Jerome's Printer

The Fed is slated to cut this week, with promises of a slow and steady easing cycle. But the evidence points to the fact that the next liquidity wave coming will be massive.

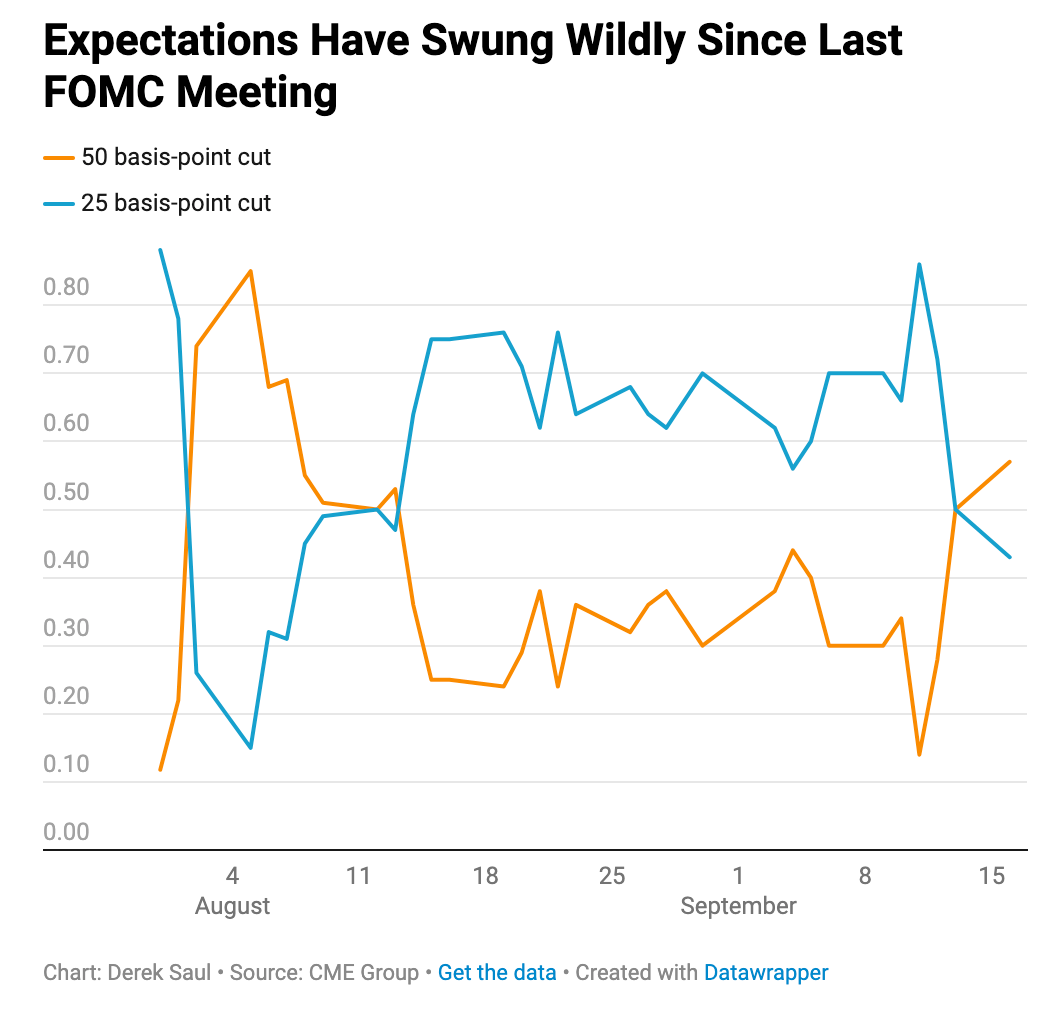

Markets are holding their collective breath this week as the Fed Open Market Committee meets from Tuesday through Wednesday. Powell is expected to give clues as to the coming rate-cutting cycle from the central bank as well as discuss key economic data. Futures markets which previously had been only predicting a 25 basis point cut have now swung to a full 50 bps, much to the surprise of CNBC commentators.

JP Morgan predicts a 50bps cut in September. Citigroup economists say the Fed will cut by 200 basis points through 2025, and their trading desk is betting on 150bps of cuts for the rest of 2024. Blackrock says the cuts are going to be less than the market expects, and is anticipating a measly 25bps cut and a slower and milder cutting cycle than others. The other banks are split.

