Gold Rush

Goldbugs, your time has finally arrived.

The yellow metal is in the midst of one of the most extraordinary runs in modern financial history, surging past $4,300 per ounce on Thursday, a nearly 67% gain year to date. This isn’t just another cyclical rally; it represents the fastest sustained appreciation since the 2008 global financial crisis.

The velocity alone should tell you everything you need to know about the state of the global monetary system. When an asset moves this fast, this consistently, breaking 40 record highs in a single year, it’s not reflecting speculation or momentum chasing. It’s reflecting a paradigm shift in the monetary order.

The market is pricing in the endgame.

For years, I’ve been writing about the structural forces that would eventually drive gold back to its rightful place as a monetary asset: Triffin’s Dilemma, the Dollar Milkshake, the unsustainable trajectory of Western debt. What we’re witnessing now is the market finally waking up to what should have been obvious all along. The era of cheap money, infinite QE, and consequence free deficit spending is coming to an end, and gold is the canary singing its final song in the coal mine.

The current rally isn’t being driven by a single factor, but rather by a convergence of forces that have been building for years and are now reaching critical mass simultaneously.

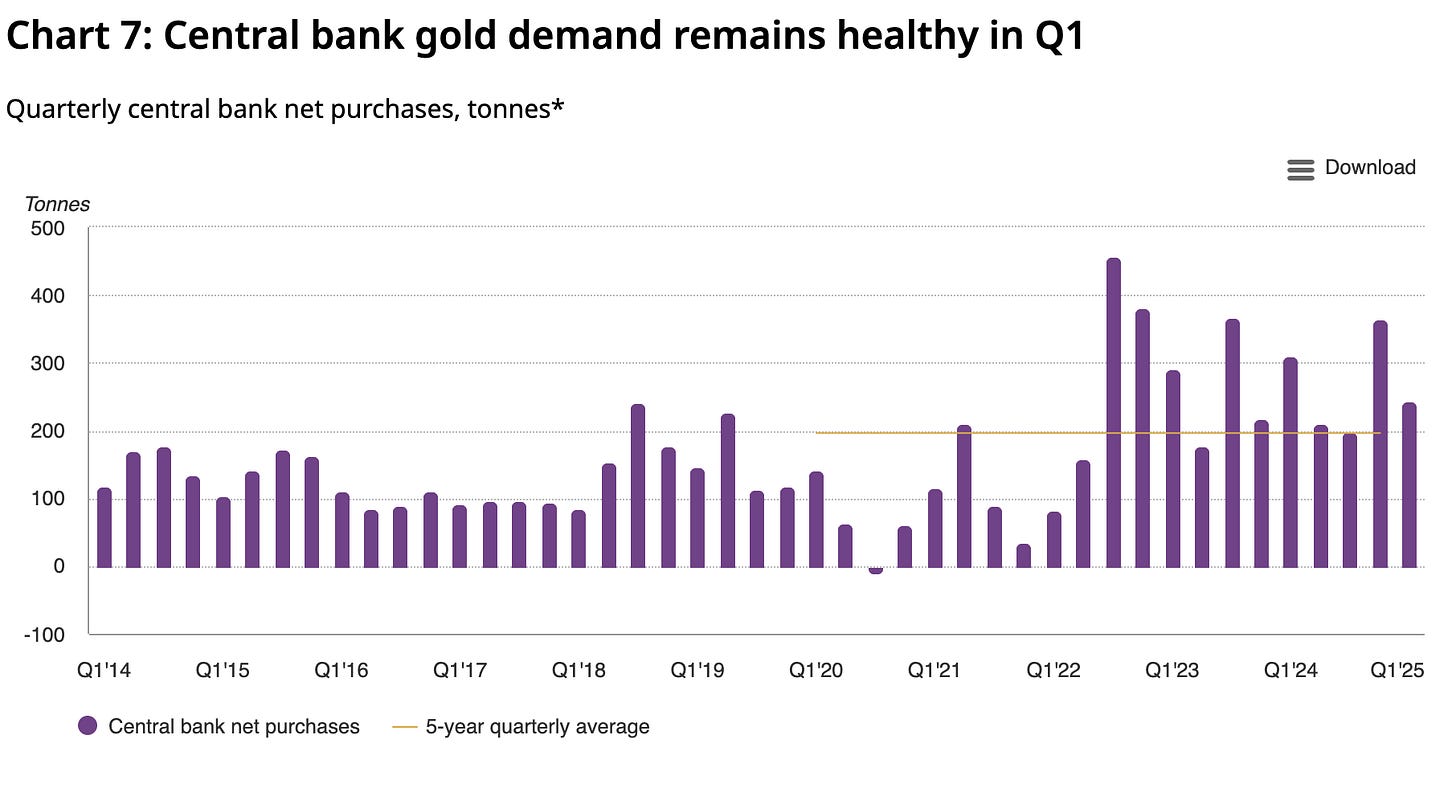

Central banks purchased 1,086 tonnes of gold in 2024, marking the third consecutive year above 1,000 tonnes and representing a fundamental shift in how sovereign actors view reserve management. To put this in perspective, this is roughly double the 500-600 tonne average central banks purchased annually in the decade prior to 2022. In Q1 2025 alone, central banks added 244 tonnes, the strongest first quarter on record.

Poland led the charge in 2024, adding 90 tonnes and bringing its holdings to 497 tonnes, or 21% of total reserves. The National Bank of Poland has explicitly stated its goal to reach 30% gold allocation by 2026. India added 73 tonnes, Turkey 75 tonnes, and China reported 44 tonnes, though actual purchases are likely 2-3 times higher when accounting for unreported domestic production purchases and offshore transactions.

The freezing of Russia’s $300 billion in foreign exchange reserves in 2022 served as a watershed moment, exposing the vulnerability inherent in holding reserves in assets that can be confiscated by geopolitical rivals. Gold offers something the dollar cannot: neutrality, no counterparty risk, and immunity from sanctions.

