gold reserves have surged by an astonishing 11.5 million ounces—10 times the amount requested for delivery.

Interestingly, as of December 1st, COMEX reported approximately 18 million ounces of gold in its vaults, which seemed more than sufficient to cover delivery requests. So why the sudden spike in inventory? Could it suggest that not all of that metal was actually available for delivery? Or perhaps a major buyer has signaled plans to purchase even more in the coming months?

We don’t know the answer to these questions now, but something is clearly afoot.

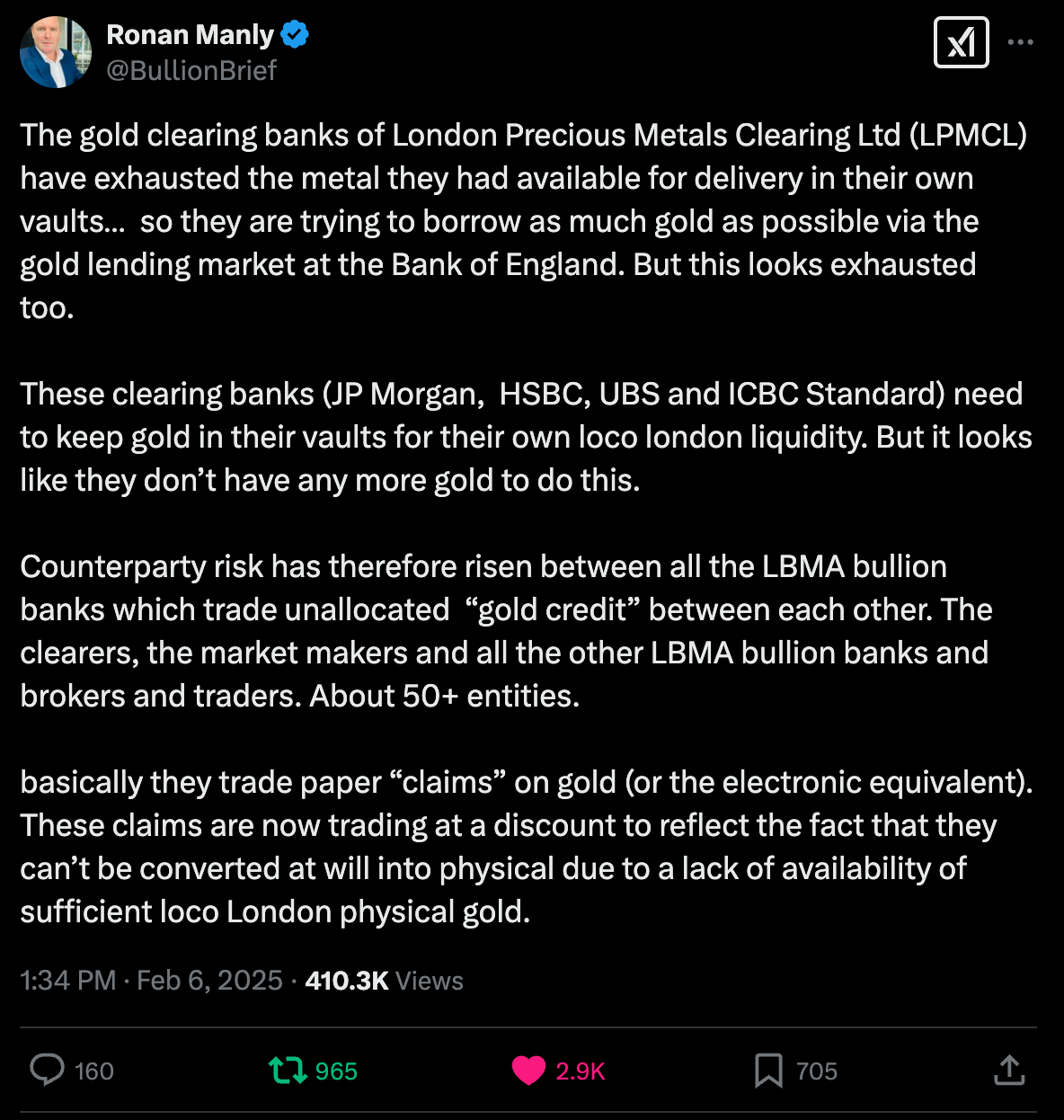

One theory is that the surge in gold shipments from London to the U.S. is driven by high gold prices in New York. This is creating high demand for withdrawal slots at the Bank of England’s vaults.

