Return of the Kitty

Roaring Kitty has returned, and with him a massive spike in $GME price action. But what’s really going on behind the scenes?

On Sunday, May 12, exactly 1060 days after his previous tweet, Keith Gill (known on Twitter as Roaring Kitty) emerged from his hiatus with a singular tweet portraying a man leaning forward in his chair. At market open on Monday morning, the price of Gamestop and several other “meme stocks” began ripping upwards, running from $17 where the stock began the Friday before to $40 in after hours trading. During the course of the trading day on the 13th, Roaring Kitty began posting cryptic videos, often of movies edited together with captions- with the first being a scene from Avengers portraying Thanos handling the Infinity Gauntlet followed by Wolverine breaking out of an isolation tank.

As the price began to soar, short-sellers began losing heavily on their bets- $1B was lost in the first hour of trading, and by Tuesday, $5B had been lost on Gamestop and AMC combined. News outlets abounded with stories of DFV’s return, and how the popular retail investor had become an “investing guru” with a cult following that drove the stock price. Very early on, I doubted this theory, for several reasons.

First, retail investors do not have a ton of dry powder. In January of 2021, we had gotten some fresh stimulus checks and inflation was rising but still not peaking. Fast forward to now, and the savings rate is falling, credit card debt is spiking, and consumers are tapped out.

However, a more cogent reason is that retail has essentially never been able to predict or “force” Gamestop price movements. In February of 2021, after the initial spike up to $500 in pre-market trading, $GME collapsed slowly and steadily, falling first to $150 then $100 before hitting a low of around $40 (pre-split). Many in the reddit subs lamented the fall of stock, some claimed the squeeze was “over”, and others made jokes about those who bought in at a high price and now found themselves deeply underwater on a falling stock.

However, on the night of February 23rd, in after hours trading, the stock rocketed back up to $120 and the next morning was hovering around $180. Exuberance spread among retail, most of whom were pretty surprised at the price movement. Chatter on the stock beforehand had been nothing out of the ordinary, and no “concerted effort” had been made to drive up the price. A few weeks later, in mid-March, this happened again. On March 10th, for example, the price soared to $330 in early trading before being slammed down to $170, an almost 50% loss in a single day.

None of this was retail. Everyday investors do not just decide to randomly move a single stock together en masse in such a coordinated fashion, especially not within a single day. A much more likely answer is trading bots moving price, or severe gamma ramps up and down due to hedging activity by market makers- but either way, not retail.

This time, the typical line of “retail investor mania” was again trotted out. DFV’s tweet was pointed to as evidence early on that this was driven by small day traders, but the actual price action disputes this theory. In fact, we can see here in this chart which displays price in May up until the 10th, that the stock began rising quite aggressively well before DFV even tweeted- we’re talking a 70% gain here in two weeks, and this doesn’t look like slow steady buy pressure to me, but instead actual price discovery after months of suppression. Just look at the chart here before May 3rd- the candles are tiny and overall volatility is crushed to near zero.

The price jumped at open on Monday the 13th, from $17 the Friday before to $21. A gamma ramp quickly pulled the stock price up to $37, and then up to $44. That day, DFV started tweeting regularly, every 30 mins. I was looking through Bloomberg with my intern, digging for data on what was driving this move, when we stumbled across something interesting. When searching for top trades on Bloomberg, there are different “sources” you can select from for the calculation. When we selected something called SEC Rule 10B-18, we saw a dozen or so trades open up, all in the tens of thousands of shares range.

Rule 10b-18 offers issuers and their affiliated purchasers (brokers) a non-exclusive safe harbor from liability under certain market manipulation regulations and Rule 10b-5 of the Securities Exchange Act of 1934, provided that their repurchases of the issuer's common stock meet the conditions specified in the Rule. I’ll include a screenshot below of these rules- they are restrictive, for sure, but the theory at the time was that this could have been adding to the buy volume. A stock repurchase cannot exceed 25% of the securities average daily trading volume, so this would have meant that still the majority of the movement was not due to Gamestop itself deploying capital to buy back shares.

They currently have $100M authorized for a buyback.

However, later that night upon doing further research I realized that this likely was not the probable explanation. For one, issuers are required to announce a stock repurchase program, including details of the share amount to be bought and the time period over which it will take place, and no such notice was sent out by Gamestop. We reached out to Bloomberg Help to determine why this SEC rule was listed as the calculation for some top trades, but we haven’t received an answer yet.