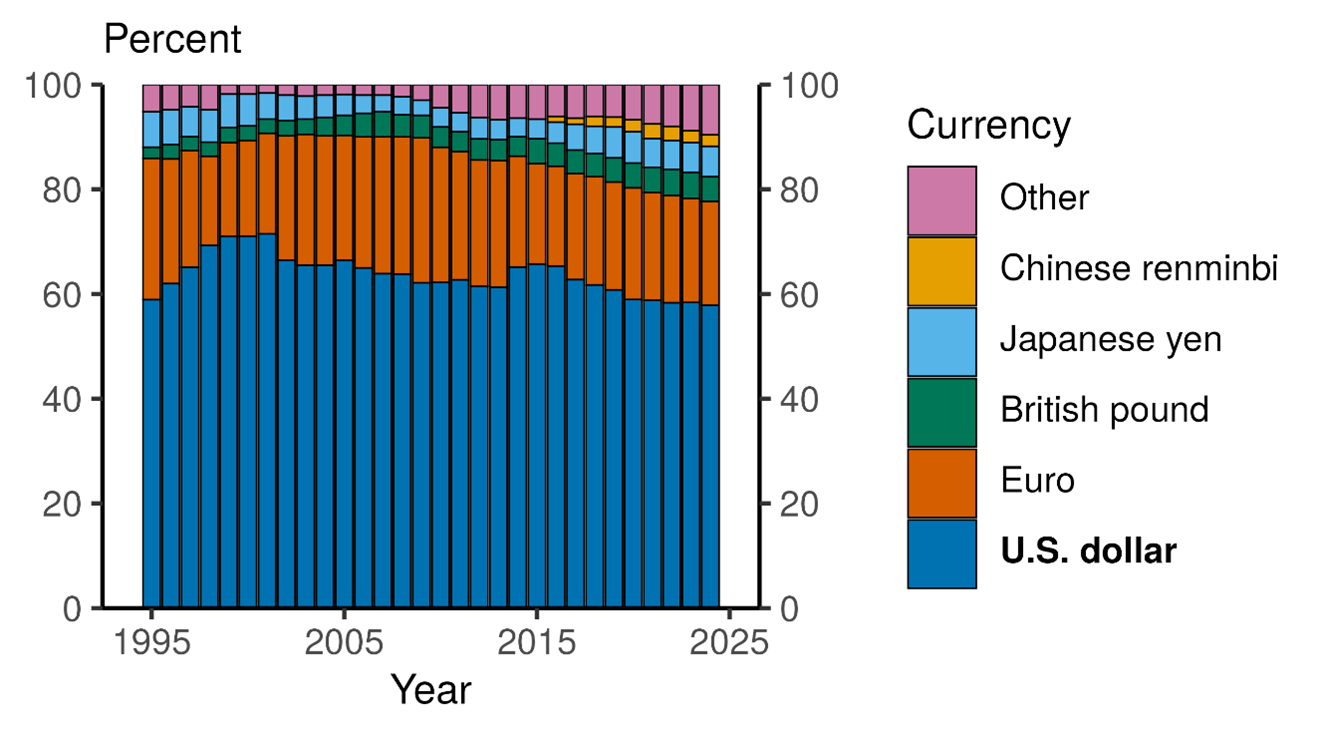

China, Russia, and other BRICS nations are building alternative payment systems and accumulating gold reserves specifically to reduce dollar dependence. The sanctions on Russia accelerated this trend by years, proving that dollar reserves carry geopolitical risk that gold does not.

The World Gold Council’s 2024 survey found that 29% of central banks intend to increase gold reserves over the next 12 months. For the first time in nearly three decades, foreign central banks’ gold reserves have officially surpassed their U.S. Treasury holdings.

Central banks wouldn’t be accumulating over 1,000 tonnes annually if they believed the dollar system was stable and sustainable.

This is strategic repositioning away from dollar hegemony.

And the fiscal side shows a startling picture.

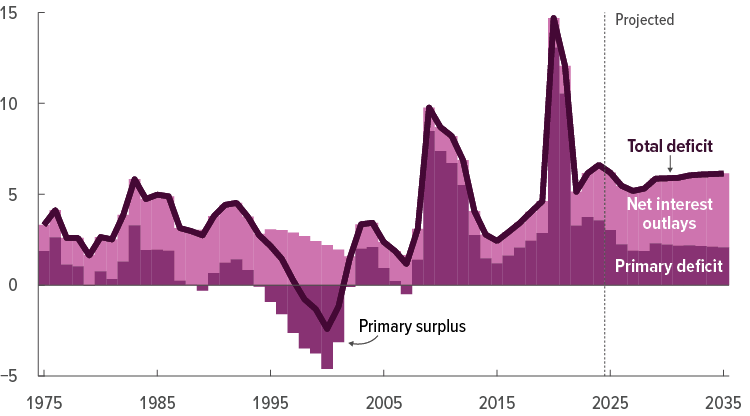

The United States is now running deficits that would have been unthinkable outside of wartime just a decade ago. The federal deficit for fiscal year 2024 reached $1.8 trillion, or 6.4% of GDP. The Congressional Budget Office projects that deficits will remain between 5.5% and 7.1% of GDP through 2034, with debt held by the public reaching 122% of GDP by 2034.

As of March 2025, total U.S. debt stands at $36.4 trillion, with debt held by the public at $29 trillion. Net interest payments on the debt reached $882 billion in fiscal 2024, more than the government spent on national defense or Medicare. Interest is now the third largest spending category behind only Social Security and healthcare.

The 12-month rolling deficit as of March 2025 was $2.1 trillion, representing roughly 7.0% of GDP. These are not temporary pandemic emergency measures; these are structural deficits baked into the system with no political will to address them.

