Musk Can't Fix This.

With the creation of Elon Musk’s DOGE, promises have been made to balance the daunting U.S. deficit. However, little do they know- the problem is much worse than they think.

One night in October 2022, I woke up at 2am with an epiphany that bolted me out of bed. Something just clicked, and a new rift opened up in my thinking- I decided to tweet what I realized. For the preceding few weeks, I had been deep in research on the U.S. debt situation, writing articles and going on podcasts, proclaiming that this crisis was a civilization-killer; something that if it was not addressed, and quickly, could destroy our financial world as we know it. But the true scale of it hadn’t hit me until now.

I scrambled to get out of bed and shot out the tweet. Within a few hours, it was at hundreds of thousands of views, and I had dozens of DMs asking me what it meant exactly.

What the tweet expressed was the realization that the generic solution that central bankers apply to the inflation problem would backfire- and horribly so. Typically, during an inflationary cycle, central bankers will apply the countercyclical monetary policy to abate the rising prices. Since most of these monetary elites are academics, they subscribe to the business cycle theory of inflation, which itself lends credence to the Phillips Curve. Essentially, what they believe is that increased employment leads to higher aggregate demand, and this higher demand drives prices up, which increases wages and creates a positive feedback loop of higher employment, higher demand, and higher labor costs. This cycle, whether started by their own monetary easing or by an external shock (such as the 1970s oil shocks), needs to be met with tighter financial conditions in order to mitigate the inflation.

In the late 70s and early 80s, this worked well. In fact, there had been multiple inflation waves during this decade, and the Fed had kind of sat on its hands, unsure what to do now that the global monetary system was unmoored from the gold standard.

Paul Volcker was appointed as Chair of the Federal Reserve on August 6, 1979, by President Jimmy Carter, and he officially took office on August 6, 1979, and served until 1987. His experience in the private sector had given him a deeper understanding of how inflation was wrecking the American economy, and he vowed to destroy this inflation by raising the Fed funds rate (the overnight “risk-free” borrowing rate that banks borrow and lend reserves at) to almost 20%. This did have the effect of finally breaking the back of the inflationary maelstrom that had occupied the United States for the duration of the 1970s, however it came at the cost of creating an artificially strong dollar as the Yen, Pound, and Mark all weakened considerably versus the dollar (a story for another time).

