For a decade now, Bitcoin has been criticized as being too clunky, slow, and inefficient. But the new layer-2 being developed on top of the basechain is revolutionizing Bitcoin- and the world.

In 2018, I had heard of Bitcoin and was interested in learning more. After listening to a few introductory podcasts and skimming through a few articles, I found a book entitled “Beyond Blockchain”- written by Eric Townsend, a software engineer turned macroeconomics podcast host that I had great respect for. In the book, he had laid out the incredible potential of blockchains. Overall, Townsend was a supporter of blockchain technology and proof-of-work, but for various reasons he believed it was limited- namely the 7 transaction per second cap for Bitcoin, and how this would ultimately prevent it ever being used as a true global currency.

“The blockchain network is not scalable,” Townsend says. “Somebody can design a proprietary product that’s not designed on an asinine contest to waste as much electricity. You know there’s got to be something better than blockchain coming.”

-Hedgeye Webinar, February 8th, 2018

We are now coming to understand that this model of thinking is wrong. By knowing how our current system works, we can reverse-engineer what is needed to make a new monetary system function properly. In his groundbreaking book, Layered Money, Nik Bhatia lays out this new framework in monetary science; the existence of different levels of monetary networks to service disparate users with vastly different needs. He explains that money as we know it does not exist, and should not exist, as a singular network upon which all transactions are completed. Various conflicting interests and user needs mean that any system built to service everyone will have to make severe compromises in all respects, and end up being sub-optimal for the vast majority of users.

In reality, the modern financial system does not operate as a single layer, upon which all transactions, no matter the size, must be executed. Instead, it operates at multiple layers- each of which has scaling solutions and key differences in security, transparency, and operability.

At the base layer sits FedWire, the payment system that the Fed uses to transfer reserve balances. It’s described like this:

The Federal Reserve Banks provide the Fedwire Funds Service, a real-time gross settlement system that enables participants to initiate funds transfer that are immediate, final, and irrevocable once processed. Depository institutions and certain other financial institutions that hold an account with a Federal Reserve Bank are eligible to participate in the Fedwire Funds Services. In 2008, approximately 7,300 participants made Fedwire funds transfers. The Fedwire Funds Service is generally used to make large-value, time-critical payments.

The system is clunky and slow. Only after a long verification and approval process, under which an institution has to pass various regulatory requirements, show proof of reserves, and acquire secure servers that can connect to the network, can a firm join. Once joined, they can use the system to settle credits and debits between correspondent banks and FIs and the Fed itself. In Q3 of 2023, the average value of transactions sat at around $5.5M USD, with around 770k transfers occurring a day- implying a transaction speed of approximately 8.9txs.

This is the network used to transfer bank reserves, a special type of financial money that can only exist on a massive centralized ledger at the Fed. Essentially, the Federal Reserve has a SQL database on which they track reserve balances of thousands of financial institutions, and initiate/confirm transfers between these institutions. This is the beating heart of the financial system- if it were to go down via cyberattack or military conflict, it could cause an immediate freefall in financial markets and a freezing of the monetary plumbing that makes our system work. It would be nothing short of catastrophic.

On top of this base layer sits deposits. These are ledger entries created by a bank when funding a loan or when receiving a transfer from another financial institution. As we covered in a recent substack piece, bank deposits make up the vast majority of M2 Money Supply and thus constitute what most would consider circulating money- if M2 goes up there is an immediate and direct impact on prices, as seen during the 2020 QE cycle and subsequent inflationary surge. I should also mention M2 is not even the full picture- credit card balances, revolving credit lines, and more technically impact the amount of circulating currency and thus prices, as these can bid up prices without initially affecting broad money.

M2 in general is a flawed metric, only capturing the generalities of what can be considered currency in the real economy. Accurately measuring all components would be much more difficult, but perhaps not impossible- it still surprises me that Fed economists do not even attempt to do so. As previously covered, they gave up trying to measure the Eurodollar market in the late 1970s and discontinued M3 money supply in 2006, just before the financial crisis.

A significant portion of economic activity is executed on this layer. Debit card transactions, once a small fraction of the total, have now risen to become the overwhelming majority of interbank payments, reaching 90B transactions a year by 2021. The number of checks has been decreasing steadily at a rate of 7.2 percent per year since 2018, reaching a total of 11.2 billion. In 2021, the monetary value of check payments amounted to $27.23 trillion, making up around 21 percent of the total.

After surpassing checks as the leading noncash payment method in terms of value in 2009, ACH transfers have experienced substantial growth, hitting $91.85 trillion in 2021. ACH stands for Automated Clearing House, a payments network established in the mid 70s and currently run by Nacha. ACH transactions are commonly used for various types of financial transactions, including direct deposits, bill payments, business-to-business payments, and certain online transfers. As of today, the network connects over 10,000 financial institutions. ACH transactions facilitated more than $72.6 trillion in 2022, facilitating over 30 billion electronic financial transactions.

Below we can see a graph of trends in this sector over the last 20 years.

This layer is faster, much less centralized (tens of thousands of nodes compared to 8,000) and in general, slightly less secure. Banks still use verification, encryption, and identification measures to try and prevent fraud or theft, but if it does happen, it is often irreversible and costly. (Don’t lose your debit card!)

Households, Individuals, and Companies use this layer and the one above for daily transactions, settling debts, and moving assets. It is the main layer of economic growth and productivity.

On top of this sits the third layer- debt. Existing as a derivative of broad money (promises to pay units of currency in the future, at a fixed interest rate and over a specified period of time), this layer naturally is the most volatile and most difficult to measure.