Lyn Alden put it best in her June 2025 newsletter:

“The deficits are more intractable than the bulls think, meaning it’s very improbable that the US federal government is going to get them under control any time soon. But on the other hand, it’s not as imminent as bears think; it is unlikely to cause an outright dollar crisis any time soon. It’s a very long slow motion train wreck.”

She’s even repeated this sentiment on Twitter with her viral “nothing stops this train” memes:

The Federal Reserve finds itself trapped in a policy vise of its own making. After hiking rates aggressively to combat inflation in 2022 and 2023, the Fed began cutting in September 2024 with a jumbo 50 basis point reduction. Another 75 basis points of cuts followed through year end. This year, they kept rates flat until the September FOMC, where they cut a measly 25bps.

But here’s the problem: inflation remains stubbornly above target, the labor market shows resilience, and fiscal policy continues to pump stimulus into the economy through massive deficits. Real yields remain suppressed, making non yielding assets like gold increasingly attractive on a relative basis.

Goldman Sachs projects that continued central bank demand and the prospect of further Fed easing will drive gold to $5,000 by end of 2025, though many now view this as conservative given the metal has already blown past these targets. JPMorgan’s Dimon forecasts gold averaging reaching $5,000-$10,000 in the coming years.

The Fed is essentially trapped: if they keep rates high to combat inflation, they risk pushing the economy into recession and exacerbating the debt service burden. If they cut rates aggressively, they risk reigniting inflation and further destroying confidence in the dollar.

There is no good option, only bad and worse.

And to add fuel to the fire, geopolitics has also created a new vector for gold demand.

The weaponization of the dollar through sanctions has accelerated the timeline for de-dollarization significantly. When the U.S. and its allies froze Russia’s central bank reserves in 2022, they sent an unmistakable message to every non-aligned nation: dollar reserves are not safe if you fall out of favor with Washington.

China has reduced its dollar reserves from approximately 59% in 2016 to roughly 25% in 2025, redirecting capital into gold, euros, and yuan denominated assets. The dollar’s share of global reserves has declined to approximately 58% in 2025, down from over 70% two decades ago.

The Trump administration’s reciprocal tariffs implemented in April 2025 also triggered heightened concerns about U.S. fiscal sustainability and accelerated diversification efforts. When the world’s reserve currency issuer engages in restrictive trade policy while running 7% deficits, liquidity flows to safe havens.

What makes this rally truly historic is not just the magnitude, but the velocity. Gold has achieved in months what previously took years during past bull markets.

Compare this to previous gold rallies:

1970s Bull Market: Gold rose approximately 1,500% over a decade following the end of the gold standard

2008-2011 Rally: Prices increased about 160% over three years during the global financial crisis

2019-2020 Move: Gold gained roughly 40% over two years amid pandemic uncertainty

Current Rally: +60% gain in 2025 alone, building on 27% in 2024

The nearly 12% price appreciation in just September 2025 represents the kind of monthly move typically associated with speculative manias or crisis events. Yet gold accomplished this while demonstrating remarkably low volatility compared to previous bull runs, suggesting this is structural demand rather than speculative excess.

The asset has broken 40 new record highs in a single year, moving from $2,000 to over $4,000 in less than two years. It’s doing so on heavy volume with massive institutional participation. Even the gold ETFs are seeing huge inflows:

This speed tells us that the transition is accelerating. The slow motion train wreck is picking up steam.

Meanwhile, this so-called “debasement trade” has become the defining investment theme of 2025, as both retail and institutional investors seek refuge from fiat currency erosion. But while both gold and Bitcoin are positioned as hedges against monetary debasement, their recent performance has diverged significantly, revealing important distinctions.

Gold has decisively won the debasement trade in 2025, outperforming Bitcoin by a wide margin. While Bitcoin has gained roughly 30% year to date, gold has surged over 60%, demonstrating superior performance during a period of heightened macro stress.

