Trade War Escalates

Global stock and bond markets have been collapsing these last few weeks as the escalating tariffs announced by Trump slammed markets lower.

It’s been a few weeks since my last post- I'm finally back stateside from a 2 1/2 week trip in Japan filming a documentary about the Japanese yen, and I've barely recovered from jet lag. (The documentary will be out in a few months, and will feature Weston Nakamura and myself talking in depth about the Yen, BoJ, and more- stay tuned.)

However, markets have started going haywire, and there’s much to discuss. The 20 year and 30 year Treasury bonds are almost at 5%, and global stocks (including the US) have been plummeting. Some breaking news was also released today which has saved markets, at least temporarily- but we can get into that later.

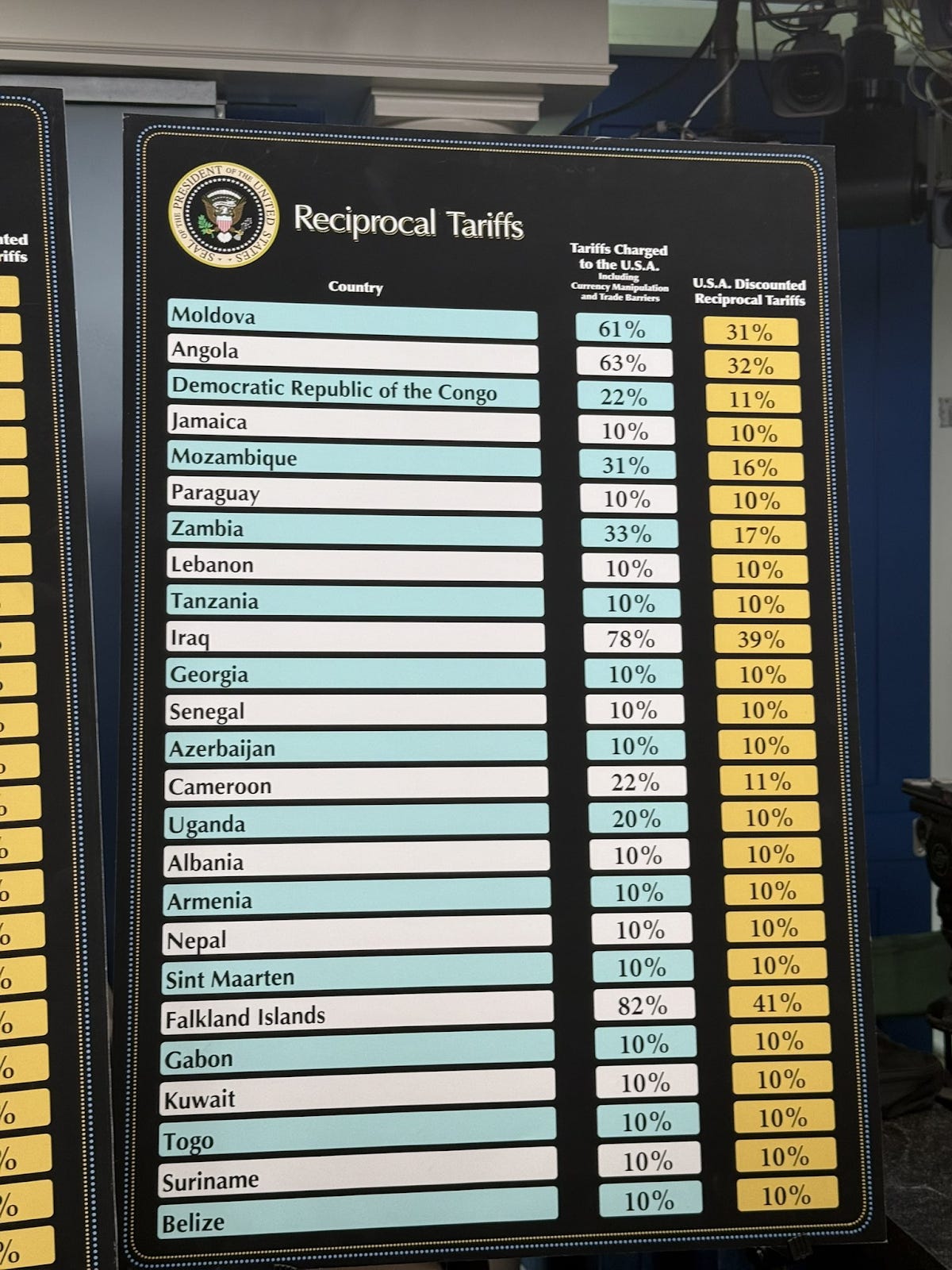

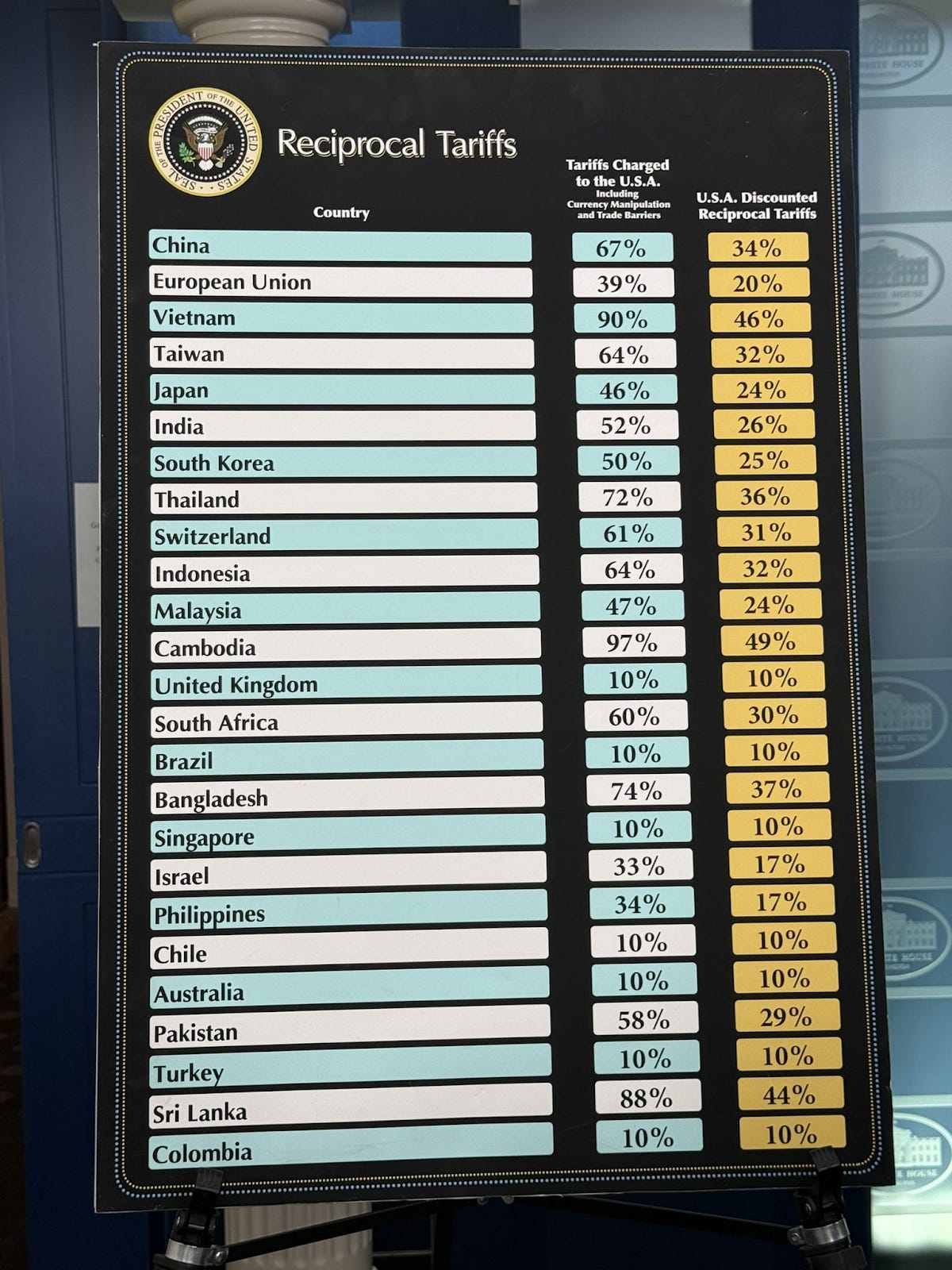

Last week, the Trump admin announced a massive escalation in their tariff policy, making new moves to end the decades-long trend of globalization of labor and offshoring of manufacturing to third world countries. Here’s a list of all countries included, released by the White House:

These tariffs included:

1. Universal 10% Tariff on All Imports:

Effective April 5, 2025, at 12:01 a.m. EDT, a baseline tariff of 10% has been imposed on ALL imported goods into the United States- this one has already taken effect!

2. Reciprocal Tariffs on Specific Countries:

Starting April 9, 2025, at 12:01 a.m. EDT, higher individualized tariffs, termed "reciprocal tariffs," are being applied to countries with which the U.S. has significant trade deficits. These tariffs are in ADDITION to the universal 10% tariff. (See a list of reciprocal tariffs in the images above)

European Union: Subject to an additional 20% tariff.

Japan: Subject to an additional 26% tariff.

China: Subject to an additional 34% tariff.

3. Tariffs on Countries Importing Venezuelan Oil:

A 25% tariff has been imposed on all goods imported from any country that purchases oil or gas from Venezuela. Basically this aims to put further pressure on the Maduro admin by penalizing countries that trade with the Latin American country.

4. Additional Tariffs on Specific Products:

Automobiles:

A 25% tariff on auto imports.

Steel and Aluminum:

Expanded trade penalties on these materials. (TBD)

Pharmaceutical Drugs, Lumber, Copper, and Computer Chips: Separate import taxes are planned for these products, but the specifics were yet to be announced.

On April 3rd, the next day, markets reacted violently.

Russel 2000 closed in bear market territory, and SPY lost almost 5% in a day.

Things didn't get better by the weekend. On Sunday night, the Nikkei 225 opened down 8% from the previous Friday, before paring losses. Overall, on Monday it was still down 9% from before the tariff announcement

The financial contagion continued to spread across Asia.

The Chinese stock market crashed 10% at the lows on Monday and is still down -5%. Taiwan hit circuit breakers. Thailand banned short selling after crashing 3%.

Over in Europe, even the German DAX index crashed 5% before attempting a recovery and then failing the resistance line on Monday. It's clear that the crashes are more severe in countries who are net exporters to the US, and thus obviously are hurt more by tariffs.

Here's a list of countries with the largest trade deficits with the US and the change since Trump's first term... many of these countries have seen significant FX currency devaluations vs the USD which has artificially boosted their exports. This has been the status quo for the post-1971 global monetary order in which US manufacturing had to be offshored in order to export dollars to supply the world economy with liquidity… and Trump is attacking it with a hammer.