SPONSOR: I’ve talked a lot about the value of Bitcoin and its use case as fiat currencies inflate away. As such, I'm proud to have Onramp as a sponsor supporting this newsletter, a firm at the forefront of pioneering a trust-minimized form of Bitcoin custody. With Onramp Multi-Institution Custody, assets live in a multi-sig vault controlled by three distinct entities, none of which have unilateral control.

To learn more about Onramp's products for individuals and institutions, connect with their team or schedule a consultation.

Now let’s get back to it!

The next morning in premarket trading, we saw a parabolic move first to $60, then all the way to $80 before settling down. As we watched the block trades on Bloomberg, a particularly large one caught my eye: 1.2M shares at $63.56, along with a dozen other block trades in the 100K-400K share range, all at the inflated prices. The notional for that largest trade is $77M.

Obviously, these aren’t retail trades. On the options side, over 30,000 options contracts at $30 that expired on 5/15 were bought two weeks ago, which created a price pinpoint at that strike, where the stock bounced off this level multiple times. Also surprisingly, around 5,000 options at $100 strike were bought, either by retail traders with extreme bullishness or institutions.

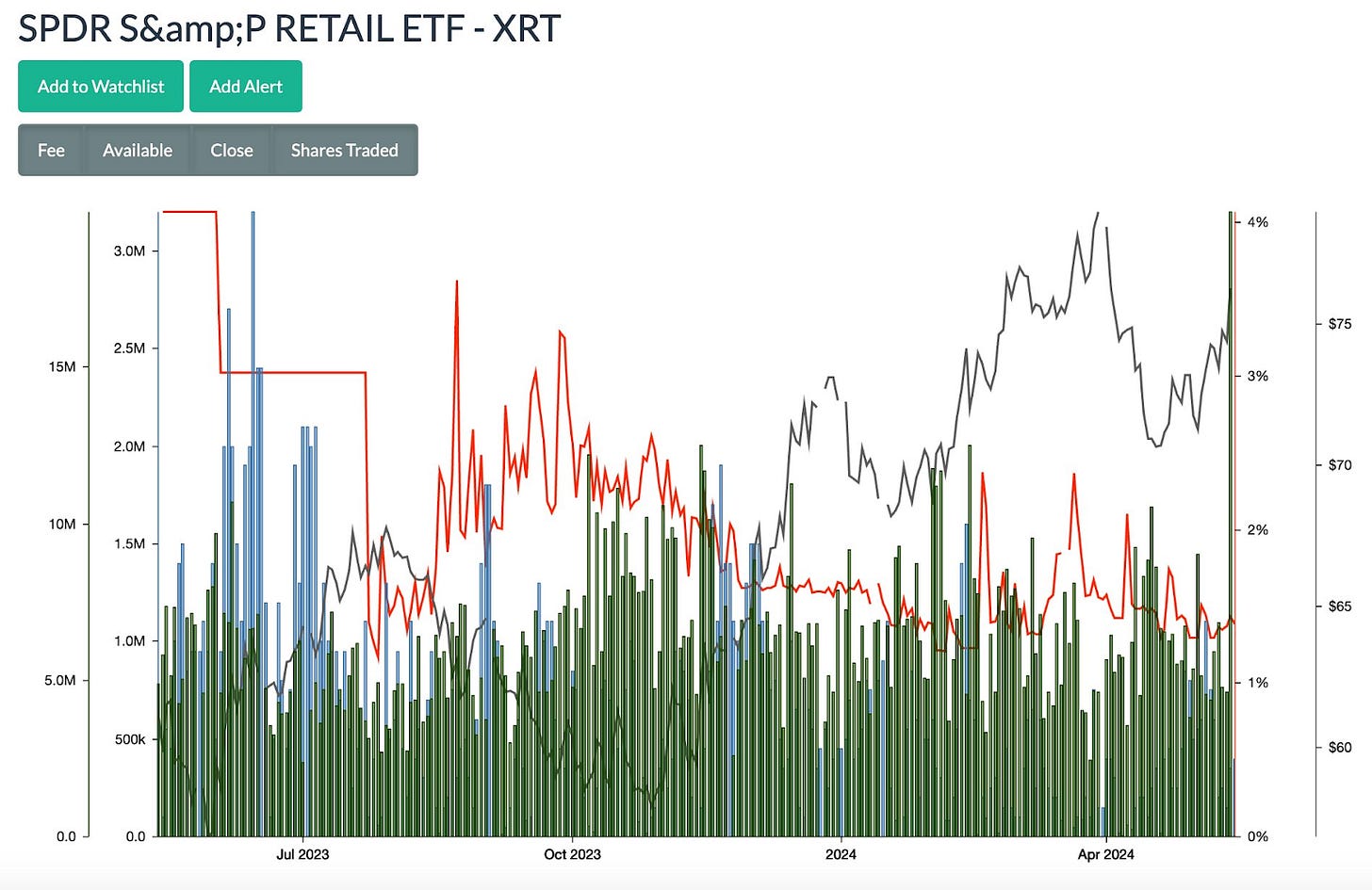

XRT, the Retail ETF that contains a substantial amount of GME shares, also had record high volume that hasn’t been seen since the January 2021 sneeze. The volume was the highest in the past year by a long shot, and a further 350K shares of the ETF showed up as available to borrow on Tuesday.

