The Milkshake Returns

The year has barely begun and multiple currencies are crashing as DXY rises once again. What happens when the Dollar Milkshake returns to claim more victims?

In September 2022, I published a viral piece on Reddit entitled “The Sword of Damocles and the Dollar Milkshake” where I discussed the growing crisis in the British Pound and the Japanese Yen, which had both slid to historic lows against the Dollar. The crisis had occurred due to the surging dollar index, which had put enormous strain on the global monetary system.

On September 22 of that year, the Japanese government and BOJ intervened for the first time in nearly a quarter century, selling dollars and buying yen, after the yen had weakened by about 25 yen in six months, briefly hitting 145 per dollar.

Yen-buying interventions were rare. The one before this had occurred in 1998 during the Asian financial crisis, which caused a yen sell-off and capital flight from the region. Prior to that, Japan intervened to support the yen in 1991-1992. Yen-buying is much more challenging than selling, as it requires using Japan's $1.3 trillion in foreign reserves, which, despite being substantial, will deplete rapidly if large amounts are needed to impact exchange rates.

These foreign exchange reserves are by definition limited, since they are another currency (dollars) that the host country (in this case, Japan) cannot print.

The British had faced a similar problem. On September 28th, The Bank of England stepped in to stabilize Britain's bond markets, announcing it would purchase as much government debt as necessary to restore order following financial turmoil sparked by Prime Minister Liz Truss's tax-cutting plans. After verbal interventions failed over the previous two days, the central bank launched an emergency bond-buying program to prevent the market chaos from escalating.

Market pressures forced pension funds to sell gilts to meet emergency collateral calls on under-water derivatives positions or to reduce exposure due to an inability to meet cash calls. One source confirmed that the Bank acted due to challenges faced by pension funds, the primary holders of long-dated gilts. The BoE stated that its purchases aimed to restore market order and would be conducted on whatever scale necessary to achieve this.

The British government bond market had a 8+ sigma move in rates all across the curve in one day at the worst point of the crisis, which was basically statistically impossible if we use the VaR models most commonly applied to risk management. On September 23, 2022, five-year gilt yields experienced a sharp increase of over 50 basis points, the largest single-day rise since at least 1991. Similarly, on September 25, two-year gilt yields jumped by 44 bps, a surge only comparable to the fluctuations witnessed during the Black Wednesday crisis of 1992.

The standard deviation of daily changes in rates was a measly 5 bps, so these moves were 10 standard deviations and 8.8 standard deviations, respectively.

This was equivalent to a move that normally takes months playing out in a single day.

The emergency measures continued throughout October for both nations, and even the Euro struggled as it neared and then broke parity with the dollar in the same month. It seemed that the currency crisis was not just isolated to the Brits or the Japanese, it was a worldwide phenomenon.

This was due to the Dollar Milkshake Theory, which was posited by Brent Johnson years earlier. Dollar Milkshake is a framework for understanding how a sovereign debt default might occur, with gold, DXY, and equities all climbing as investors scramble for safety and liquidity. The paradox is the dollar’s strength amid financial chaos, driven by its global reserve status.

As the system melts down, the dollar melts up.

And if you take a look at the graphs below, you can clearly see this playing out. Gold is moving higher as a hedge against uncertainty, the DXY is surging on dollar demand, and equities are holding strong despite the turmoil. Milkshake is in full force in 2025.

To understand the full nuances of the DMT, we must first dig into the history of the dollar system. After World War II, the Bretton Woods system made the U.S. dollar the star of the show, pegging it to gold at $35 an ounce while other currencies hitched their wagons to the dollar. But by the time the Vietnam War rolled around, U.S. spending was out of control. Charles de Gaulle, France’s president, called America’s bluff and asked for gold in exchange for dollars. That put major strain on U.S. gold reserves and forced President Nixon to pull the plug in 1971.

SPONSOR: I’ve talked a lot about the value of Bitcoin and its use case as fiat currencies inflate away. As such, I'm proud to have Onramp as a sponsor supporting this newsletter, a firm at the forefront of pioneering a trust-minimized form of Bitcoin custody.