The “Black Friday Crypto Crash” on October 10 wiped out over $19 billion in leveraged positions, sending Bitcoin tumbling while gold surged to breach the $4,000 mark. Bitcoin was down 8% on the weekly chart while gold gained nearly 6% in the same period, revealing that Bitcoin still trades with low liquidity and lots of leverage.

JPMorgan estimates that on a volatility adjusted basis relative to gold, Bitcoin could rise to $165,000, suggesting it remains undervalued relative to the yellow metal. The bank notes that Bitcoin would need to rise about 40% from current levels to match the scale of private gold holdings once risk is accounted for.

But here’s the critical distinction: gold is institutional money, central bank money, generational wealth preservation money. Bitcoin is a peer-to-peer cryptocurrency. When central banks need to diversify $10 trillion in reserves, they buy gold, not Bitcoin. When pension funds need to hedge against fiat debasement without taking on 50% drawdown risk, they buy gold, not Bitcoin.

Gold has thousands of years of monetary history, physical tangibility, and most importantly, central bank acceptance. As I’ve written before, institutions like central banks want assets they can control and understand, and Bitcoin is far too libertarian and technical for them to grasp or trust at scale.

(I say this by the way as a Bitcoin bull. Please do not crucify me- it’s just that both assets have distinct characteristics that make them more or less attractive to different investor groups. For central banks, gold is the play.)

This doesn’t mean Bitcoin has no role to play. Over longer time horizons, Bitcoin’s digital portability and fixed supply give it unique advantages, particularly for younger investors and tech native wealth. But in the here and now, when the system is under stress and sovereign actors are repositioning reserves, gold is winning decisively.

Overall, the gold rally of 2024-2025 is telling us several important things about where we are in the economic cycle and where we’re headed.