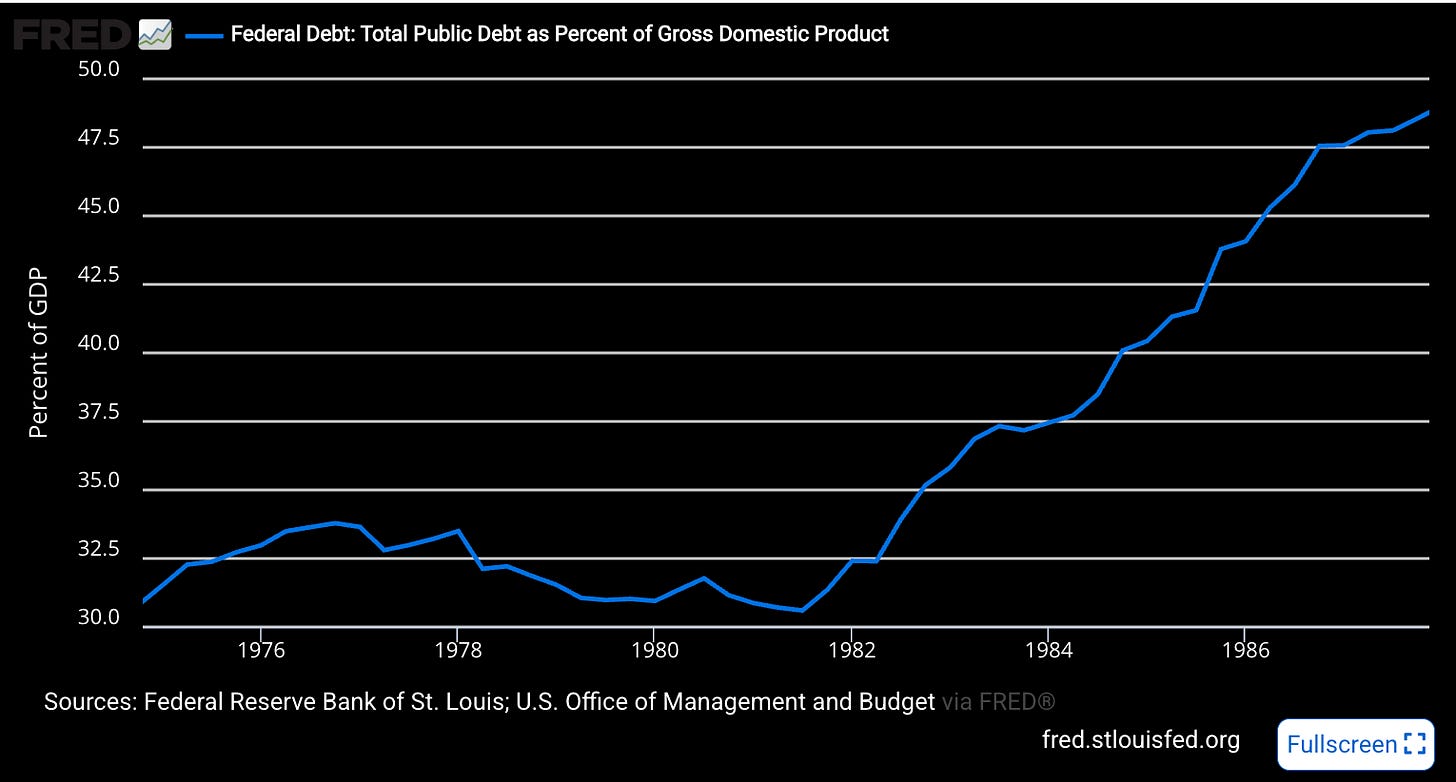

He was able to do this because the Federal debt-to-GDP ratio was at very low level- when he was appointed Chairman of the Fed, it was barely at 31%. With this low of a debt ratio relative to government income (and overall GDP), a hike in rates would hurt the government finances only mildly, while slowing the monetary velocity and price inflation that was plaguing the American consumer.

The hike in rates was successful in killing the inflation, but it also planted the pernicious thought that this Phillips curve notion was economic law, rather than just a convenient relationship that held up from time to time. Due to the success of the Volcker Shock, central bankers everywhere now dogmatically believed that raising rates was the perfect solution to high inflation, and with minimal side effects. They could debase in cycles now, and downplay the effects of inflation during the boom and then downplay the negative effects of the rate hikes during the moderation.

Well, these ideas are coming to their breaking point. The 31% official debt to GDP ratio in 1980 is now a massive 121%, if you believe their official figures- which is hard to do given the size of the unfunded liabilities. If you include just social security and medicare (not even defense or gross interest expense), there is around $175T-$230T of additional liabilities held by the U.S. government that need to be paid out. Since the Boomers are the largest (and most powerful) voting bloc, it’s extremely unlikely they will vote themselves out of their own benefits, especially since they feel they are entitled to them.

In any regard, hiking rates in this environment is not the same as what Volcker did 45 years ago, which brings me back to my original point. Higher rates, normally thought to reduce inflation, will be successful in moderating price rises, but they will blow out interest expense paid by the Treasury. Since June of 2024, we have crossed the vaunted $3B a DAY in interest expense- equivalent to almost $1.1 trillion per year.

This is where we now enter our conundrum.

If the Fed hikes rates, they blow out interest expense, which means the debt growth continues to accelerate, which means more eventual Treasury issuance. This higher Treasury issuance must be funded somehow, and with foreign central banks slowing down their net purchases of Treasuries, especially bonds, someone has to pick up the tab.

The authorities have tried to find ways around this. In 2008, they sold government bonds to the Chinese, who in combination with a couple other CBs, funded 71% of issuance for almost a decade. When that started running out, they changed SEC regulations to make money market funds take on Treasury issuance. They also created Basel III, and determined that banks needed to hold a certain percentage of capital in HQLA assets (which conveniently stuffed the banks with Treasuries). (See my piece Stuffing the Coffers for reference)

In 2024, the banks themselves proposed a rule change that would mean that they could lever up on Treasuries literally without limit by eliminating the Treasury inclusion in the SLR. This is a more modern leverage ratio that calculates an amount of capital that banks must hold in reserve against assets, in case they fall. If they are successful in making this rule change, the banks would be in effect helping to swallow this massive Treasury issuance, delaying the eventual QE from the Fed and buying monetary authorities precious time.

Many point to the fact that Elon Musk’s DOGE has been hard at work eliminating government spending, and they claim that this will help solve the debt crisis that is growing by the day. However, if you look closer at the actual figures, you quickly discover why this is not the case.

SPONSOR:

Taking self-custody of your Bitcoin has never been more critical, and that's exactly why the team at Blockstream has created the perfect solution: the Jade Plus hardware wallet.

Blockstream Jade Plus is the simplest and most secure way to protect your Bitcoin—whether you're brand new to Bitcoin or a seasoned stacker, Jade Plus has you covered. With its sleek design, intuitive setup, and step-by-step instructions, you'll be securing your Bitcoin in minutes, not hours.