With Onramp Multi-Institution Custody, assets live in a segregated, cold-storage, multi-sig vault controlled by three distinct entities, none of which have unilateral control.

To learn more about Onramp's custody solutions, and financial services like inheritance planning, connect with their team or schedule a consultation. You can use this link to get a discount on their services.

Now let’s get back to it!

The monetary economist consensus was that this would’ve hurt the dollar’s standing, right? Nope. Instead, the dollar became even more powerful. The Eurodollar market, dollars floating around outside the U.S. in global trade and finance took off, and the Federal Reserve became the ultimate boss of central banks.

The Eurodollar market began in the 1950s with an innovation by Midland Bank in the UK, which capitalised on the high cost of capital in post-World War II Britain. Midland’s ability to lend in U.S. dollars gave it a competitive edge, allowing it to participate in the forwards market by lending itself dollars and investing in higher-yielding gilts to capture the spread.

This practice set the stage for the explosive growth of the Eurodollar market from the 1950s to the 1970s, expanding to the point where today, nine out of every ten dollars worldwide are Eurodollars. You can read more about genesis of the Eurodollar system in a piece we wrote here - this is one of the most opaque and complex parts of our modern financial system.

Unlike domestic loans that can be influenced by central bank policies, Eurodollar loans cannot be inflated away by the lenders. This structure creates a sustained demand for U.S. dollars outside the U.S., reinforcing the dollar’s global dominance as these offshore derivatives, now totalling over $400 trillion, dwarf the $36 trillion in domestic U.S. dollar debt.

Conks covered the cracks in the Eurodollar system in The Fed’s Global Put: Part I in which he discussed where fragility really started showing during the 2008 financial crisis. When Lehman Brothers collapsed on September 15th, it sent shockwaves through the offshore dollar market. The spread between onshore rates (3-month OIS) and offshore rates (3-month LIBOR) blew up, with offshore rates skyrocketing.

Bernanke and Paulson had to scramble to set up emergency programs to prevent the system from imploding. Massive bailouts came through, propping up the entire money market fund (MMF) system. Rates were slashed aggressively, and the Fed doubled the maximum dollars available through swap lines.

The global swap network they built basically turned the Fed into the world’s central bank.

On October 13th, 2008, the Fed went even further, announcing unlimited swap lines with all the major Western central banks. They ended up lending a jaw-dropping $3.3 trillion in emergency funds, with a hefty chunk going to foreign banks and big corporations like Barclays, RBS, and even Toyota. While this stabilized the global economy, it didn’t come without controversy, critics pointed out that the Fed had essentially become the de facto lender of last resort for the entire world.

Brent Johnson's "Dollar Milkshake Theory," predicts that as the sovereign debt bubble unravels, demand for the U.S. dollar will surge, causing it to strengthen against other currencies. This strengthening effect draws capital into dollar-denominated assets, even as inflation and debt levels strain global economies. The theory suggests that while many assets may decline in this environment, the dollar will rise sharply, alongside gold, as investors seek safe havens from sovereign debt instability.

Here’s a quote from one of his videos on the topic:

“A giant milkshake of liquidity has been created by global central banks with the dollar as its key ingredient – but if the dollar moves higher this milkshake will be sucked into the US creating a vicious spiral that could quickly destabilize financial markets. The US dollar is the bedrock of the world’s financial system. It greases the wheels of global commerce and exchange- the availability of dollars, cost of dollars, and the level of the dollar itself each can have an outsized impact on economies and investment opportunities.

But more important than the absolute level or availability of dollars is the rate of change in the level of the dollar. If the level of the dollar moves too quickly and particularly if the level rises too fast then problems start popping up all over the place (foreign countries begin defaulting). Today however many people are convinced that both the role of the Dollar is diminishing and the level of the dollar will only decline. People think that the US is printing so many dollars that the world will be awash with the greenback causing the value of the dollar to fall.

Now it’s true that the US is printing a lot of dollars – but other countries are also printing their own currencies in similar amounts so in theory it should even out in terms of value. But the hidden issue is the difference in demand. Remember the global financial system is built on the US dollar which means even if they don’t want them everybody still needs them and if you need something you don’t really have much choice.”