During the normal trading hours on Tuesday, the price was slammed down all the way to $36, a 52% decline from pre-market. During the rest of the trading day, the price recovered and finished up 44%, typical volatility for Gamestop. At the same time, the amount (in dollars) of market loans tripled and the amount of hedge loans doubled from the previous Friday.

Shorts were waging their war, trying to reduce the pace of price appreciation by any means possible- the typical tricks of ETF borrowing and traditional shorting were being used once again.

The mainstream media came out and trotted the line that this was “dangerous” to our financial system, including the former SEC chair Jay Clayton who paraded on CNBC and claimed that the “meme craze” bothered him and that trading in $GME should be halted.

It’s extremely interesting to note the vitriol hurled at retail during market events like these. If Gamestop truly is a non-issue, and dumb retail investors are losing money, then what do they care? The underlying truth is that $GME still represents a thorn in the side of short sellers, a position that they cannot cover and a squeeze that was going to crush them until they turned off the buy button to get themselves more time.

Total return and basket swaps have long been hypothesized to be one of the mechanisms by which short hedge funds and market makers can roll over FTDs and create more synthetics to short stocks. In March of 2021, for a period of a little more than 24 hours, a massive put position owned by Credit Suisse showed up on Bloomberg, with the location identifier tagging Brazil as the source.

Lawson, who is a professor of finance, saw these puts and screenshotted them- and when he reached out for comment they erased the options positions and claimed it was a glitch. To settle an FTD, you need either a share or a bona-fide agreement for a share- this can mean an option contract, ETF shares that can be redeemed for the underlying basket, or an equity swap, among other things. All can be used to “settle” (or more accurately, roll) an FTD forward and kick the can down the road without having to deliver an actual share.

For those who aren’t familiar, an equity swap is a derivative contract where two parties agree to exchange cash flows at regular intervals based on the performance of an underlying equity asset, such as a stock, a group of stocks, or an equity index. This means an investor can gain exposure to an equity asset without actually owning it. Typically, one party makes fixed payments, while the other makes payments based on the returns of the underlying equity.

For instance, if Company A has $10 million in cash but wants exposure to Stock B without directly buying the shares, it can enter into an equity swap with Bank C. Company A agrees to make quarterly fixed payments to Bank C at a set interest rate. In return, Bank C makes quarterly variable payments to Company A based on Stock B's performance during the same period.

This allows hedge funds, family offices, or other sophisticated investors to get synthetic exposure to an underlying stock without buying it outright and putting it on their books. It also allows them to get a bona fide agreement for a share, which can roll an FTD forward. Also, something which is very important to note, such as what is mentioned in this SEC comment letter, is that the counterparty to the swap holds the underlying securities as a hedge against the position- and when it is unwound, the long investor can purchase these securities from the counterparty, without hitting the lit markets. If the counterparty is irresponsible, this can mean that if the stock has appreciated, they will have to go out and buy equity shares in the underlying before expiration to deliver them to the long investor, causing buying pressure.

I started to look for swaps data, and immediately began running into issues. Bloomberg makes it incredibly difficult to find accurate and up-to-date information, and their help chat was unresponsive. When we did find data, strangely we could edit some of the boxes, and the notional was steady at $10M for every single trade. Because of the peculiarities around the data, we didn’t trust this initial find as actual data for swaps.