Yet, it’s still not enough.

Monday morning, Elizabeth Warren wrote a letter to the Fed practically begging for a rate cut three times the size of what the FOMC have been signaling.

This has to be a first; sitting Senators crying to Papa Powell to inject some more liquidity. And yet, this is very on-brand for a financial system that has changed markedly since 2008. As I’ve covered in depth in Financial Gravity and other pieces, the markets have become completely addicted to the heroin of easy money and low interest rates. Every hiking cycle has been met with more monetary accommodation, lower and lower rates, which must be held there for longer to cure the damage done by the high rates in the first place.

In a world of debt, interest rates are a weapon.

And Powell is determined to use it.

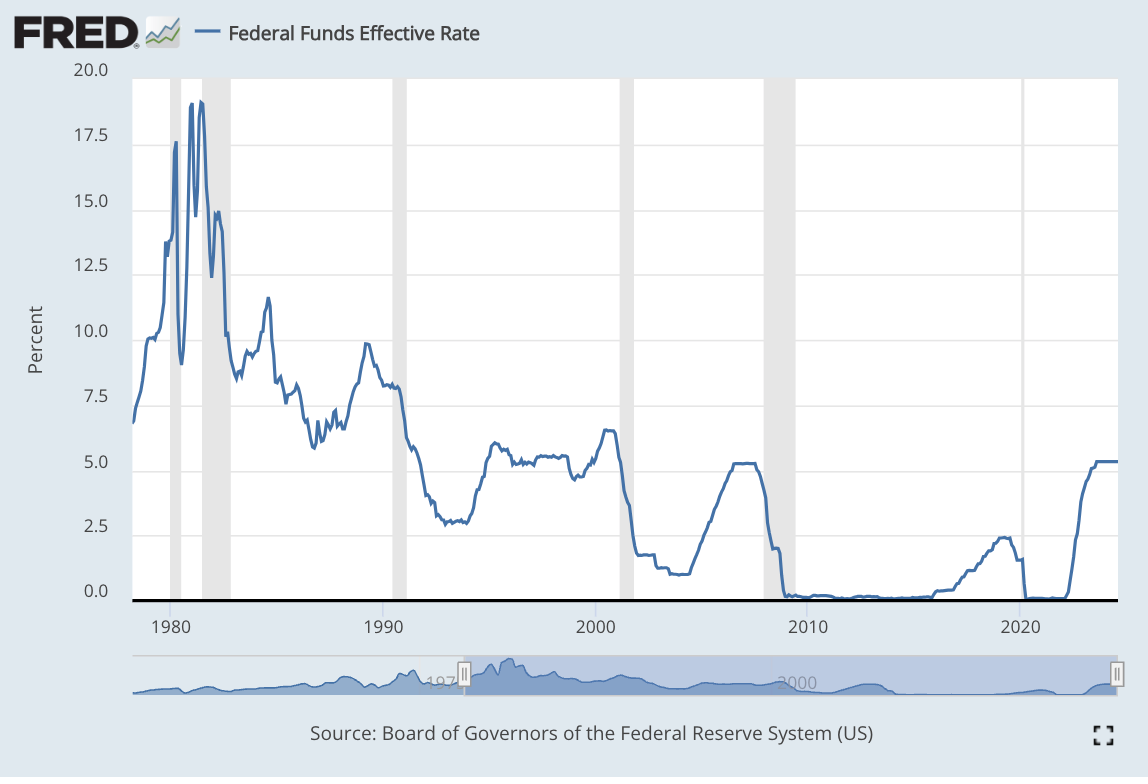

If we examine the history of rate cuts, we see that there hasn’t been a slow cutting cycle since the mid-1980s, when Volcker decided to taper back the extreme financial restriction he put in place at the beginning of his term. In fact, every rate cutting cycle since 1992 has taken place over an average of 18 months. Since the turn of the century, the rate cuts have totaled an average of 4.35% from peak to trough.

This portends the rate cuts being much deeper, and happening a lot quicker, than even the most astute market participants imagine.

But why? What’s the reason, and urgency, for such a rate cut in the first place?

Warren claims in her letter that the reason for the needed rate cuts is purely economic. Multiple indicators, like inflation and unemployment, are pointing to the fact that the Fed is already behind the curve and is woefully underpricing the risk of a recession.