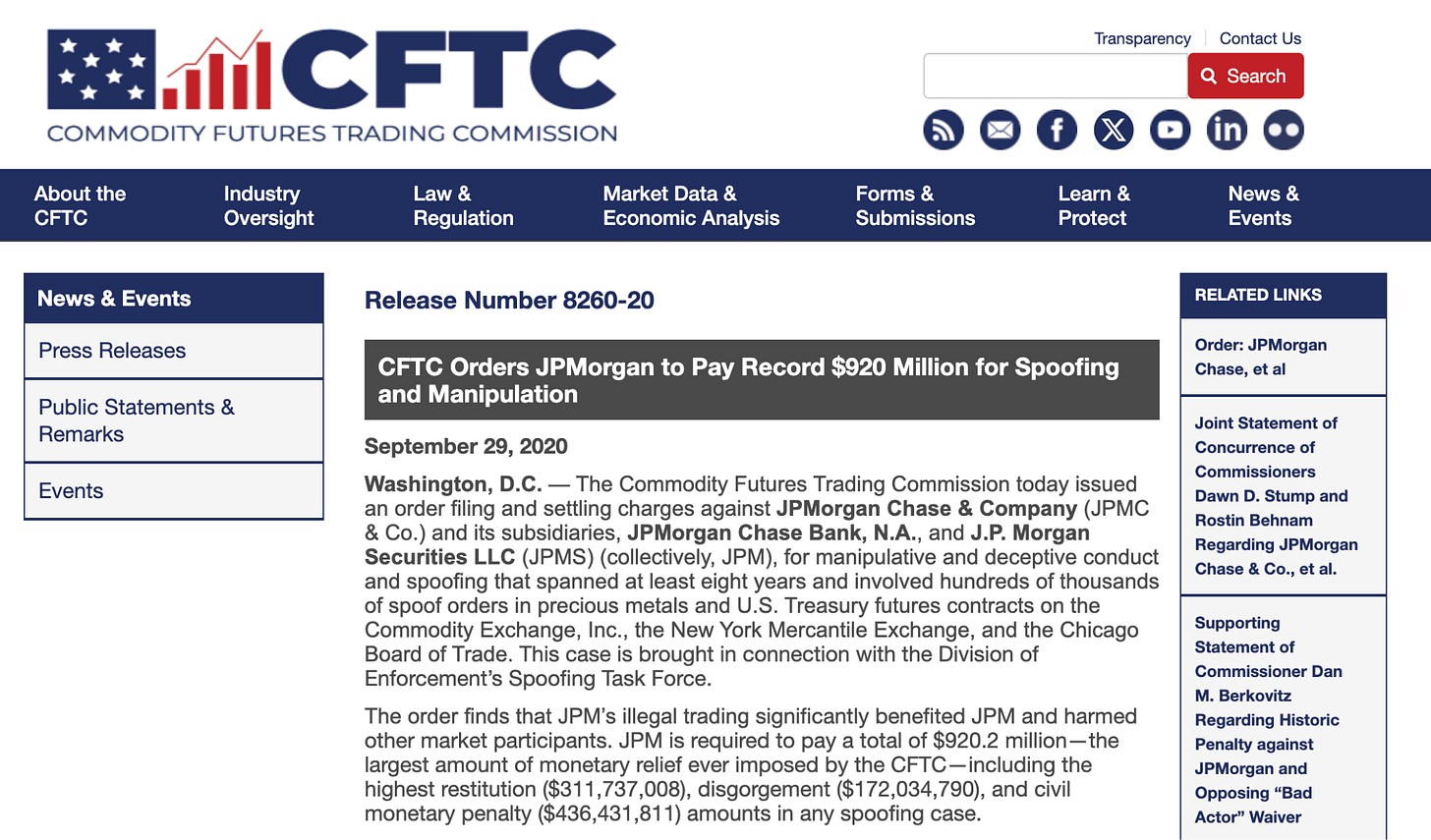

For years, Western bullion banks have used paper derivatives to suppress gold prices, creating synthetic supply that divorced price discovery from physical reality. JPMorgan was fined $920 million in 2020 for illicit trading in precious metals futures markets over an eight year period. Deutsche Bank, HSBC, and UBS all faced similar charges.

The paper manipulation of precious metals markets has gone on for decades. Sadly, it’s a feature, not a bug, of the current system.

Here’s a quote from “The Gold Endgame Begins”, a previous substack piece that touched on this topic. In this excerpt, VBL (author of Goldfix) and I are talking about the structure of the gold market:

“VBL: So investors know that miners are always selling regularly and so they wait. They wait for it to come to them, right?

Banks push it there. So they front run their own business. And that’s, and that’s part of it. And it gets really, really ugly when you get down into the depths of it. You know, they, here, here’s, here’s something. There are two banks. There’s your bank, right? The Peruvian bull bank and the VBL bank. And we have mining clients.

We both have Newmont as a mining client. Newmont calls me, tells me he wants to sell. He calls you and you’re telling me on a text or an IM that Newmont’s on the phone. And you and I know that Newmont is getting itchy. It’s like a person who walks into the room too many times. Like, okay, they, they want something.

[...] And so you and I say, you know what? This guy’s going to sell. And we start to say, we. Start to sell for our own books before Newmont even sells and that’s, and that’s it. That’s the RICO aspect of it. I’m selling this idiot over here. So I’m, I’m selling first.

You go, yeah, I’m going to sell too. Well, let’s see who can sell the worst. And that’s what happens. And the market sells off and it’s a license to steal. And it’s a license to steal because the miners, unfortunately, the miners haven’t gotten very sophisticated over the years. Whereas oil producers, they did get sophisticated.

So the miners sell through the banks because they have to, they’re captive clients. They have to do their business there. And the COMEX is a garbage dump for them. And that’s what happens at the granular level.

PB: Here’s one of the things that shocked me when I first started looking into, you know, gold market manipulation is most people don’t take delivery and it’s like an overwhelming amount, something like 97% of buyers of gold futures are not taking physical delivery.

They’re just handling cash delivery.

VBL: That’s right.