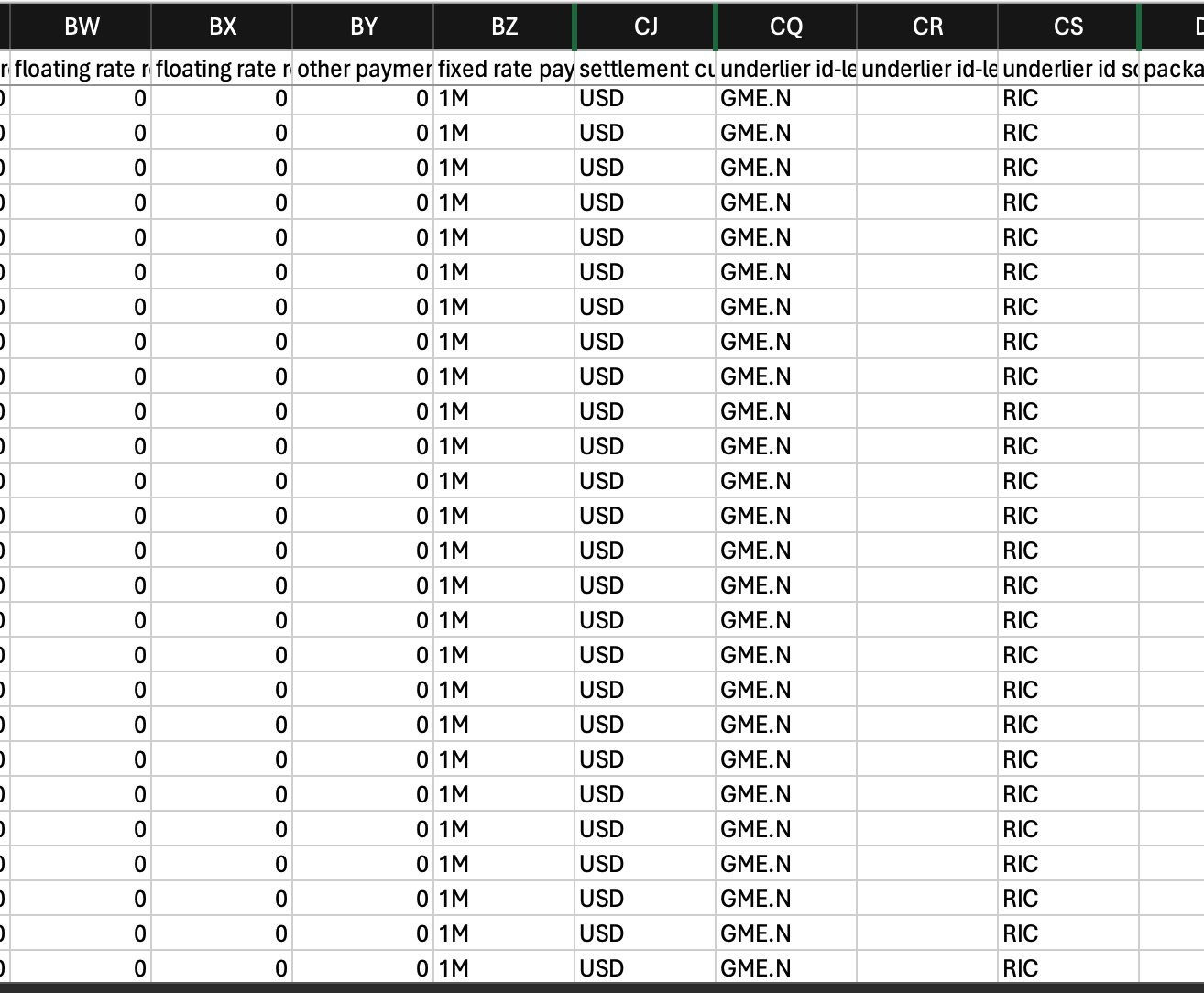

After this little setback, we began searching for other more reliable forms of data and stumbled upon a trove compiled from a discord user- it appears to contain CFTC swap transaction logs. When going through the massive data set (it goes back years), we found a huge amount of swaps expiring on May 31st, 2024 and in early June as well. The list was truly extensive!

After doing a bit more calculations, we realized that this represented a shocking $2.9 BILLION of overall notional exposure to $GME. That’s almost half the entire company’s market cap!

EDIT: After further review, I want to stress that I am not sure about the manner of calculation of this data. I need to confirm the sources and the best way to calculate the actual amount of swaps being rolled over. I am going to rescind the hard claims on the swap data.

EDIT 2: Current estimate puts it closer to $108M coming in the next two weeks, after filtering for terminated, failed, and canceled swaps. Much smaller than $3B. I will still stress I need to confirm this number with a trader who has experience with data like this, so hold on.

The N at the end of the ticker merely identifies which exchange the stock is traded on- in this case, it stands for NYSE. To be fair, I am not sure how much of this notional position is already hedged, and much of it probably is, so this does not mean that $3B of buying pressure is here. But as I stated at the beginning, I think there is a fair bit of reason to believe that this spike was not mainly retail driven, just as the other price spikes occurred without significant retail coordination beforehand, with the exception of the first spike in January 2021.