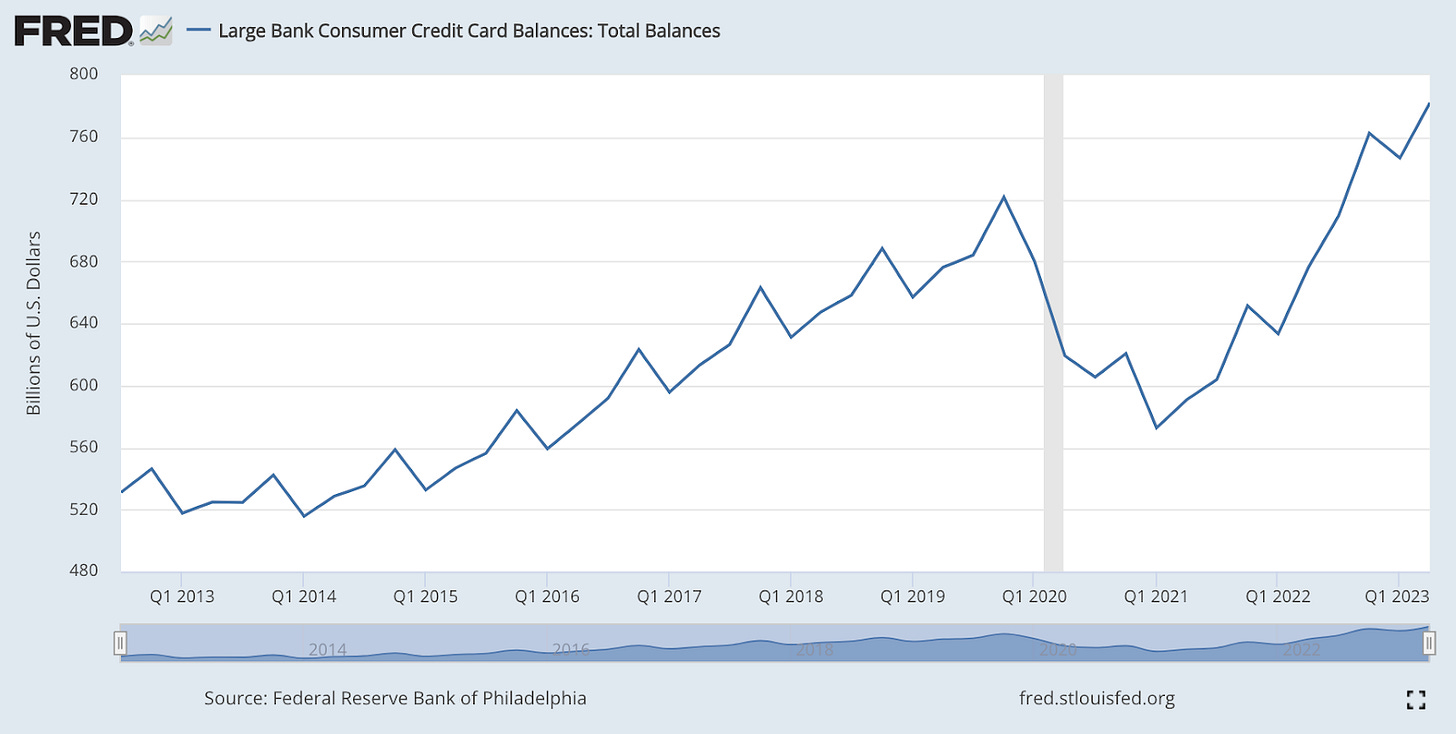

For example, credit card debt held at large banks displays seasonality and is highly sensitive to the business cycle. Every year, balances spike during Thanksgiving and Christmas, and then they dip in the early part of the following year as debt gets paid off. During economic downturns such as the COVID-19 crisis, debt is either defaulted on or (more likely) is paid down as cash flooded into the system and consumer spending collapsed.

There are also obviously credit lines, HELOCs, mortgages, and other ways in which debt is taken on by households and businesses during the credit cycle. What is not included here, and difficult to measure, is shadow bank lending. This may sound nefarious, but in reality it constitutes PayDay loans, paycheck forwarders, hard money lenders, and more. Some of this industry is dark and predatory, as covered in Bad Paper by Jake Halpern- lenders who target the old and infirm, poor and uneducated in order to loan them money at obscenely high interest rates and chase them for life.

Again, this final measure of money is not measured by any single metric and it would be hard to do so given the opacity of the shadow banking system. Overall though, these three layers service the needs of basically every type of entity in the economy, ranging from multinational banks to a single mother taking out a short term loan.

This is important because of the vastly different needs of the users in each layer; security and insurance on the first, convenience and speed on the second; credit access and interest rates on the third.

(You can argue shadow banks make up the fourth layer as well, trading in derivatives, Eurodollars, and more- but we won’t touch on this fourth layer here as it deserves its own post and in depth exploration.)

Bitcoin would fail, claimed Townsend and others, because it could not fulfill the requirements of the 3 main monetary levels simultaneously due to technical constraints on the basechain. This was due to something called the Blockchain Trilemma, a term coined by Ethereum founder Vitalik Buterin in 2021 and it highlights the delicate balance among three fundamental elements in blockchain technology: security, scalability, and decentralization.

Keep reading with a 7-day free trial

Subscribe to The Dollar Endgame to keep reading this post and get 7 days of free access to the full post archives.