“It is clearly the time for the Fed to cut rates. In fact, it may be too late: your delays have threatened the economy and left the Fed behind the curve. Inflation has fallen to 2.5 percent, well below the mid-2022 peak of 7 percent and just above the Fed’s target of 2 percent.

[...]

The FOMC must cut rates by more than the 25 bps cut that some Fed officials have already signaled. A rate cut of 75 bps would put the federal funds rate at 4.5 - 4.75%, which would still be higher than it was at any point between November 2007 and January 2023.

[…]

If the Fed is too cautious in cutting rates, it would needlessly risk our economy heading towards a recession. A number of economists have warned of this risk since July.16 Former president of the Federal Reserve Bank of New York, Bill Dudley, wrote, “dawdling now unnecessarily increases the risk.” The Committee must consider implementing rate cuts more aggressively upfront to mitigate potential risks to the labor market.”

These arguments do have some validity. Significant progress has been made on the inflation front, even if you do not believe the faulty BLS consumer price index (realized inflation is probably around double what they claim). The interest rate hikes have slowed the massive price appreciation from the tsunami of money, and the damage brought on the banking system has been papered over well enough to avoid a full-blown crisis, although there are still gaping holes, as I have covered in The Underwater Banks.

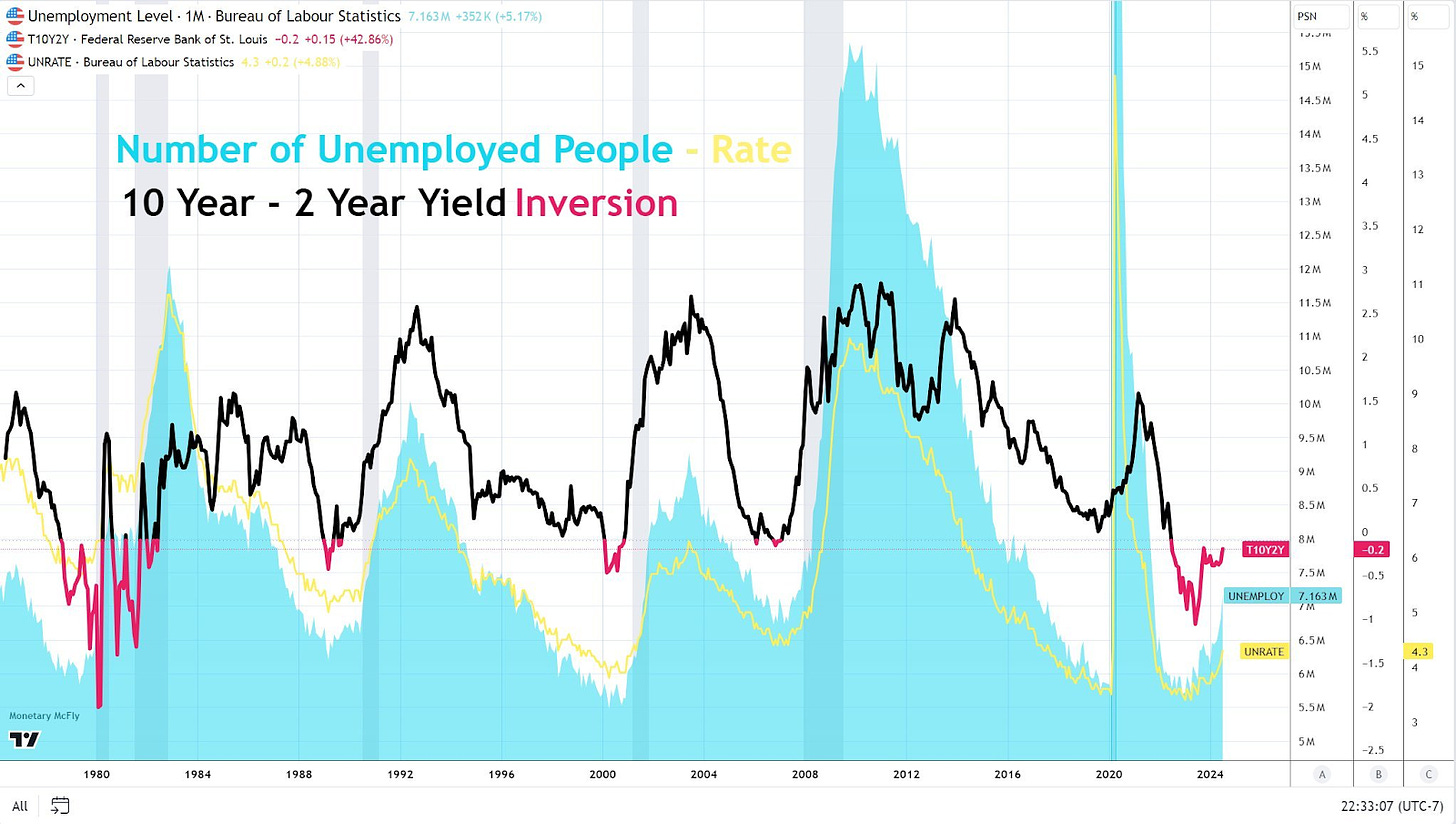