It’s also interesting to note that this spike occurred with much lower volume than previous ones. Could this be a result of the DRS movement? Only time will tell, but the similar price increase with lower volume is interesting.

Finally, the last bombshell dropped Friday that Gamestop filed a mixed-shelf offering to sell 45M shares to raise capital. This includes common stock that’s publicly listed, as well as other types of equity and equity options. The price plummeted quickly in trading Friday, down from $30 to $20, and many on Twitter lauded this event, stating that it was all over and retail investors had gotten rug pulled. However, given that a lot of the buying is institutional, this could be just Gamestop taking advantage of high prices to raise capital or do something strategic. Which isn’t a bad idea for the company in the long run, all things considered.

The share offering included Preferred Stock, Depositary Shares, Warrants, Stock Purchase Contracts Units, and Subscription Rights. The expansion of these types of shares tells us that something more may be at hand- a likely option is a possible merger with another firm, as these more specialized forms of equity are normally given as consideration to another company when firms do a merger or acquisition. Could this be a preparation for a move like this? Potentially. It’s hard to imagine Gamestop will sell all the common equity for cash when they are already sitting on over $1B.

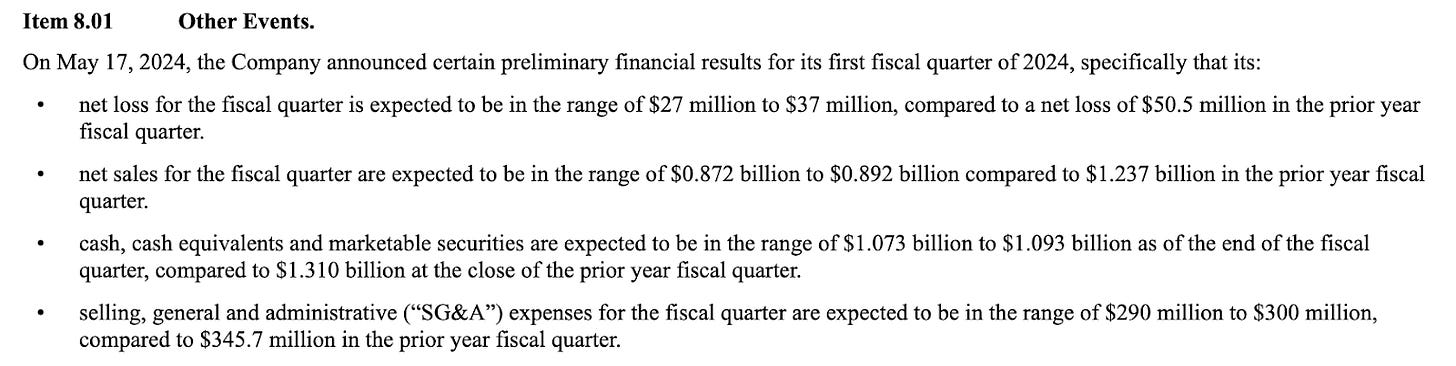

Crucially, they also released an 8K report early, which had an interesting clue:

"The Company intends to use the net proceeds from the Offering, if any, for general corporate purposes, which may include acquisitions and investments in accordance with our investment policy."

They also demonstrate here that net sales are expected to continue to struggle, the cash balance is expected to fall, and SG&A expenses are also going to be $50M less than the prior year. All of this points strongly to acquisition- and Twitter user FoxenFlask stated it directly:

Also saw, from the 8k from today vs last quarter: after accounting for an estimated projected loss of $27-37m, the Cash/Equivalents projected balance shows a delta of $71-102m that is unaccounted for outside of the losses. Could be the ~ size of the first acquisition

Hey,

u/Andym2019 is writing comments since he seems to have found the source of the swap data. Here's a quote from him from yesterday (May 20th 2024):

"DTCC GTR North America Real Time Dissemination reports. Go to search, enter a timeframe that is <= 180 days long, SEC, equities, set notional value to 1000 usd, submit search. Takes a long time to download, filter column “underlying asset id- leg 1” to “GME.N”.

Currently downloading a large report but the data for today shows $30,000,000 in GME swaps was created just today"

It seems that historical search is only available up to end of January.. but there are consolidated daily reports for download. I tried to find GME in the SEC equities report and couldn't (OP refers to it being 30m yesterday), but most likely I am just to smooth brained for that.

Love your work, man!

Fuck this highly manipulated stock, better buy bitcoin, no circuit breakers, no bail outs or bail ins.