Essentially, the issue is an extension of Triffin’s dilemma. Every other country trades, borrows, and lends in a currency THEY CANNOT PRINT. This creates massive consistent demand for dollars, which preserves the dollar’s value on the forex markets and leads to a buoying effect on the dollar.

Although Johnson is known for best articulating this framework, initial support for this view came from the gold writer “Another” and his successor, FOFOA, in 20 Years Later – A Freegold Project: Interview with FOFOA. Here, FOFOA explains that the unwinding of the current monetary system would manifest in both the U.S. dollar and gold appreciating together against other assets—a rare occurrence, as these typically move inversely. Both FOFOA and Johnson highlight a future where the dollar’s strength and gold’s value increase in parallel, driven by the collapse of debt-laden systems and the shift toward stable assets.

We covered FOFOA in depth in a prior piece called ANOTHER: The Inside Gold-For-Oil Deal That Could Rock The World's Financial Centers.

The reason why these two assets will move upwards together is a symptom of the debt-based eurodollar system the globe finds itself entrapped in. As global debt markets rollover, borrowers rush for liquidity. This means selling risk assets like bonds and equities, and rushing to safe havens- namely, gold and dollars.

The cruel irony of this system, as Johnson so brilliantly elaborates, is the longer it goes on the stronger it becomes. As more and more eurodollars are lent into existence, the overall debt load on the global economy grows, which increases demand for dollars and ensures the next correction will be even more severe.

The Fed no longer even tracks the existence of Eurodollars or of Eurodollar debt- these metrics were deemed too difficult to measure and the reporting was phased out in the mid 2000s. M3 Money Supply, for example, which included some Eurodollar measures, was eliminated in 2006.

A Milkshake crisis appears as follows, as outlined by Johnson:

“But, the real risk comes when other economies start to slow down or when the US starts to grow relative to the other economies. If there is relatively less economic activity elsewhere in the world then there are fewer dollars in global circulation for others to use in their daily business and of course if there are fewer in circulation then the price goes up as people chase that dwindling source of dollars. Which is terrible for countries that are slowing down because just when they are suffering economically they still need to pay for many goods in dollars and they still need to service their debts which of course are often in dollars too.

So the vortex begins or as we like to say the dollar milkshake- As the level of the dollar rises the rest of the world needs to print more and more of its own currency to then convert to dollars to pay for goods and to service its dollar debt this means the dollar just keeps on rising in response many countries will be forced to devalue their own currencies so of course the dollar rises again and this puts a huge strain on the global system.”

We’ve seen this play out several times before. As mentioned previously, in the fall of 2022 there was a massive prolonged spike in the dollar, which began to cause massive issues across the global financial system.

This had accelerated due to the Fed’s rapid hiking cycle which was announced in March of that year- literally the fastest in its history, outpacing even the Volcker Shock of the early 1980s. The rise in interest rates had occurred when the rest of the world was even farther behind the curve. The Eurozone did not even start hiking out of the zero bound until late 2022, and Japan was pinning rates in the negative territory while running a massive yield curve control program- one that began blowing up in their face, as previously discussed.

The terminal rate for the ECB was a full 100 bps lower than the US, and at one point the spread between Japanese rates and the US Fed funds was in excess of 500 bps.

This caused massive carry trades to open up, which were put on by borrowing in Euros or Yen and lending in USD- effectively shorting these weaker currencies and buoying the Dollar. Over time, these pressures built up to the point that both currencies essentially began a slow motion collapse and the Milkshake was now in effect.

Paradoxically, everything these sovereigns did would make it worse. If they tried to defend their currency with forex reserves, they only delayed the inevitable, and burn through billions of dollars to do so. Raising rates to parity with the US meant widespread defaults, as both Europe and Japan are heavily indebted, although to different extents, obviously. Truly there is no option and no fiat solution to the Milkshake- no other currency can usurp the Almighty Dollar.

Now, the Milkshake has returned.

This month, the DXY has climbed to a record 109, a two year high, just within the first few days of the new year. This comes off the back of a record year for the dollar, where it gained almost 7% against the major currencies. All this occurred despite three rate cuts from the Fed and an acceleration in both headline CPI and Core PCE inflation.