The bigger reason than even inflation is the growing unemployment rate. The official number now sits at 4.2%, up from 3.4% in April 2023. The BLS has also been busy doing its best to obfuscate these numbers as well, by overreporting jobs numbers and then revising them downwards months later after the media attention has shifted. The Bureau of Labor Statistics (BLS) reported that the U.S. economy added 142,000 jobs in August 2024, an increase of 28,000 compared to July. Private sector payrolls grew by 118,000 during the month. However, job growth for the previous two months was revised downward by 89,000 jobs.

This is not the first time they’ve done this. In March, the BLS held its annual benchmark review of its own data and found it was far weaker than initially thought, with 818,000 fewer jobs for the year prior. This has happened so consistently it is becoming a trend, and many are starting to question if the jobs figures are actually much worse than they are letting on- something I discussed here.

In any regard, the unemployment rate has ticked up considerably and the economy is softer than when the Fed began their hiking cycle. Furthermore, the 10yr-2 yr spread has inverted again, which is typically a sign of oncoming recession. In fact, since 1976, this indicator has accurately predicted a downturn every single time, with the one exception being the recession brought on by the COVID pandemic.

A bottoming and then slowly rising unemployment rate is also a sign of an oncoming recession, being a reliable indicator for every contraction in the last 50 years with the exception of COVID, same as the yield curve inversion.