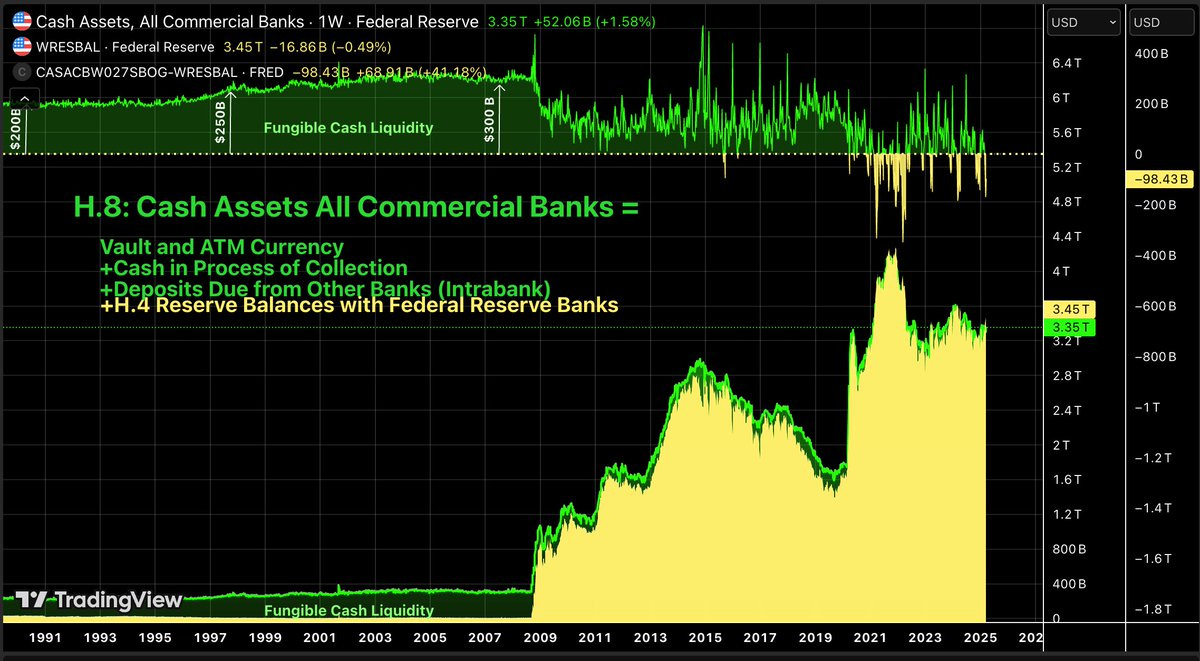

Like I've been tweeting for weeks, the onset of the trade war comes at an inopportune time as the main alternative sources of Fed liquidity (Reverse Repo and TGA) are all but dried up.

Analysts hate to admit it, but liquidity has become the driving factor. Put enough fresh cash into the system and SPY will ignore any bearish events. The correlation between the Fed's balance sheet (or Fed net liquidity) and markets is 0.89.

This dependence on liquidity has emerged since 2008 as one of the driving factors of the market now that fundamentals are largely a thing of the past and real economic growth is harder and harder to come by. This has meant that the actions of the federal reserve and other central banks has grown to play an increasingly large role in the direction of markets during the 2010s, and this trend accelerated post Covid as central banks began to run massive waves of QE in an attempt to forestall the economic depression caused by the lockdowns.

SPONSOR:

Taking self-custody of your Bitcoin has never been more critical, and that's exactly why the team at Blockstream has created the perfect solution: the Jade Plus hardware wallet.

Blockstream Jade Plus is the simplest and most secure way to protect your Bitcoin—whether you're brand new to Bitcoin or a seasoned stacker, Jade Plus has you covered. With its sleek design, intuitive setup, and step-by-step instructions, you'll be securing your Bitcoin in minutes, not hours.

Pair your Jade Plus seamlessly with its dedicated companion app, Blockstream Green, on your mobile or desktop, and experience the easiest onboarding journey you've ever had. As your Bitcoin stack grows, Jade grows with you. Activate advanced features like the air-gapped JadeLink Storage Device, or take advantage of the game-changing QR Mode, letting you securely send and receive Bitcoin with Jade’s built-in camera, no cables needed!

Want even more security? Jade Plus supports multisig wallets using popular apps like Blockstream Green, Electrum, Sparrow, and Specter—giving you ultimate flexibility and peace of mind.