The Indian rupee, for example, fell to an all time record low on Friday as the dollar strengthened again, putting pressure on regional currencies. The rupee dropped to 85.97 against the U.S. dollar, slightly below its previous record low of 85.93 set just the day before. The east asian currency has had 10 consecutive losing weeks due to a strengthening dollar and weak capital inflows, though regular interventions by the Reserve Bank of India have helped stem the losses.

Even state banks have been reported to be aiding in the interventions to help the devaluing currency!

Japan continues to face a growing fiscal crisis, with its debt-to-GDP ratio towering at a staggering 260%, the highest among developed nations. The Yen has been in a slow motion train crash since 2022 when the global hiking cycle began. The Bank of Japan’s yield curve control (YCC) program has kept borrowing costs artificially low for years, but cracks are showing. The 10-year Japanese Government Bond yield just hit 1.165%, the highest since July 2011.

We have covered extensively on this substack, in pieces like Godzilla Returns or the Japanese Maginot Line, so check those out for more detail- but the long and short of it is that the process has put immense pressure on the currency, with the BoJ making frantic moves to try and slow the decline of their currency. In the last 3 months, despite the Fed easing cycle, we’ve seen a resumption of the weakness, with dollar yen headed back to the 160 level where they have intervened many times before.

Issues are also arising across the Atlantic, as the UK is now grappling with a toxic mix of soaring gilt yields and a crumbling Pound, an unnerving combo usually reserved for emerging markets, not the sixth-largest economy in the world. Gilt yields have surged to their highest levels since 1998, a grim milestone that underscores the precarious state of Britain’s finances. These same levels of financial strain infamously forced Liz Truss out of office in 2022 after her fiscal policies spooked markets and tanked the currency.

h/t @alexharmstrong

Last week, fiscal chaos sent shockwaves through global markets. Traders, bracing for more volatility, have rushed to hedge against further sterling weakness. According to Barclays’ global head of currency distribution, Mimi Rushton, there’s been a 300% spike in trade inquiries about sterling options. Hedge funds are positioning for the Pound to fall another 8%, signaling deep bearish sentiment and a lack of confidence in the UK’s economic outlook. The Pound has become a punching bag for global markets, dragged down by fiscal missteps and the Dollar’s relentless ascent under the Milkshake Theory.

Up north, the Canadian economy isn’t faring much better. The Canadian dollar has depreciated nearly 8% against the U.S. dollar in the past year, sinking to a two-decade low of C$1.44. Like the UK, Canada is facing rising bond yields and a weakening currency. The widening interest rate gap between Canada and the United States is a key driver. While the U.S. Federal Reserve has held rates high, the Bank of Canada has cut its benchmark rate by 1.75 percentage points since June in a bid to prop up a weakening economy. Political instability has only added fuel to the fire. Prime Minister Justin Trudeau’s recent resignation momentarily lifted the loonie, but uncertainty about Canada’s future leadership quickly reversed any gains.

On the bond side, Canadian government yields are creeping higher, with the 10-year yield reaching 3.47% as of January 10, 2025. Meanwhile, looming trade threats from a new U.S. administration are adding to the uncertainty. Proposals for steep tariffs on Canadian exports have rattled markets, threatening to disrupt one of the country’s most vital economic lifelines.

This combination of a weakening currency, rising bond yields, political uncertainty, and trade threats from Trump is creating a challenging environment for the Canadian economy.