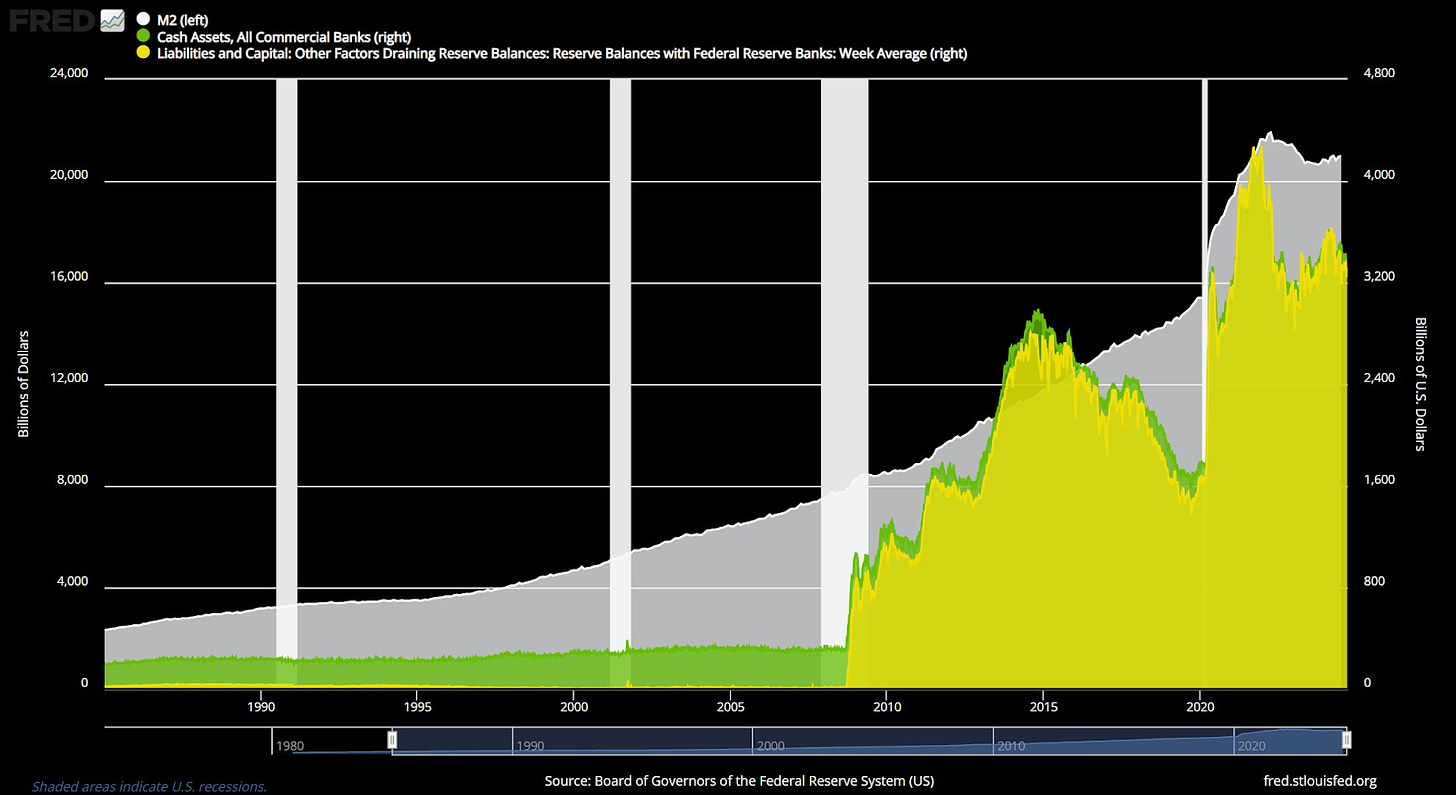

But we don’t need the unemployment rate or even the inflation rate to explain why the Fed feels it has to cut again (despite what it claims is strong economic data). The real reason always has been and always will be LIQUIDITY. Although most people think that the Fed has been tapering since March of 2022, the reality is that M2, cash assets, and bank reserves all bottomed in the fall of 2022 and have been slowly grinding upwards ever since.

This may come as a shock to some of you- the Fed is supposed to be tapering, right? Tapers come with the attendant balance sheet drawdown, sales of securities, falling equity prices, deflating bubbles, etc. And yet, if you take a glance at the S&P 500 or NASDAQ, you know that isn’t the case. Mysteriously, the Fed has been able to pull off this taper without actually causing the typical symptoms of one- a clever sleight of hand, where it appears to work on the surface without actually impacting anything underneath.

Equity markets have broadly become yet another measure of liquidity. Their continuing rally warns us that liquidity is not falling, but rising. The money is coming from somewhere.

That money however, is running out.

Reverse Repo, now understood to be one of the Fed’s new secret liquidity tools, is finally beginning to run out. This facility grew to a gargantuan $2.2 trillion in the aftermath of the massive wave of QE unleashed during the lockdowns, and has been the secret war chest from which the Fed has been drawing ammo to keep the monetary system working as intended. Even in 2008, the facility had only held around $25B of cash, and this had later grown to between $100B-$300B during QE II and QE III.

Once Reverse Repo is gone, the only major liquidity tools remaining will be the Treasury General Account (which is much harder to manage since this entails conspiring with Yellen for more spending on a daily basis to inject cash) and the Foreign Repo Pool, which affects only offshore (Eurodollar) banks and does not look inwards to the domestic markets.

Realistically, Reverse Repo has been the best tool the monetary officials could have hoped for in this scenario. As it finally runs out, the urgency to find a new source of liquidity is ramping up.

Hence, the underlying urgency (and severity) of the rate cut discussions makes sense. In a system that is completely dependent on fresh money printing, the incumbents cannot afford for this printer to stop. Lowering rates means a resumption of the monetary stimulus; not only will it make it easier for individuals and corporations to borrow and load up on debt, it will also come with new QE.