Don’t wait until it’s too late—take control of your Bitcoin now. Get your Blockstream Jade Plus, the all-in-one, Bitcoin-only hardware wallet, today.

After the easing cycle, multiple things were done to withdraw liquidity as as stocks were overvalued and crypto mania had reached new exuberant highs, but the figure has basically flatlined since 2022 as monetary officials realized that any further cutting back of liquidity was going to cause blowups in the financial systems of Europe, Japan, and the United States.

Here we can see a more detailed breakdown of global liquidity which includes the balance sheets of the major central banks and the offsetting line items like reverse repo and the TGA. This chart goes back until 2004, and the second one is more zoomed in view of the last few years.

Fungible cash liquidity at US commercial banks has also been contracting since March 3rd, creating a perfect storm. Tariffs, which reduce corporate profits and international trade, hitting at the same time that banks (and other entities) begin to really feel the effects of QT.

Here’s an even closer look at the YoY change of fungible cash asset liquidity at commercial banks- it’s currently down $98B and still falling.

There's many reasons the U.S. stock market has outperformed literally every other stock market since 2008.

The Dollar Milkshake, U.S. geopolitical hegemony, culture of innovation and growth, etc.

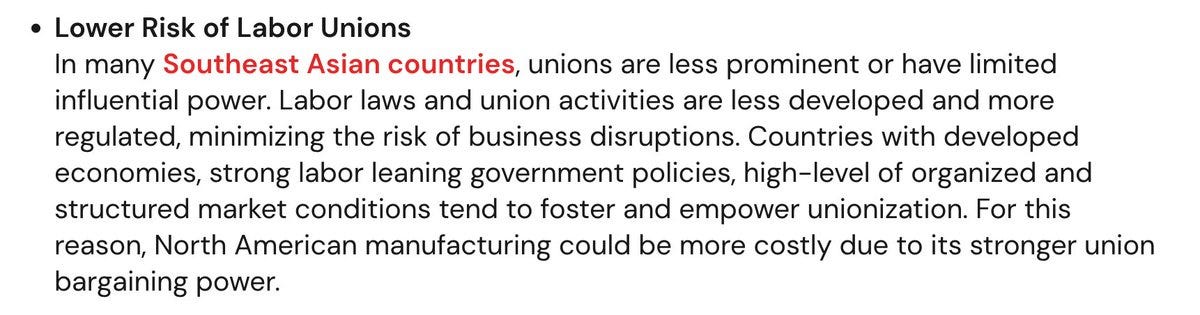

But one underappreciated factor has been the "exorbitant privilege" granted to US corporates due to the dollar's reserve status. Exporters have weak currencies relative to USD in order to boost their own trade. This means much cheaper input costs for Fortune 500 companies. Not only that, but labor costs both domestically and across Asia collapse as suddenly workers are not only competing with their countrymen for work, but also with the Vietnamese and Chinese who are willing to work for 1/10th a typical American salary. It also helps them that labor unionization laws in SE Asia are much weaker than here in the US.

In most cases, firms failed to pass these savings onto consumers and opted instead to recycle them into offshoring or financial engineering strategies.

A research paper by Artemis Capital found that a massive 95% of corp earnings the prior year were spent on share buybacks!