Pair your Jade Plus seamlessly with its dedicated companion app, Blockstream Green, on your mobile or desktop, and experience the easiest onboarding journey you've ever had. As your Bitcoin stack grows, Jade grows with you. Activate advanced features like the air-gapped JadeLink Storage Device, or take advantage of the game-changing QR Mode, letting you securely send and receive Bitcoin with Jade’s built-in camera, no cables needed!

Want even more security? Jade Plus supports multisig wallets using popular apps like Blockstream Green, Electrum, Sparrow, and Specter—giving you ultimate flexibility and peace of mind.

Don’t wait until it’s too late—take control of your Bitcoin now. Get your Blockstream Jade Plus, the all-in-one, Bitcoin-only hardware wallet, today.

The billionaire tech CEO had stepped in with a promise to bring Silicon Valley speed and cost-cutting to the sluggish machinery of Washington. In just a few months, DOGE has made some bold claims: they say they’ve already saved the government around $160 billion.

So where do those savings come from? A good chunk, according to DOGE, came from canceling contracts and leases. For example, they axed over 100 government contracts tied to diversity and inclusion programs- about a billion dollars’ worth, by their count. They also ditched leases on vacant office space, saving a few tens of millions more. Musk’s team is presenting this as a major cleanup of government bloat, but some of the savings are more smoke than fire. Watchdogs have pointed out that many of these contracts were already partially paid or scheduled to end soon, meaning the actual money saved might be far less than advertised.

Another piece of DOGE’s claimed savings comes from tracking down fraud and improper payments. They’ve leaned into tech here, using AI-powered tools to scan for duplicate or erroneous payouts in federal programs. It sounds great, and they claim they’ve saved billions this way, but again, the details are murky.

Here's the main point- even with all these cuts, federal spending has actually gone up in 2025, by about 6% compared to last year. That’s mostly because of increases in military and infrastructure spending, which DOGE isn’t allowed to touch. So while they’re slashing in some areas, the overall budget is still growing.

The U.S. debt clock has their own estimate of DOGE savings, which are even higher at $397B. This figure, while encouraging, is not backed up by any hard study or research, and the website does not provide how they are estimating the number.

In any regard, the fiscal deficit is currently around $2T, and most of that deficit is non-discretionary spending, so actually reducing that meaningfully would require a new budget passed by Congress. This would likely entail a combination of cuts in benefits for seniors, healthcare for the poor, and even veteran’s benefits and the myriad of military bases overseas.

None of these proposals are politically expedient and therefore the chances that this reform can actually take place are slim to none. This means the debt will continue to grow, forever.

I recently ran a non-linear regression analysis of the U.S. debt using a python script. After downloading the raw data month-by-month from the Treasury website, you can plug this into a “best fit line” function and it will spit out an equation that most closely matches the data set. The one that came out for the U.S. debt spiral is an exponential function, as you can see here:

Here is the function represented graphically.

The long term trend is exponential. Although some may claim that we can balance the budget, like I stated earlier, cutting $2T of spending is a gargantuan task. Worse yet, this STILL does not solve the interest rate expense issue- the debt would still be growing as interest keeps stacking on top of it. A neutral deficit would just mean a slower rate of change in the function.

To move towards solving the debt issue, we’d have to cut deeper- an additional $1.1T at least to just flatline the debt, and another couple hundred billion to actually start taking a chunk out of it every single year.

This is the paradox- if the Fed hikes rates, it only increases the speed of this incline, which means more treasury issuance- and with the foreign CBs and local banks all plugged full with Treasurys, this means they will have to pick up the tab and do QE, actually to a greater degree than before since they now have to fund the interest expense. This means that the higher they hike, the further they move behind the curve as the coming waves of QE cause more and more inflation and thus the need for higher and higher rates. This is a death spiral of higher rates and more QE, just like what Argentina experienced in 2022 and 2023.

If they lower rates, this will stimulate monetary growth again and cause inflation, which will cause the deficit to blow out even further. This means higher inflation, and more federal borrowing, which means higher debt levels and a faster rate of growth.

Beyond the Monetary Event Horizon, there’s NO WAY OUT.

One of the next steps will likely be to require all tax exempt retirement accounts to hold a certain percentage of UST's. And that percentage will likely grow to 100 percent.

Energy money; finish the half done petrodollar and make energy the basis of money . 10kwh dollar.

Then generate our way free. We need and get here 3 vital things:

1) Money of value

2) Out of debt

3) more energy.

The state controls by digital stamp-blockchain what is money and what is energy. Seigniorage as usual. The people get energy, the (greed) animal spirits will produce vast energy.

We can’t at this point have either excess energy or too much money. Have the KwH as the standard to avoid exhaustion of any one source of energy.

Note well the actual 1/0s are electric impulses already. Note the petrodollar is only half done as it is, and of course only the top half.

The petrodollar was always only half done, finish the logic and share the wealth and value.