The media is blaming this on concerns that President Donald Trump may impose tariffs impacting gold - this, they argue, has led to rising premiums in the New York market and weeks-long wait times to withdraw metal from the BOE. Additionally, gold bars stored at the Bank of England have been trading at a discount compared to the broader market, as withdrawal delays make BoE-held bullion less desirable than gold stored in more accessible commercial vaults. (That, or the market is beginning to price in the fact that the BoE may not actually have the gold.)

Deputy Governor of the BoE Dave Ramsden said at a press conference on Thursday:

“All of those bodies who ship the gold, they’ve all got the delivery slots they need over the next few weeks. If you were coming in new to us, you might have to wait a bit longer because all the existing slots are booked up. But this is a very orderly process.”

The Bank of England plays a vital role in the London gold market, which is the world's largest hub for bullion trading. It holds gold accounts for other global central banks, which choose London for its convenience in lending or selling gold. The BOE also allows select commercial entities (such as bullion banks) to hold gold accounts at the bank, which provides liquidity to central banks, and the vaults store a significant portion of the "London Good Delivery" gold bars that meet LBMA standards. The gold stored at the BOE can be used for lending and swaps, which obviously helps to change the structure of the market.

Gold stored at the Bank of England is being quoted at discounts exceeding $5 per ounce below the London spot price. This price gap might seem small, but it’s actually massive, as gold at the BOE typically trades exactly in line with the broader London market. Historically, any premiums or discounts have been minimal, usually just a few cents per ounce, so the current $5 per ounce discount is several hundred times larger than normal!

The Bank of England holds over 400,000 gold bars, valued at more than $450 billion at current prices. This is only a fraction of the more than 8,000 tons of gold stored in London, according to the LBMA. But, a significant portion of that gold is owned by exchange-traded funds (ETFs), other central banks, and long-term investors who may not be willing to sell. This means the market is EXTREMELY tight.

The central banks particularly do not seem to be willing to sell. Instead, global central banks in general have been on a bullion buying spree the last few years.

In 2024, gold purchases remained robust, continuing a trend of increasing reserves observed over the past decade, but especially since COVID. Central banks added a net 1,045 metric tons to their gold holdings, marking the third consecutive year of purchases exceeding 1,000 tons. This accumulation was driven by a diverse group of countries, with the National Bank of Poland leading by adding 90 tons, bringing its total reserves to 448 tons, which constitutes 17% of its total international reserves. Other notable buyers included the Central Bank of Hungary, which increased its reserves by 16 tons, and the National Bank of Serbia, which added 8 tons. (This is a lot for countries that are this small in population and GDP).

The first quarter of 2024 had also set a new record for central bank gold demand, with net purchases totaling 290 tons—the strongest start to any year EVER. This surge was largely attributed to large purchases by China, Turkey, and India, with India leading the charge. As the World Gold Council describes:

The Reserve Bank of India (RBI) was once again a major purchaser in 2024, having bought gold every month before leaving reserves unchanged in December. Its annual purchases totalled 73t, more than four times the level of its gold buying in 2023 (16t).

By the end of 2024, total global central bank gold reserves had reached approximately 36,699 metric tons, accounting for a massive 17% of all the gold ever mined. The central banks are making a strategic shift towards gold as a hedge against economic volatility and a means to diversify their foreign exchange reserves, which are currently primarily in dollars. (This can be seen as one of the signposts that slow dedollarization is taking place, although the dollar’s use as a payments mechanism is showing no signs of slowing down.)