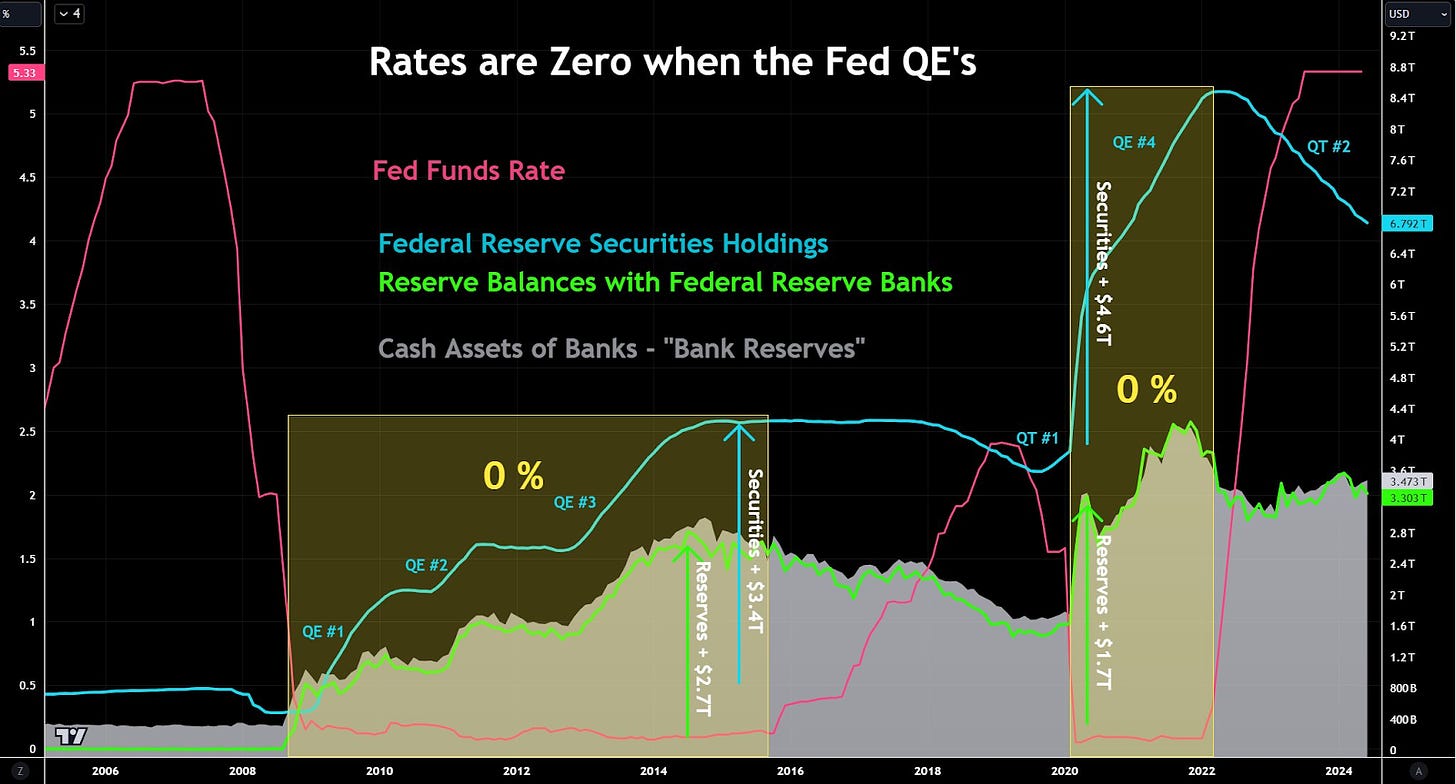

In fact, historically the Fed has never done a rate cutting cycle without an attendant rise in securities (aka QE). This makes intuitive sense- lowering the Fed funds rate only affects the extreme short end of the curve, the overnight interbank borrowing rate. By including asset purchases with a move lower in the Fed Funds, the central bank is able to affect the entire yield curve, bringing down rates across tenors. Given that Treasuries function almost as money in many regards, especially in the Repo market, the Fed is able to affect the price and quantity of the collateral that underlies the wider shadow banking system.

Increases in the Fed’s balance sheet are accompanied by increases in bank reserves, which are a liability to them but an asset to commercial banks. This also means an increase in cash assets, which are an even more direct way to view liquidity. Any form of overt (or covert) QE therefore, increases cash and therefore liquidity, pumping asset prices back up and freeing up capital for investments.

This next rate-cutting cycle will thus see a new wave of QE.

Que the cuts, Jerome.

(Special thanks to Monetary McFly for help with the charts)

We can also see that QE is starting once the funds rates went to 0. Can we expect the recession before to go to 0% rates and the start of the QE? Which could mean a recession in mid/short term, maybe after the elections.