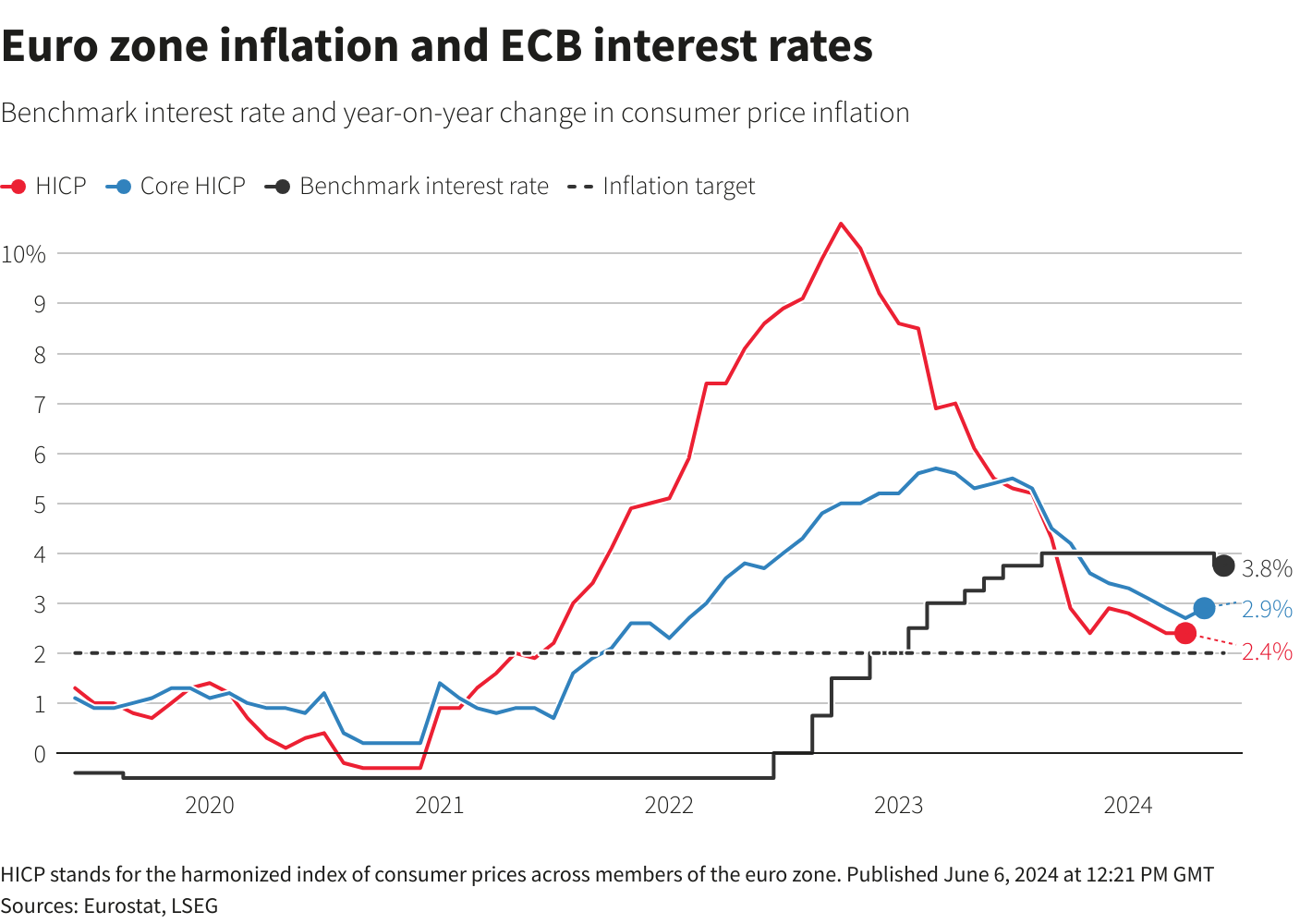

All of this doesn’t even mention the elephant in the room, which is the Euro. The currency has been weakening substantially over the past year again, and is nearing parity with the dollar for the first time since it broke it in 2022. Before that, we have to go to 1999 to find another time that the Euro and Dollar were at parity. The Eurozone is facing a whole host of issues, including weakening economic growth, an immigration crisis, high interest rates, and growing inflation. In December 2024, Eurozone inflation reached a five-month high of 2.4%, driven by rising services costs.

The European Central Bank (ECB) has been reducing interest rates to support the economy, lowering them from 4% to 3% over the past year. However, the recent spurt in inflation has led to doubts regarding the pace of future rate cuts, similar to the Fed.

In any regard, it appears that the Dollar Milkshake is alive and well. This system is a cruel one- the lower DXY goes, the more dollar debt gets borrowed, and therefore the more pressure grows to push DXY higher since dollar demand is higher. Once it goes higher, however, these countries have to either let their currencies blow out or intervene using billions of dollars of reserves.