PB: Which means that you have this entire marketplace of commodity futures, which in every other commodity, the speculators are the minority and the majority is people who actually have usable demand like oil, you know, giant oil users, right?

Like Chevron or Gazprom- If they’re going to produce oil and they’re going to sell it, or they’re going to buy oil because their reserves are running low. They’re going to actually demand delivery and they’re going to take that delivery and take it out of the exchange. With gold that is not the same case.”

The current rally suggests that physical demand has overwhelmed the paper suppression mechanisms. When central banks are buying hundreds of tonnes quarterly and retail investors are flooding into gold ETFs, the paper games can’t hold prices down indefinitely. Physics eventually wins over finance.

And ironically, although ETFs have seen major inflows, they haven’t matched those inflows with new purchases of gold yet. They are massively short gold, and they need to buy a lot more to catch up. Another quote from a different previous substack piece, Gold Sends a Warning published September 5th, 2025:

“But even though the ETFs have loaded up on exposure to gold, this is a red herring, because by relative measures they are not anywhere close to where they should be. As you can see here, leaving physical gold holdings at 2022 levels means the ETFs are net short about 100M ounces. That’s an astronomical amount- about 38% of total US gold holdings (allegedly held at Fort Knox).

So this means that all of this massive move in physical has happened without genuine ETF buying (that would match retail demand), and that most retail investors are actually buying paper gold. Which means that when the Authorized Participants (the institutions who create or redeem ETF shares and usually act as custodian) are finally forced to catch up, it will force the gold price to move substantially higher.

Using our prior equation, we can actually estimate the amount- if we’re being exact, the ETFs are short 117M ounces, which equates to roughly $419B at today’s gold prices of around $3,580 per troy ounce. If a buy of this size were executed over the space of just a few months, we could expect gold prices to rise by 20% or more, since movements in price scale non-linearly with buy pressure as liquidity dries up. That would mean a ~$700 increase in the gold price.”

(If you want to see the equation we made to estimate gold price moves based on institutional flows- consider becoming a paid subscriber to Dollar Endgame)

Despite gold’s extraordinary run, we’re likely in the middle innings of this bull market, not the late stages. Compare gold’s performance to other assets: it still represents a small fraction of global financial assets, central banks still hold the vast majority of reserves in fiat instruments, and retail investor allocation to gold remains modest.

When this cycle truly matures, you’ll see gold’s percentage of global portfolios increase significantly, probably from current levels around 2-3% to 10-15% for institutional investors seeking genuine diversification and risk management. That’s 3x-5x more demand coming in, just to get us to historical levels of portfolio allocation.

The fact that Goldman Sachs can revise its gold forecast upward multiple times in a single year and still see the metal blow past their targets tells you that the market is ahead of even bullish Wall Street analysts. This is a structural repricing event, not a cyclical trade.

So where does this leave us? If you’ve been following my work on the Dollar Endgame, Triffin’s Dilemma, and the structural unsustainability of the current monetary system, none of this should come as a surprise. We’ve been building toward this moment for decades.

The gold rally of 2024-2025 is not the endgame itself, but it’s a clear signal that we’re entering the final act. When sovereign actors collectively decide to reduce dollar exposure and increase gold holdings, when an asset can gain 60% in a year while breaking dozens of records, when the fastest rally in modern history occurs against a backdrop of 7% deficits and trillion dollar interest payments, the writing is on the wall.

Gold is reasserting its role as money, not commodity. It’s reclaiming its position as the ultimate reserve asset, the one that requires no counterparty, fears no sanctions, and survives monetary regime changes. Central banks understand this; they’re voting with their reserves. Smart money understands this; they’re following the central banks.

The system built on infinite debt and consequence free money printing is reaching its limits. Gold is telling us that in the clearest possible terms: through its price. And if history is any guide, we’re still early. The transition from one monetary regime to another doesn’t happen in months, it happens over years or decades. But the direction is now clear.

The Gold Rush has begun.

No mentions of Bitcoin?