In any regard, due to this massive rush to ship gold back to the U.S. and into the COMEX, markets have begun flashing stress signals. This began with the implied 1 month lease rate in London, which began spiking in December and then broke through 5 year highs in January.

The rate represents the return that individuals holding bullion in London’s vaults can earn by lending out their metal on a short-term basis. The surge in the rate means that demand to borrow metal is stronger than any other period in the last few years, by a long shot.

It appears that the bullion banks are the ones driving this demand, who are trying to borrow as much gold as possible to arbitrage the difference in prices between London and New York. If they actually want to go through with this, they have to go through Switzerland to melt down the bullion.

This is because the standard 400-ounce bars traded in London cannot be directly shipped to New York for delivery on the Comex exchange. (Like we mentioned earlier, COMEX launched a 400oz contract in 2020 but in reality this contract rarely trades and no one has taken delivery so far). Instead, traders need to re-refine (if that is a word) the bars into 100-ounce bars in Zurich before shipping them to the U.S. As a result, premiums rose as high as $50 per ounce, making the trade highly profitable for arbitrageurs.

Another sign that the market is under stress is the fact that the futures market has entered backwardation. This is where the forward prices for 1 month trade below spot, which indicates that traders want the gold now and will pay a premium, rather than wait a month for delivery. Demand for physical gold is soaring.

The backwardation is even worse for silver. One month lease rates have soared to 8%,well above where even gold is. This is despite the claim that the tariff threat will only affect gold- if that is true, why is silver demand spiking as well?

In any case, the stresses in the market are clearly worrying officials at the BoE, as well as other leading bullion banks. London is being drained, and New York vaults (owned or managed by COMEX or COMEX banks like JPM) are filling up.

As this panic besets London, and delivery timelines lengthen to 1-2 months, the bullion banks will continue to scramble to get any sort of gold liquidity possible. This is why they are borrowing gold from the market (lease rates exploding), this is why they started redeeming gold held in the BoE vaults (even though they can hold gold in commercial vaults which are more easily audited and more accessible than BoE, albeit more expensive) and this is why all paper gold certificates have begun trading at a discount.

The Emperor has no clothes.

Meanwhile, as we mentioned COMEX is importing as much gold as they can get their hands on, perhaps to front run redemption requests from their own customers. If this process continues at the current rate, in a few weeks they will surpass even the record high gold stocks they held during COVID.

These stresses show up even in other paper gold markets. GLD, the largest gold ETF in the United States, has seen borrow rates for their shares skyrocket in the last few trading days. The SPDR Gold ETF stores its gold in several vaults, but it is primarily in London. The gold is held in the form of allocated bullion, meaning each bar of gold is specifically assigned to the ETF and cannot be used for other purposes.

The vaults are operated by trusted custodians, including the Bank of New York Mellon, and GLD’s gold holdings are audited regularly to ensure transparency and compliance with regulations. This means the ETF gold is one of the easy to access physical gold sources, if you call the shares in for redemption.

Many writers, including bloggers from the late 1990s like ANOTHER and FOA, have hypothesized the end of the LBMA paper gold manipulation and a real revaluation of the yellow metal. Paper claims, they said, were worthless representations of real money, and would collapse in value as capital flies into gold, rocketing the price upwards by hundreds of percent. In their analysis, they claimed that the Bank of England and global central banks in general were aiding and abetting the paper gold scam, pulling demand into derivatives and suppressing the price of gold so that nation state actors could get bullion on the cheap, and so as to not upset the global monetary order which would view a rising gold price as a threat to the incumbent Dollar.

Great article! What do you think about CME delisting a number of gold and silver futures? Seems like more instability occurring: https://www.cmegroup.com/notices/ser/2025/03/ser-9515.html

Well, is their theory starting to play out? Your article is very interesting but it doesn't conclude with a definitive answer, so it leaves up back at the beginning. Let's hope somebody figures it out