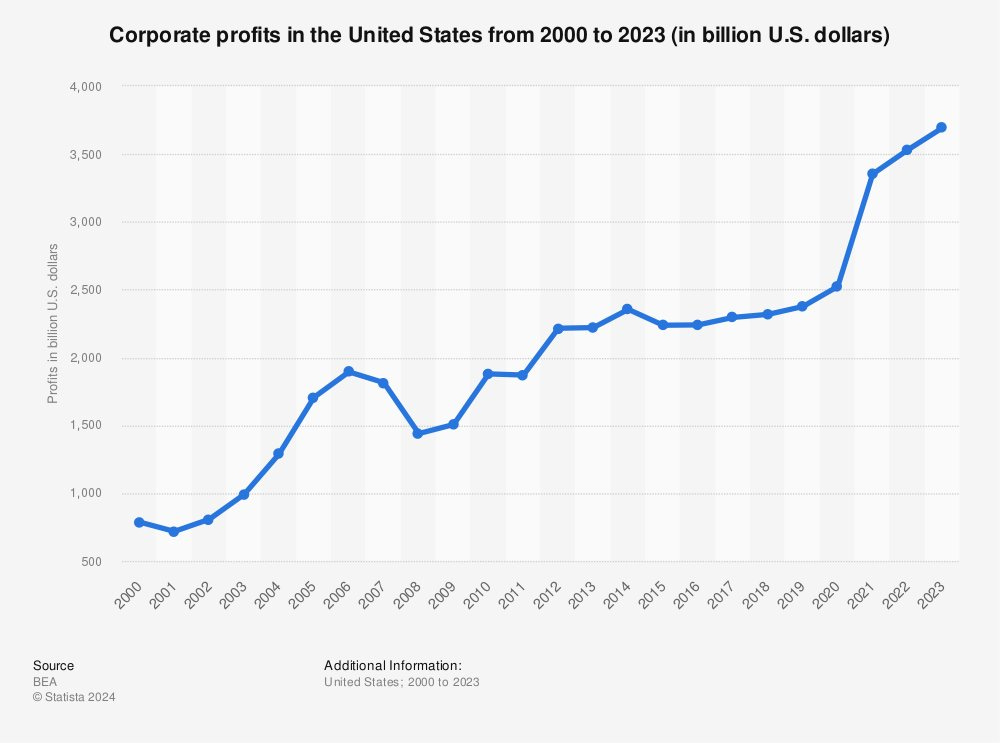

US Corporate profits have continued to soar higher, partly due to the collapsing currencies of the Yen, Euro, Canadian Dollar, Indian Rupee, Thai Baht, etc which are all facing the onslaught of the Dollar Milkshake as the Fed raised rates at its fastest pace ever.

As more and more countries follow the beggar thy neighbor policy of currency devaluation, corporations continue to benefit and yet charge high prices to the American consumer. They can use these profits to buy back their own stock, which is a form of financial engineering.

Will tariffs cause economic pain for Americans? most likely.

But, it will hurt S&P 500 companies as well, including those who own the 84% of these firms, which are mostly wealthy boomers in the top 10% of the distribution. The stock selloff accelerated this week as SPY continued to collapse and entered technical bear market territory on Tuesday, along with the Russell 2000 which had done so a day earlier.

The carnage was not isolated only to stocks, bond sold off very severely as well as the 20 year passed 5% and the 30 year bond closed just off that figure. The 10 year - 2 year treasury spread, which measures the difference in rates between these two bonds, started to un-invert at the fastest pace since COVID, which signals that financial stress is returning to the system.

If these tariffs are actually implemented as written, and liquidity is not added soon, I expect more downside for US markets.

But this is the great caveat- if they are implemented as written. As of just a few hours ago, as I was writing this piece, Trump emerged with another bombshell that he had decided to put a 90 day pause on tariffs as they begin negotiations. It appears this entire trade war was really a ruse to see which foreign nation states would acquiesce as quickly as possible.

I’m not here to make political prognostications, but in my years of studying markets, I have never seen anything like this. A president crashing his own markets, and causing bond rates to spike, and then walking everything back a few days later?

Some are saying this was a 4D chess move by Trump and Bessent to sniff out enemies, and others are calling this blatant market manipulation or a panic move. I’ll leave the final decision to you.

Markets are rallying into the close and yields are calming down. If the correction is truly over and we are back to a bull market, remains to be seen.

In any regard, I am going to take a couple glasses of wine with dinner tonight to digest what just happened.

(More pieces coming soon as I continue to recover from the jetlag- apologies for the delay!)

Level headed take. Nicely done, sir.

was a rug pull - insider trading- at least Trump understandz markets better than Sleepy Joe